In brief

- The rise of Compound has brought new life into Ethereum’s DeFi landscape, according to a new report.

- To gauge user activity, the report analyzes general user activity and cross-application use.

- The report concludes that, though DeFi activity is on the rise, most of this volume comes from repeat users.

The meteoric rise of new Ethereum platforms such as Compound and Uniswap have put decentralized finance use cases (or DeFi) front and center in the crypto landscape in 2020.

A new report by Codefi, a subsidiary of the Ethereum software development firm ConsenSys, shines a light on how many unique users are leveraging these and other DeFi services. Even as the value locked in DeFi applications has nearly tripled from April of this year, the report concludes, most of the DeFi activity isn't coming from new users. (Disclosure: ConsenSys funds an editorially independent Decrypt.)

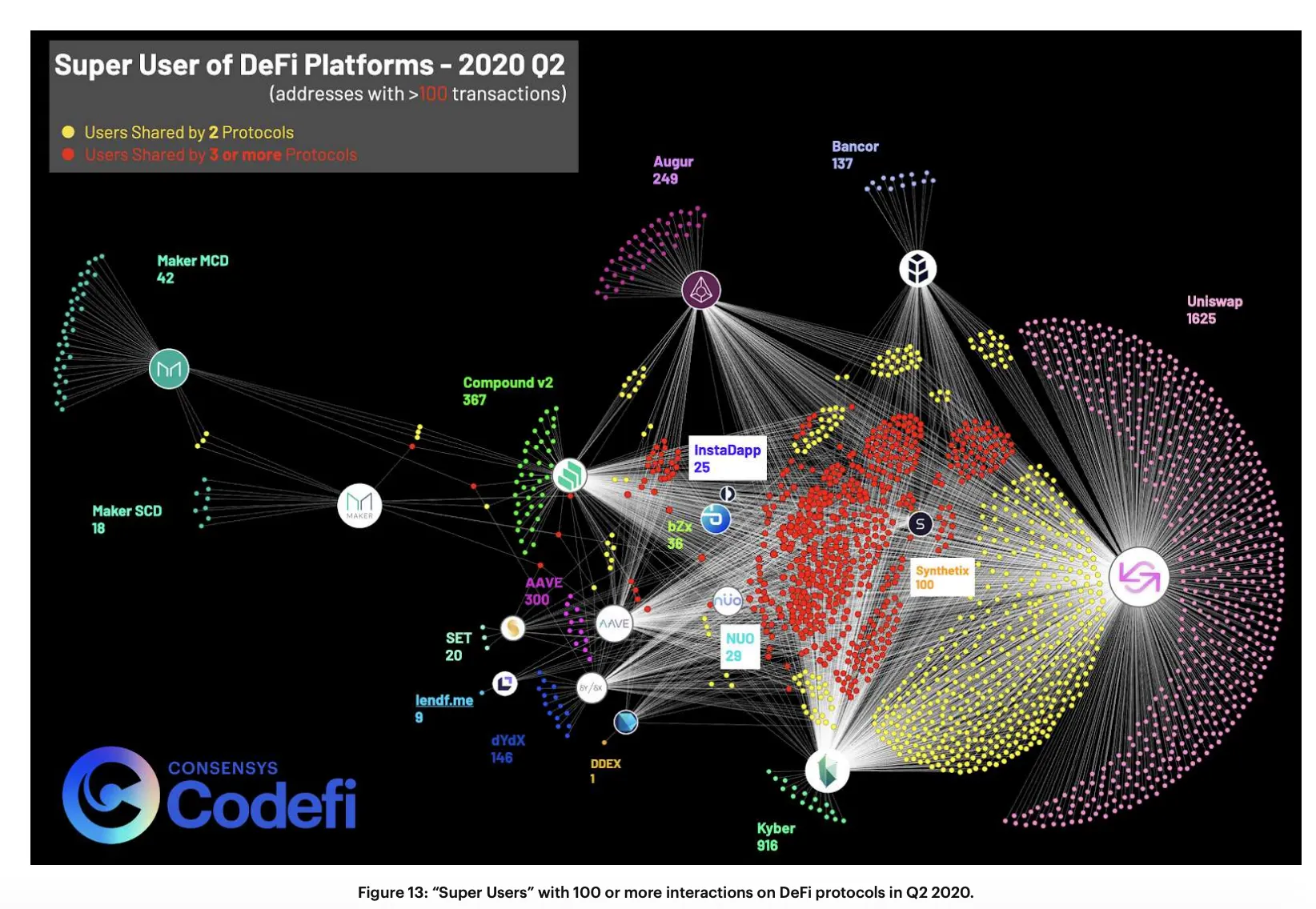

One of the report’s central questions asks if “DeFi users [are] actually taking advantage of the interoperability of Ethereum-based DeFi protocols.” In an effort to answer this question, the report analyzes the 79,648 addresses that interacted with a DeFi smart contract in Q2 of 2020 (Ethereum surpassed 100 million unique addresses in June of 2020, and active address usage is up 118% since the beginning of the year.)

According to the report, out of all the users who have deposited some $1.2 billion worth of ETH and Ethereum-based tokens into DeFi applications, only 1,884 of these had sent 100 transactions or more over the course of the quarter. Further measuring user activity, the report states that the majority of DeFi users remain loyal to one platform in particular and rarely use other DeFi apps (these are users who transacted at least once but no more than 99 times over the course of Q2 2020).

When compared to average users, “super users” had a higher proportion of users who had interacted with at least two or three different DeFi protocols than users who hadn't. Uniswap captured the majority of these overlapping users with 1,625 super users active with the platform over the quarter; Kyber Network came in second with 916 super users, followed by Compound’s 367.

The report did not indicate how large the account balances were for these user groups. Ultimately, though, it concludes that Compound’s explosive rise did little to attract new users who aren’t already using DeFi applications.

Instead, much of the ramped-up activity came from users who are already in the ecosystem. The solution then, the report’s authors suggested, is to focus on design, user experience, and education, lest DeFi run the risk of growing in a bubble, instead of expanding beyond it.

“The data suggests, however, that the frenzy stayed within the walls of the existing community. The likely conclusion is that many DeFi innovations run the ‘risk’ of increasing adoption only within the community of knowledgeable DeFi users,” the authors of the Codefi report stated.

Of course, that assumes the ultimate goal is to actually “grow the size of the DeFi community,” the report concluded.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.