In brief

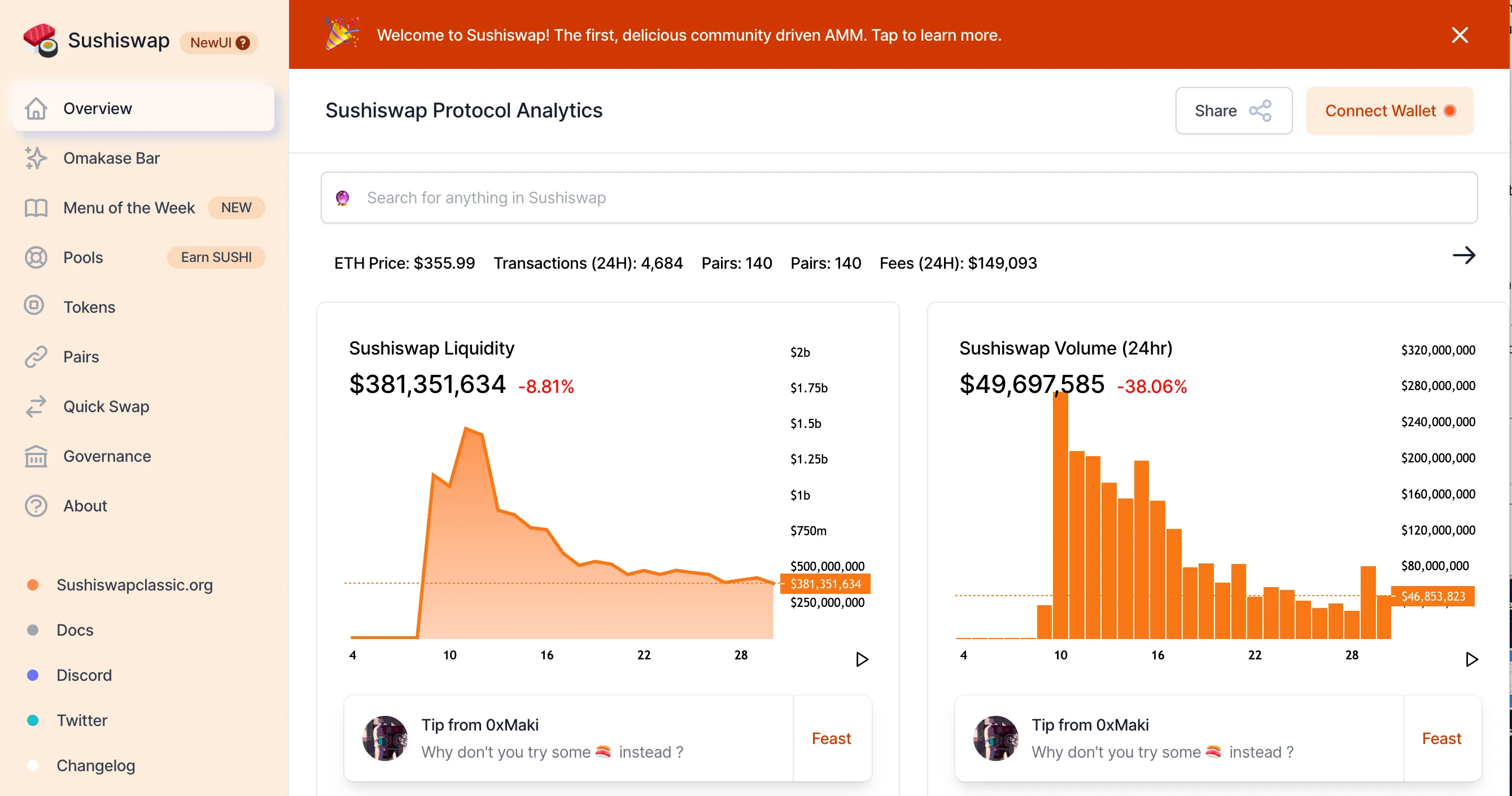

- Despite a 70% plunge in volume and corresponding drop in its token price, SushiSwap it still the fourth-largest DEX.

