The Ethereum 2.0 staking protocol now holds over 2.2 million ETH, data from on-chain analytics site Dune Analytics shows.

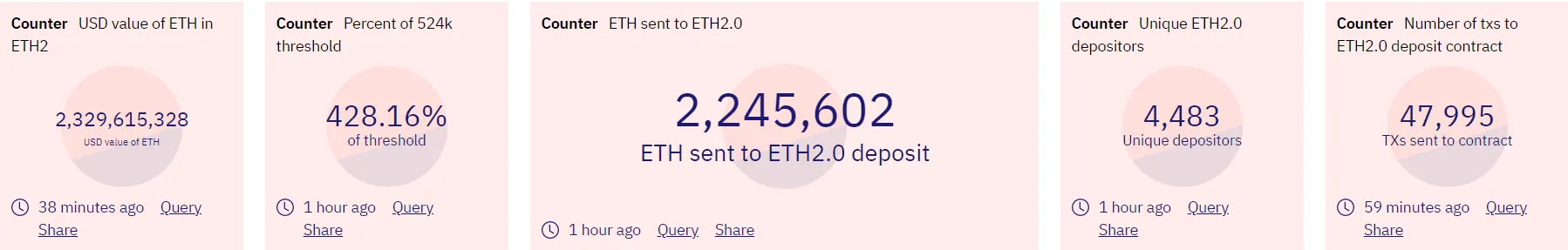

The amount is worth over $2.3 billion at Ethereum’s current market price of $1,049. However, the asset itself rose over 43% in the past week, meaning the figure may change if prices correct downwards and no new ETH is deposited.

The network now ranks fifth among the biggest cryptocurrency staking networks, according to StakingRewards. Leading the pack are Polkadot, Cardano and Synthetix.

Ethereum 2,0, which initially got off to a slow start in November 2020, is the Ethereum network’s multi-phase shift to a proof-of-stake consensus mechanism—one that validates transactions using nodes run by “stakers”—in favor of the current proof-of-work design, which relies on centralized entities called “miners” for validating transactions on the network.

Benefits of the move include a faster and theoretically safer network, a narrative that has attracted takers by the dozens. The Ethereum 2.0 deposit contract initially required 524,000 ETH to launch, but as per today’s data, it has been oversubscribed by over 428%.

Despite the huge money involved, there are not as many depositors. Data shows only 4,483 “unique” validators have deposited to the network, or an average of 500 ETH per depositor. Of that, some known depositors are crypto lending platform Celsius Network (25,000 ETH) and Ethereum creator Vitalik Buterin (3,200 ETH).

Meanwhile, the deposits keep coming in. 34,000 ETH were deposited in the contract just yesterday, Dune Analytics data shows, the highest amount so far this year.