Kek pic.twitter.com/NFXqtivIo3

— Anthony Sassano | sassal.eth 🏴 (@sassal0x) February 22, 2021

$65,979.00

-1.98%$1,942.52

-4.36%$613.04

-1.56%$1.35

-4.46%$0.999915

-0.00%$82.18

-4.82%$0.28337

-0.93%$1.04

0.79%$0.094004

-4.32%$49.18

-2.37%$0.279225

-3.48%$0.999856

-0.01%$466.77

-3.89%$8.79

0.63%$27.96

-1.59%$0.172611

-0.97%$340.32

0.94%$8.77

-3.59%$0.999284

-0.06%$0.159336

-1.38%$0.999511

-0.01%$0.00938649

-0.18%$0.100209

-1.11%$0.999651

-0.04%$54.46

-1.99%$8.99

-3.06%$222.47

-7.83%$0.91138

-2.68%$0.0000058

-3.57%$1.31

1.09%$0.113417

-3.01%$0.076158

-1.34%$5,220.45

1.18%$1.57

-0.15%$5,252.21

1.17%$1.43

1.03%$3.77

-0.92%$0.637116

-0.60%$1.00

0.00%$1.12

-0.12%$0.999995

-0.01%$0.997443

-0.00%$113.57

-1.51%$178.67

-1.25%$0.689583

-0.83%$76.23

-1.75%$0.170021

1.45%$0.067424

-2.75%$0.00000369

-4.74%$2.18

-2.47%$0.999966

0.01%$0.0000016

-0.80%$1.11

-0.29%$8.68

-1.49%$2.46

2.57%$0.999292

-0.01%$0.258184

-3.28%$0.109153

-1.44%$11.00

0.01%$6.96

-2.13%$0.39356

-1.32%$8.35

-3.44%$0.00180611

1.29%$1.81

-4.21%$0.059384

-0.02%$1.88

1.09%$63.83

0.29%$0.01636414

-1.15%$0.104019

-2.76%$0.848183

-1.10%$1.00

-0.06%$0.02985508

-5.61%$1.24

0.20%$0.00933541

-2.65%$3.36

-3.05%$0.086339

-2.70%$1.00

-0.60%$114.42

0.01%$0.997782

-0.23%$0.947639

-1.20%$1.42

-1.54%$1.028

0.01%$0.03519681

3.05%$1.11

-1.30%$0.03401048

-4.02%$0.00743143

-1.89%$0.635889

-26.77%$35.55

13.63%$0.080206

-0.18%$0.100918

2.24%$1.096

0.02%$0.997838

-0.16%$0.154223

-0.44%$1.001

0.06%$0.00000599

-2.89%$0.01287124

0.03%$0.999017

0.01%$0.260746

-0.50%$1.089

0.22%$0.069103

-1.59%$1.18

0.12%$0.997576

-0.25%$0.682443

1.16%$0.241312

-5.45%$0.00684143

-1.88%$1.29

-0.59%$33.67

-2.31%$0.04779793

0.88%$0.388991

-0.28%$168.90

1.58%$0.999425

-0.09%$0.498624

-2.02%$0.243744

-2.86%$0.158889

-1.63%$0.999725

-0.01%$0.080259

-4.27%$0.03338298

4.21%$1.37

-5.38%$0.970486

-3.65%$0.00000034

-0.65%$1.019

-0.06%$125.86

-2.25%$0.00000033