- It rolled out a number of product improvements yesterday, including a revamped website.

- The community continues to eye a migration to Solana.

After a peaceful migration of almost one $1 billion in funds from Uniswap on September 9, SushiSwap has seen its trading volume decline by around 70% with its token price following suit.

All is far from lost however: Its daily volume is still enough to make SushiSwap the 4th largest DEX. And in an attempt to parlay that success, and revive the community and perk up its token price, on Tuesday, SushiSwap announced major improvements to both its product and on the community-management end.

What’s cooking at SushiSwap

On the product side, it released a newly redesigned website at a new URL where users can see all their SUSHI in one place, the “OmakaseBar.” A SUSHI Reduced emission program also started where two-thirds of new SUSHI are locked up for 6 months. (This could be a way to prevent the price from further decline.) And finally, it offered up a weekly rotating menu of rewards pools, with nine going live already.

From a community perspective, Sushi’s core team underwent some major changes.

Though Sam Bankman-Fried led SushiSwap to safety, the new head chef is now 0xMaki, who assembled a team of early contributors and volunteers. A growth fund was established to attract and reward more volunteers.

Indeed, the growth fund has incentivized devs to contribute to the community. Jiro Ono, an early volunteer and now a core member of the Sushi team, told Decrypt that he’s been impressed by both the speed and community-run nature of the project.

“Every decision made on a day to day basis is decided wholly by the community, with tons of ideas being discussed in the discord/forum.” he said.

One of the proposals that was approved, and will likely be the biggest addition to the project is BentoBox. It will be Sushi’s answer to DeFi lending and introduces “isolated lending pairs” that allow risk to be contained to individual pools rather than the whole platform. (This is a complicated concept, but basically: existing lending protocols calculate risk based on the riskiest asset listed. Because Sushiswap isolates these risks, the riskiest asset will only affect its own pool rather than the entire lending protocol.)

And finally, to ease the public’s anxiety on a potential recurrence of ChefNomi’s behavior, Sushi ensures that all dev funds are now managed under community-elected multi-sig.

Community approval

So far, so good, according to Sushi-philes who spoke with Decrypt. One community member said that he’s bullish because of the “experienced and intelligent devs” whose single goal is “to make Sushi competitive and take on Uniswap.” He believes that so far, the community is hodling firm, but at some point soon, hedge funds and crypto funds will develop a taste for SUSHI.

As the godfather of all UniSwap forks, SushiSwap had its moment of glory, peaking when it threatened a vampire-like attack to drain $1.3B worth of liquidity from Uniswap.

But all glory has to come to an end at some point. For SushiSwap, that point came when its anonymous founder ChefNomi claimed $13M worth of SUSHI as a reward to himself. After the ChefNomi scandal, Bankman-Fried took over Sushi and executed a bloodless transition before returning control to the community.

Is Solana in SushiSwap’s future?

Focusing on community appears to be a smart move if it wants to compete against Uniswap and other forks. After all, why would anyone farm on SushiSwap when there are so many other options. That’s why Sushiswap needs to offer competitive rates—and novel products.

And that requires a community of devs and operators to push the project forward. A glance at Sushi’s Discord channel reveals that the community has been proposing and executing new features such as flash loans, stop orders, and margin trading.

In addition, Sushi has also been returning revenue to its token holders. Bankman-Fried, despite taking a back seat, told Decrypt that around $25k had been paid out from net fees, profits from facilitating decentralized trading, to SUSHI stakers.

Another project Bankman-Fried has been pushing is Sushi’s migration from Ethereum to Solana, a public blockchain that will enable tiny, $0.00002 gas fees, one-second settlement times, and customizable Automated Market Maker parameters.

“There's been significant support for the idea but in the end, whether it happens will come down to whether the community is excited enough about it to build it,” he said.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.