A common theme in DeFi this year has been to increasingly decentralize governance, with teams giving up an increasing share of control over their project to their communities. The boom in governance tokens, which are used as incentives for traders to add liquidity to these protocols, has accelerated the trend.

But as this nascent ecosystem of decentralized governance systems evolves, with protocols holding hundreds of millions of dollars worth of digital assets, the idealistic quest for open and democratic systems is being tested. Will DeFi teams design systems and incentives that allow for truly decentralized token distribution, or will their projects’ tokens and voting power tend to concentrate in their own wallets? Curve Finance and 1inch are two examples of this question.

Curve Faces Backlash for Governance Control

The most recent DeFi drama shows all the lofty ideals of decentralized governance quickly come back to earth when there’s real money at stake.

Curve Finance, the stablecoin-focused DEX at the heart of yield farming, last week proposed that CRV holders who lock up their tokens in a voting escrow can multiply their rewards by up to 2.5x, starting Aug. 28.

Token holders of yEarn Finance, which holds roughly $2.5M worth of CRV from its early liquidity provider rewards, decided to take advantage of the new incentive, locking the entirety of their CRV treasury for 4 years (the max duration).

But Curve’s core team locked up their own tokens too, overpowering yEarn’s and every other token holder in the voting escrow. They’re effectively holding ~71% of the DAO’s governance power at the time of writing.

This sets a dangerous precedent in which a quorum (currently set at 30%) can currently only be reached if the Curve team participates in voting. Some in the community are up in arms over the concentrated voting power in what was supposed to be a decentralized governance system.

As a quick refresher, a quorum is the number of votes necessary for a proposal to pass. With this quorum, at least 30% of all CRV locked in the DAO must vote on a proposal. In its current breakdown, a quorum can only be reached if Curve chooses to vote with its tokens, despite the team stating it does not want to vote and sway what “decentralized governance” looks like.

Fat-Finger Mistake

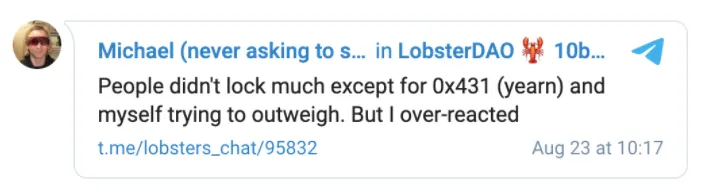

Curve’s founder Michael Egrov publicly stated that he “overreacted” while other Curve supporters are claiming that it was a “fat-finger mistake.”

Now, Curve is looking to reel back the action by encouraging more people to lock CRV in the DAO. Only ~7% of the circulating supply is locked for governance, which means that if more token holders locked their tokens governance could become more decentralized.

The team is also trying to leverage Discord polls as a “soft-vote” to determine community sentiment for how the Curve team could vote with its tokens.

Interestingly, Curve’s 622k CRV were originally only locked for 1 month. As of yesterday, the timelock was adjusted to the full 4-year vesting.

Farm and Dump

As any farmer knows, the trend since launch has been to earn CRV and immediately sell at a profit. With this continuing to take hold, it will take a special kind of community member to take the risk of locking CRV for 4 years while the token sits at a fully diluted market cap of over $1T (yes, trillion).

The larger narrative here is that DeFi governance is still in its infancy. With power dynamics at play before real governance is even live, many are starting to question the foundations on which multi-billion-dollar protocols are built and controlled.

1inch Token Distributions Gets Smoked

1inch, the largest DEX aggregator with $1.8B in cumulative volume, is facing backlash from the community regarding its 1INCH token distribution.

Liquidity providers to 1inch’s new automated market maker DEX Mooniswap will earn one-year locked tokens for adding liquidity to any of these pairs before the token launch. The token’s launch date hasn’t been set yet.

Detailed in the announcement post, 1INCH will distribute 2% of tokens to early Mooniswap liquidity providers and 21% to ecosystem growth. This is just 0.5% more than the core team (22.5%) and 3% more than investors (19.5%).

For perspective, here’s how other prominent DeFi projects are treating LP reward allocations:

yEarn (YFI) - 100%

Balancer (BAL) - 65%

Curve (CRV) - 62%

mStable (MTA) - 45%

Compound (COMP) - 42.3%

Defensive Posts

Touting itself as “the system (which) will mark the most efficient and benevolent structure to ever hit the market” the 1inch team is scrambling to emphasize 1INCH is much more than just a worthless governance token, hence the conservative distribution. Still, they haven’t clarified exactly what the token’s utility will be other than saying “it is gonna be huge.”

Their defensive posts are backfiring with some in the community, who say 1inch has sided with investors over modeling the distribution towards its users.

Now, many are coming out of the woodwork to voice their opinion about the project and its communication - best encompassed by DeFi Prime stating that “1inch needs to grow up and get over running social media like they are just a hackathon winners”

If one thing is clear, community members are scrutinizing teams much more heavily around key dynamics like token allocations. While the 1inch team has certainly displayed their worth, they’ll need to maneuver carefully to retain the good standing community ethos which got the project to where it is today. (See long Twitter thread here.)

—By Cooper Turley

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.