0.18%$1.56

-20.69%$1.63

5.19%$3.35

3.18%$0.055544

-1.48%$0.343111

-5.23%$15.78

-2.37%$3.12

-1.30%$0.01606557

-0.69%$0.050738

-2.74%$0.067584

-2.07%$0.999345

-0.25%$0.326025

-3.55%$0.02652993

-0.65%$0.303136

-3.13%$0.00566388

-5.19%$0.00002876

-1.33%$0.236764

-2.87%$0.982668

-0.85%$17.01

-3.29%$0.076299

-0.04%$0.303101

-3.76%$0.121389

0.36%$0.352065

-5.39%$1.38

-1.72%$0.04909228

-2.55%$1.54

-2.63%$0.00255461

-1.87%$0.00244524

-0.18%$1.89

3.01%$6.07

-3.38%$0.997636

-0.21%$1.34

-1.04%$0.084532

-0.04%$0.02075219

-1.40%$0.00004084

13.66%$0.04073056

-6.23%$11.26

-2.33%$0.120307

-4.02%$0.999994

-0.00%$0.986187

0.13%$0.999729

0.01%$1.075

0.01%$0.095023

-0.65%$1.27

-1.70%$22.79

0.00%$0.207845

-0.72%$0.00000098

0.36%$4.67

14.55%$0.489604

0.12%$0.00207769

-0.79%$0.875383

2.55%$0.097401

-2.17%$2.77

-0.20%$5,121.00

0.44%$0.053414

0.18%$1.00

0.00%$0.189164

-1.67%$0.080413

1.69%$0.096816

0.49%$0.185608

-5.29%$0.00492053

0.69%$18.70

1.12%$1.00

0.00%$0.01939841

-1.29%$0.999414

-0.04%$0.0036845

-1.20%$0.171605

-12.20%$2.17

3.52%$0.02302307

-3.13%$2.07

1.41%$0.02005257

-0.63%$1.79

-0.19%$0.052133

-3.12%$0.162375

19.02%$48.01

0.01%$3.47

6.58%$0.161566

-2.76%$0.107893

-4.61%$0.597809

-2.65%$1.73

-5.03%$0.992075

-0.28%$1.26

0.64%$0.04035205

-1.46%$0.99929

-0.07%$0.00000747

-3.92%$0.998537

0.02%$0.166847

-0.24%$0.314143

-3.25%$0.302966

-0.47%$0.395935

-2.39%$0.138154

-3.83%$1.016

0.32%$0.638149

-1.73%$0.267717

3.54%$4.50

-0.26%$0.614945

-0.33%$0.132031

-0.76%$1,095.79

-0.05%$0.080397

-0.30%$0.092734

-1.95%$0.073941

-0.23%$1.62

5.75%$0.07797

1.76%$0.282474

1.24%$0.304213

-3.18%$0.129622

0.32%$0.00145208

-1.88%$11.03

-2.27%$0.02145845

0.79%$0.00398038

-1.32%$0.245796

-1.74%$0.215936

-2.46%$1.001

0.00%$7.75

9.84%$2.33

-0.16%$0.995109

-0.07%$0.335579

-5.21%$1.08

0.01%$0.999918

-0.03%$0.999619

-0.02%$1.062

-0.11%$0.112485

0.17%$0.187476

-4.16%$0.999793

-0.00%$1.002

-0.77%

