In brief

- QuadrigaCX is a bankrupt Canadian exchange.

- 17,053 users filed claims worth a collective CA$224 million to CA$291 million.

- EY, the trustee, filed a report with a Canadian court outlining how it thinks recovered funds should be distributed.

In December 2018, QuadrigaCX founder Gerald Cotten died. Nearly two years later, users of his cryptocurrency exchange are still trying to get their money back—or what’s left of it.

Big Four accounting firm EY (née Ernst & Young), the trustee in the ongoing bankruptcy case, filed an update with the Ontario Superior Court of Justice today. It suggests dealing with all affected user plans in the same way, proposes two rates at which claims could be paid, and asks the court to process claims with minor errors as is.

When the Canadian exchange finally shuttered, there were 76,000 users that the exchange owed money to. But the funds that had been coming in from clients were allegedly used by Cotten to feed a Ponzi scheme—with him at the top of the pyramid.

Slowly, EY has helped to claw some of those funds back, including by settling with Cotten’s widow, selling assets from his estate, and going after funds with a third-party payment processor QuadrigaCX used.

Thus far, EY has received 17,053 claims from users who had funds in the exchange—or, rather, thought they had funds in the exchange’s cold wallets. Funds were funneled into an account controlled by Cotten so he could do things like travel to India.

Many users held multiple fiat and digital currencies on the exchange. Therefore, each user claim is subdivided into 42,957 claims for individual currencies.

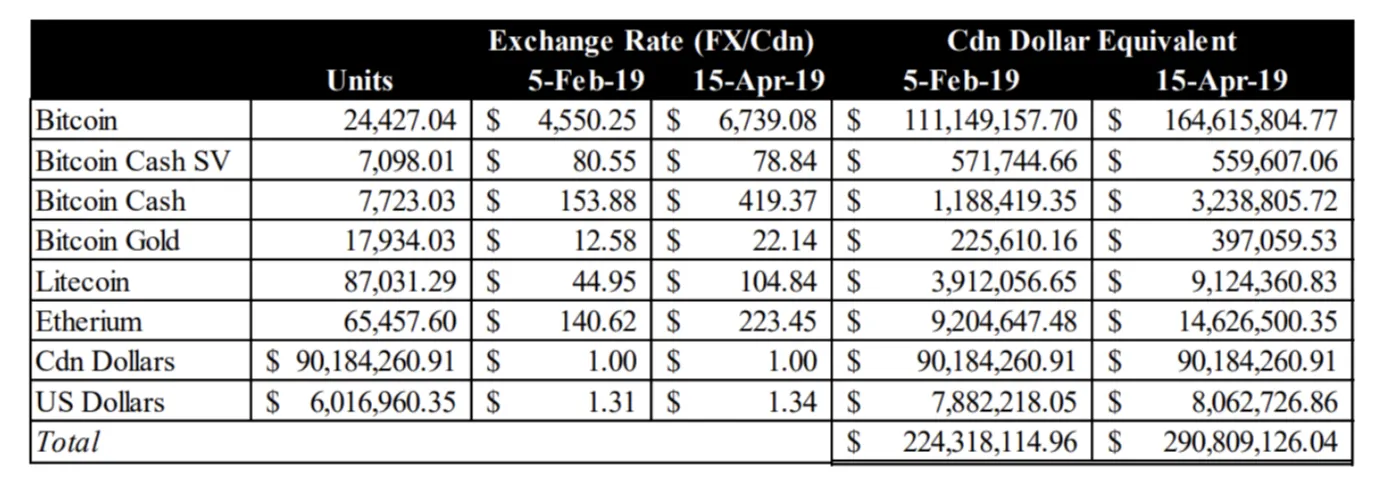

Users are seeking CA$90,184,260 and US$6,016,960 in addition to crypto in the following amounts:

- 24,427 Bitcoin

- 7,723 Bitcoin Cash

- 17,934 Bitcoin Gold

- 7,098 Bitcoin SV

- 65,457 Ethereum

- 87,031 Litecoin

But these cryptocurrencies aren’t sitting in a wallet—the report notes, “Mr. Cotten proceeded to trade these account balances with Affected Users that had deposited real assets, as such, Quadriga’s assets likely never matched the liabilities owed to Affected Users.”

So, then, at what rate should users be compensated?

EY says it will convert all the assets it has recovered into Canadian dollars and use the cryptocurrency conversion from either April 15, 2019, when Quadriga declared bankruptcy, or February 5, 2019, when users were first locked out of the platform.

That will have an impact on the total amount paid out, costing at least CA$224.3 million ($171.5 million).

EY is asking the court to decide the date to use.

In addition, the report notes that some claim forms had minor errors, including no signature or witness and wrong account numbers. Since roughly one-third of the forms have a defect, EY thinks it will cost more to follow up and fix them than to just accept them and get on with the potential refunds.

EY is asking that user claims all have equal footing, as sorting out who would have priority for distribution "on a claim by claim basis would be inefficient, costly and a significant drain on estate assets otherwise available for distribution."

And it's already short on recovered funds for distribution. It reports a current balance of just CA$39.1 million ($29.8 million).