In brief

- The Cambridge Centre for Alternative Finance surveyed crypto entities from over 50 countries and has published a report.

- One key find was that crypto mining is making substantial use of environmentally friendly energy supplies.

- Other findings illustrated that employment growth in the industry is slowing down, and almost half of service providers are uninsured.

The 3rd Global Cryptoasset Benchmarking Study, published by the Cambridge Centre for Alternative Finance (CCAF), shows that crypto employment growth is slowing down, some miners are continuing to rely on public subsidies, and regulatory standards are mirroring the traditional finance space.

This report is the third of its kind, with the 2nd Global Cryptoasset Benchmarking Study taking place in December 2018. Since that date, the industry has undergone significant changes. Now, data has been compiled to create an up to date view of the crypto industry that accounts for these changes.

“A lot of existing reports are based primarily on on-chain data. To my knowledge, there is no other crypto-industry focused report that does survey-based research on a regular basis,” Apolline Blandin, research associate at CCAF and co-author of the report, told Decrypt.

The report has produced a plethora of data-driven findings, including the discovery that crypto miners are becoming environmentally-friendly.

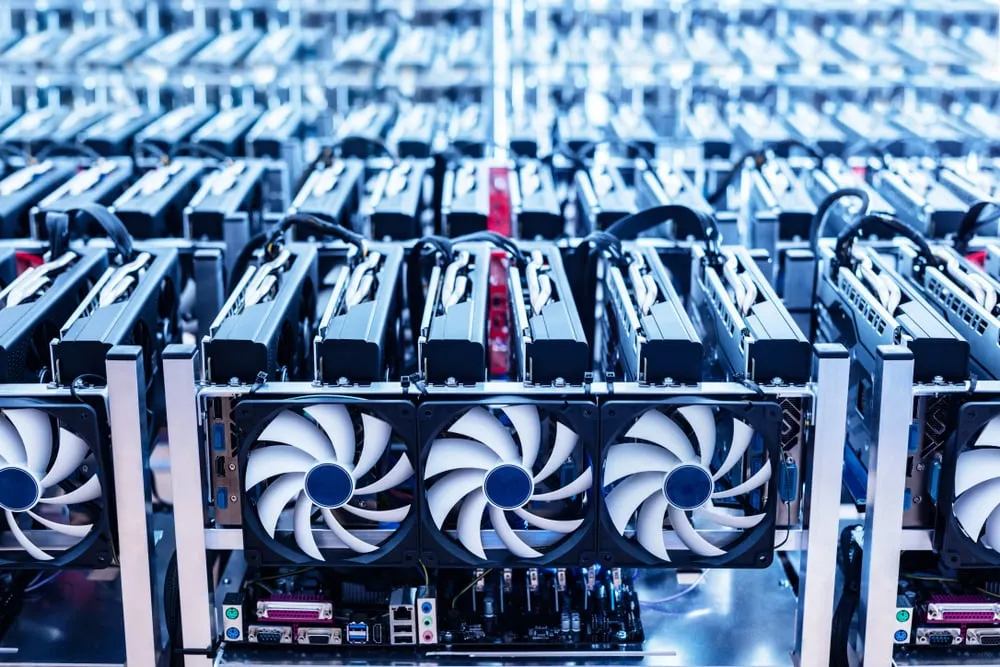

Mining, the environment, and centralization

The report looked at how the crypto mining landscape has changed.

One of the major costs beared by all miners is energy expenditure. Miners have long competed for the cheapest energy source, and that competition has resulted in an average of 39% of proof-of-work mining being powered by renewable energy, according to the report.

Hydropower is listed as the number one source of energy, with nearly two-thirds (62%) of surveyed miners indicating their mining efforts are powered by hydroelectric energy.

Despite sitting behind coal and natural gas, other clean energy sources like wind and solar power are also used by miners to power their operations. These power sources account for 17% and 15% of the total surveyed mining operations respectively.

In addition, 12% of miners are using nuclear power to propel their operations.

On the whole, it also turns out that mining can be cheaper in China than it is in the United States. Capital expenditures, mainly relating to buying equipment, take up to 56% of American miners’ costs, compared to only 31% of Chinese miners’ costs. This suggests that China has a competitive edge over the US when it comes to mining cryptocurrencies.

That edge might also be explained by some elements of centralization found across the industry.

A total of 23% of miners admitted to receiving government subsidies, usually for electricity costs. Two-fifths of those subsidized are also based in China.

The environmental benefits of mining cryptocurrencies may be growing, but the report also shows a slowdown in employment growth.

Crypto’s employment crunch

The report’s analysis of growth indicators find that employment growth is slowing down considerably.

Industry wide, the slowdown in employment growth saw a decrease of 36 percentage points between 2017 and 2019. In addition, the median firm surveyed reported a downward trend in employment growth of 75 percentage points.

“This shouldn’t come as a surprise given the sharp decline in prices and market capitalization that occurred after the 2017-early 2018 market frenzy,” Apolline added.

These figures however, do not necessarily reflect an overall negative view of the crypto industry. Individual firm data, according to the report, shows 26% of companies generating sustained annual growth in employment level above 10% over the past three years.

As industry-wide employment growth experiences a slowdown, crypto companies continue to adopt security measures, and aim for compliance standards akin to the traditional world of finance.

IT and regulatory standards

With the growth of the crypto booming over the last decade, IT and regulatory challenges have repeatedly been faced by the industry.

The vast majority of service providers (90%) are keeping cryptoasset funds in cold storage, which the report highlights is a robust IT security measure.

However, the data also shows that prudent security measures do not necessarily translate to robust insurance plans. According to the report, 46% of service providers are not insured against any risks, leaving these entities vulnerable to cybercrime, professional errors, hazards, and the loss of private keys.

“We knew that insurance was a growing concern for cryptoasset service providers, but we were still surprised to find out that only one in two service providers reports being covered against potential risks,” added Blandin.

As a result of the Financial Action Task Force (FATF) introducing AML and CFT international standards for crypto firms, the industry is becoming further intertwined with regulatory practices inspired by the traditional financial space. The report found that service providers that are incorporated in an FATF jurisdiction are more likely to serve traditional institutional investors than those that are not.

This trend is bolstered by the fact that, according to the report, the share of cryptoasset-only companies that did not conduct KYC checks fell from 48% to 13% between 2018 and 2020. Finally, some good news.