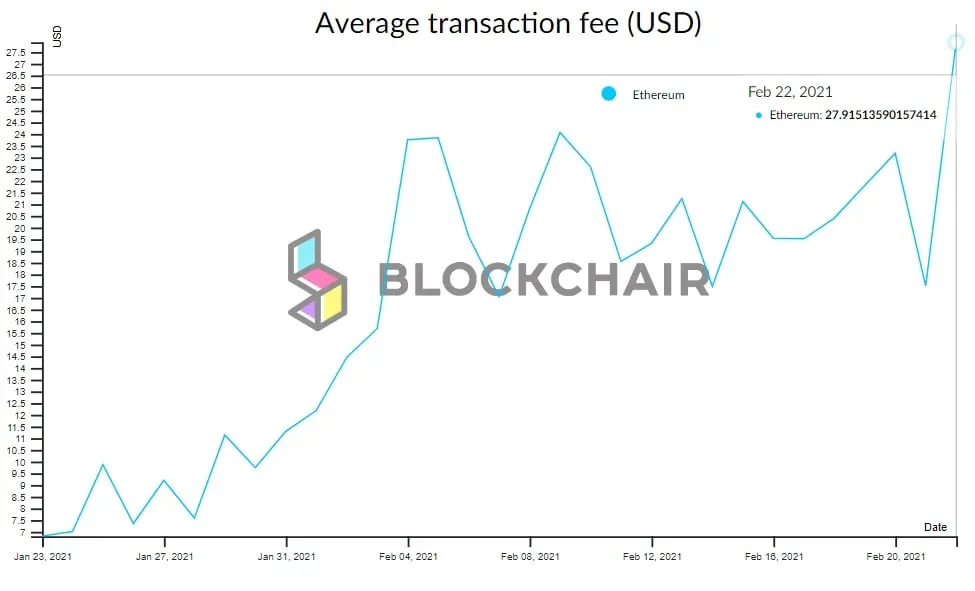

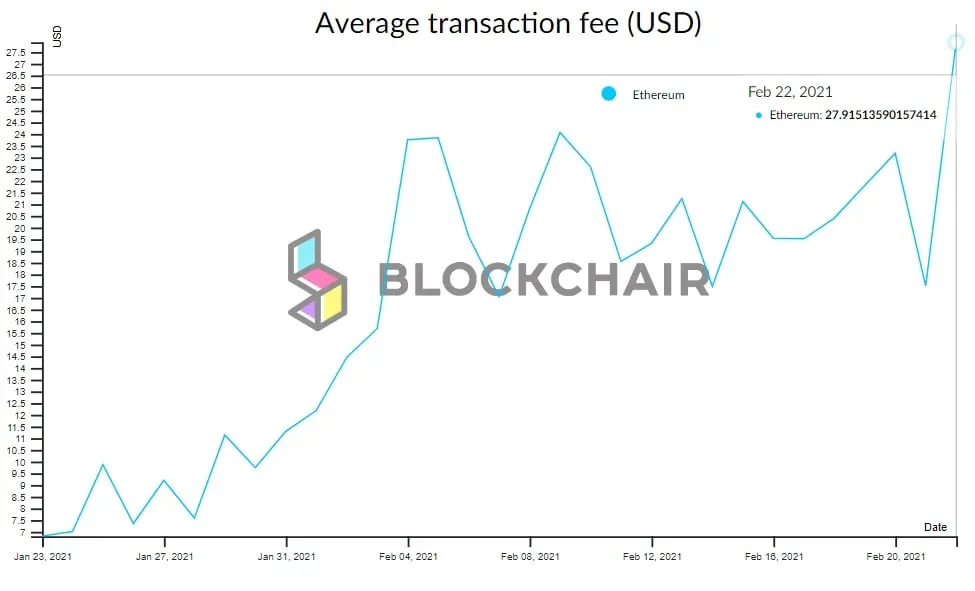

Ethereum (ETH) transaction fees have skyrocketed above $50 as the crypto market plunged into the red zone today. In the last 24 hours, ETH’s price has dipped to around $1,700, down over 12% on the day.

But for those who want to move their Ethereum, or trade on decentralized exchanges (DEXs), they’ll need to pay hefty sums.

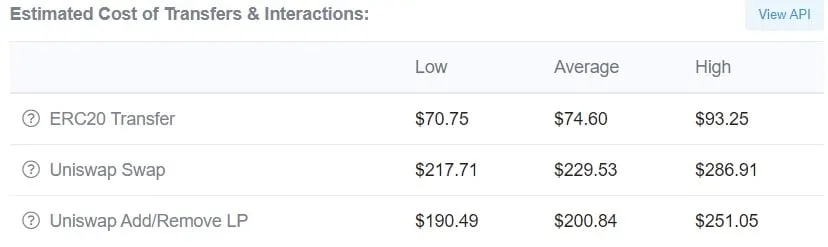

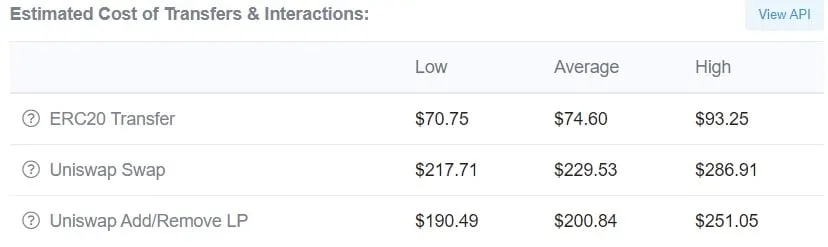

According to metrics platform Etherscan, Transaction fees have surged to 1,450 Gwei (the unit in which Ethereum’s gas prices are measured), which equates to more than $50 for a high-speed transaction.

Kek pic.twitter.com/NFXqtivIo3

— Anthony Sassano | sassal.eth 🏴 (@sassal0x) February 22, 2021

For an average-speed transaction users have to pay some $30 at press time—but their transfer will be confirmed in less than a minute. Even fees for low-speed ETH transactions have spiked to around $26, with these expected to take over an hour to get confirmed.

“Low," "average" and "high” refer to rough categories for how long a transaction is expected to take. It’s useful for measuring how much you need to spend on a transaction depending on how quickly you want it to take place.

For decentralized finance (DeFi) users, however, the prices are much worse. One transaction on Uniswap, Ethereum’s most popular DEX, currently costs anywhere between $217 and $286 in fees, depending on its priority. So, unless you’re trading a lot more than this, it’s probably not worth it.

Even transfers of Ethereum-based tokens are quite expensive today—between $70 and $93, Etherscan’s data shows. These are tokens that run on the Ethereum network but are not ETH themselves. Since transactions of Ethereum-based tokens are processed using smart contracts, they are more expensive.

In this light, it’s hardly surprising that Ethereum users are flocking to alternative networks, irrespective of how centralized they are—such as Binance Smart Chain.