In brief

- Bitcoin options contracts for $745 million will expire tomorrow.

- Depending on whether a large number of traders decide to close the contracts, Bitcoin's price might get affected.

- Such situations are "not anything we can really prepare for," say trading experts.

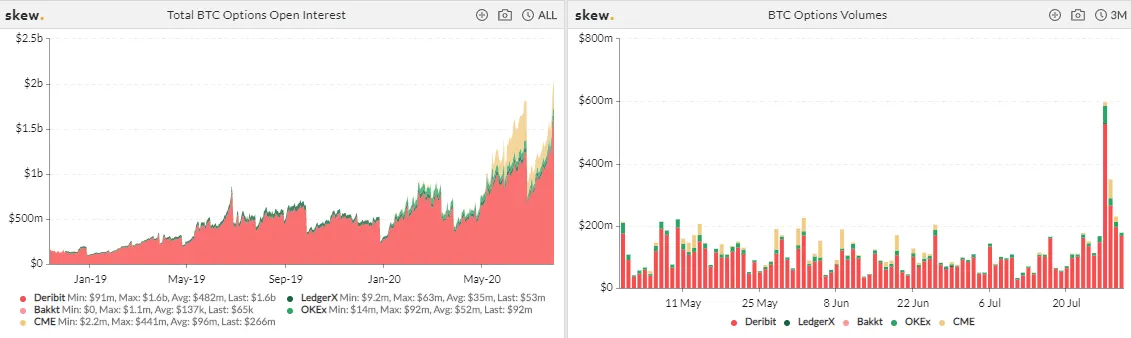

Options for 67,700 Bitcoin (BTC)—worth $745 million at current prices—will expire tomorrow, according to crypto data analytics platform Skew. But experts are divided on whether this won't have an impact, or if it could shake up the crypto markets.

It's expiry week, 68k #bitcoin options will drop off tomorrow pic.twitter.com/dD0JGg2R0u

— skew (@skewdotcom) July 30, 2020

Options are a type of financial derivatives. They give buyers the right—but not the obligation—to purchase assets at a specified price on a set date in the future, for which they pay sellers a “premium.” If the asset’s price is higher than the agreed price on the expiration date, buyers can execute the contract and receive profit, or refuse and lose the paid premium.

Depending on whether a significant number of traders will decide to buy—or not—BTC at specified strike prices, this could push Bitcoin’s market price in either direction.

Nicholas Pelecanos, the head of trading at NEM Venture Fund, told Decrypt that crypto markets are certainly attracting more attention lately—both institutional and retail—and the growing volume of Bitcoin options contracts is a sign of that.

“The open interest for BTC options is currently at its highest recorded level. There is potential for some options related moves around the expiry but can't see any big bear move on the cards,” said Pelecanos, adding, “The overall skew for BTC options is still heavily on the side of upside interest.”

He said that in the long run, maturing options markets will likely reduce the volatility of BTC price action since large spikes in price will be capped. However, this could increase the case for Bitcoin as an alternative currency and as a store of value.

Mati Greenspan, market analyst and founder of Quantum Economics, also surmised that while such a massive options expiration probably wouldn’t entail much, this is “not anything we can really prepare for anyway.”

“It could [have a meaningful impact on Bitcoin's price and volatility] but it's very difficult to anticipate. We've seen many times where large contract expiries have moved the markets one way or another and many times when nothing happened,” said Greenspan.

Talking about CME futures at the Decrypt Daily podcast on Tuesday, Bobby Ong, COO of crypto analytics platform CoinGecko, noted that, “Typically, in the last week of the month there’s usually high volatility in price.”

“In the last week of the month there is a huge spike in price, either upwards or downwards,” he added.

As Decrypt reported, a similar situation occurred in late June, when Bitcoin options worth $1 billion expired, marking the largest options expiration to date. That time, the massive options expiration had no noticeable effect on the crypto market. But considering the wild week Bitcoin is having so far—nothing is out of the question.