In brief

- The total value of outstanding Ethereum futures contracts reached a new high of $1.5 billion.

- This was spurred by ETH's price finally breaking above $400.

- The value of open Ethereum futures grew twice as fast as Bitcoin's since February.

The total value of outstanding Ethereum (ETH) futures contracts has reached an all-time high of $1.5 billion today, according to crypto analytics platform Skew.

⬆️ Another new ATH in ETH Futures Open Interest, crossing the $1.5bn mark for the very first time across the exchanges https://t.co/0KkntYiyQp tracks. pic.twitter.com/bnh2WcWixT

— skew (@skewdotcom) August 14, 2020

Also known as open interest, this figure reflects the current total value of Ethereum futures that have not been settled yet. Futures are a form of financial derivatives where parties agree to sell/buy an asset at a specific price on a set date. Unlike options contracts, where buyers might choose to not purchase the asset, futures are contractually binding and must be settled on the expiration date.

The overall growth of the futures volume combined with the rising price of ETH, which is currently up roughly 9% on the day and trading at around $428, signifies a strong market amid an upward trend, said Bobby Ong, a co-founder of crypto metrics platform CoinGecko.

"Ether finally broke past the $400 resistance level today. It has been trying to break past the $400 level unsuccessfully since the start of August. The successful breakout led traders using technical indicators to view this as a bullish indicator and traders started leveraging long on the futures market leading to it reaching its all-time high of $1.5 billion today," Ong told Decrypt.

Nicholas Pelecanos, the head of trading at NEM Venture Fund, also cited the break above $400 as the main catalyst for the latest Ethereum futures all-time high.

“Since [2017] the $400 range has acted as a key level in ETH’s price history. The break of this level technically is very bullish and is likely the cause of the large volume on ETH futures,” Pelecanos told Decrypt.

Yet, he also noted that there is currently friction within the Ethereum community caused by continuing debates about supply and transaction fees. Such disconnect “between the hype around the technology and what it can do can lead to bubbles,” but also simultaneously could result in an even more bullish market if these issues to be resolved.

Outpacing Bitcoin

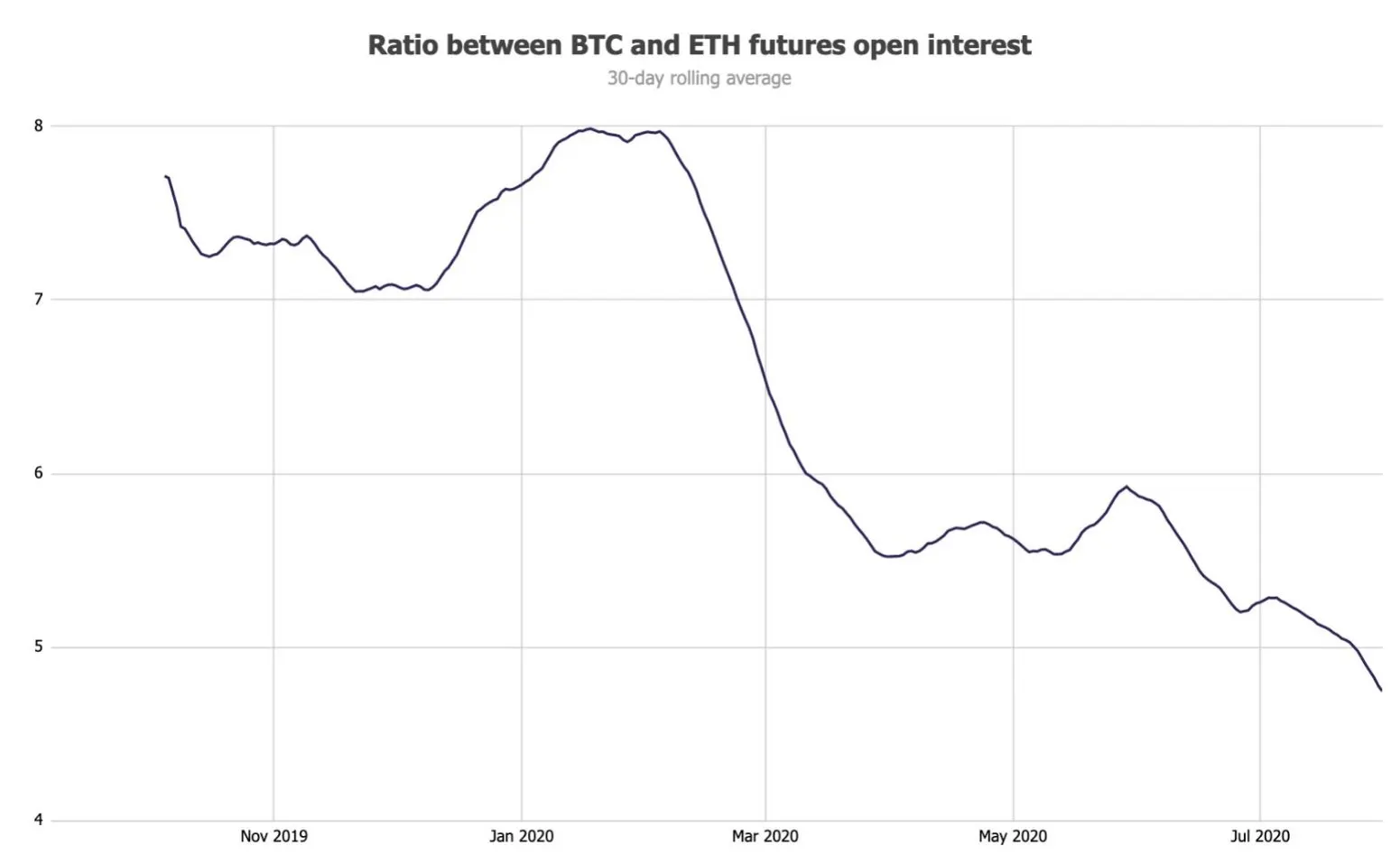

In the last six months, the open interest of Ethereum futures grew twice as fast compared to Bitcoin (BTC), noted Larry Cermak, director of research at The Block.

“Bitcoin's futures OI was 8 times higher than ETH's in February. Only 6 months later, it's now about 4 times higher. OI of ETH grew relatively twice faster than BTC,” Cermak tweeted.

This somewhat mirrors the two currencies’ increase in prices since February. Six months ago, BTC was trading at roughly $10,233 while ETH’s price hovered around $268. Since then, Bitcoin and Ethereum have gained roughly 15% and 45%, respectively, with the latter outperforming BTC by around 200%.

"Ethereum has been on fire lately. The industry of tokenization and new-wave finance seems to be in a sort of consolidation around this network and continue to build a vast majority of new crypto-fanlged projects on the Ethereum blockchain," summarized Mati Greenspan, a popular analyst and the founder of Quantum Economics, speaking to Decrypt.