In brief

- Bitcoin trading throughout Latin America is hitting all-time highs.

- But that's only if you measure trading volume in each country's rapidly inflating fiat currency.

- The real data shows a very different picture.

If you’ve read the headlines today throughout cryptoland, you know that crypto trading in Latin America is on fire.

Or is it?

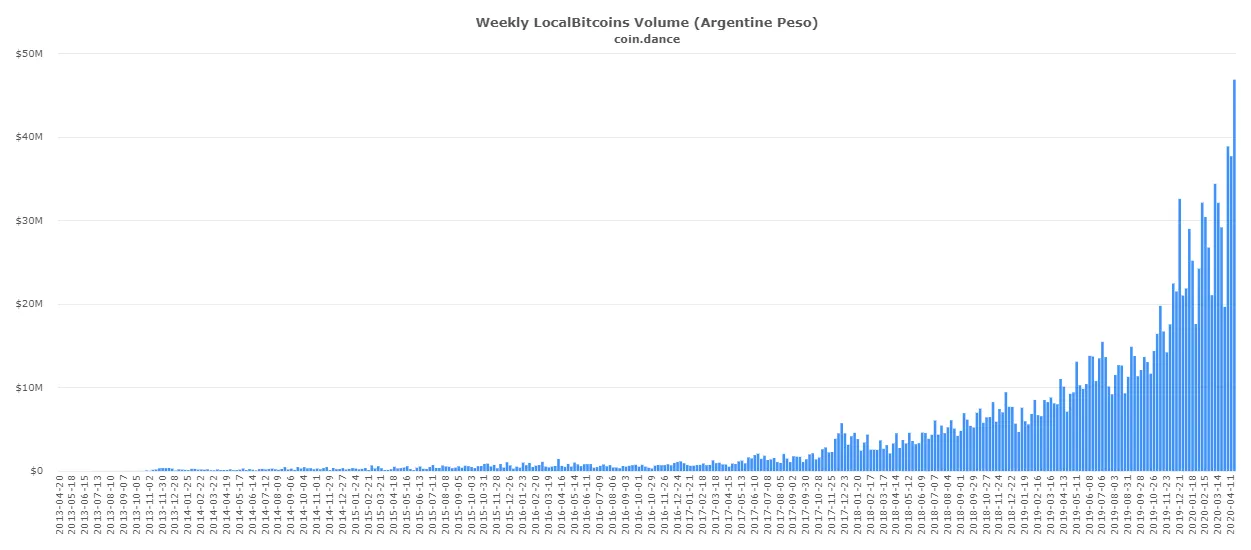

According to data from LocalBitcoins, local Bitcoin trading throughout Latin America has shown a considerable increase in the last week. But only if you measure trading volume in terms of each country’s rapidly inflating fiat currency—which is a terrible metric.

Over the past few days, trading activity in almost every country in the region has increased considerably in fiat terms. Argentina, Chile, and Venezuela registered all-time highs in Bitcoin trading volume, whereas other countries such as Brazil, Colombia, and Mexico saw considerable jumps in the amount of fiat money spent to buy and sell Bitcoins during the last week.

But it would be a mistake to interpret these figures as a sign that crypto trading in Latin America is entering a new golden age—or, at least, not in the way that crypto evangelists would like.

What the Bitcoin trading data actually says

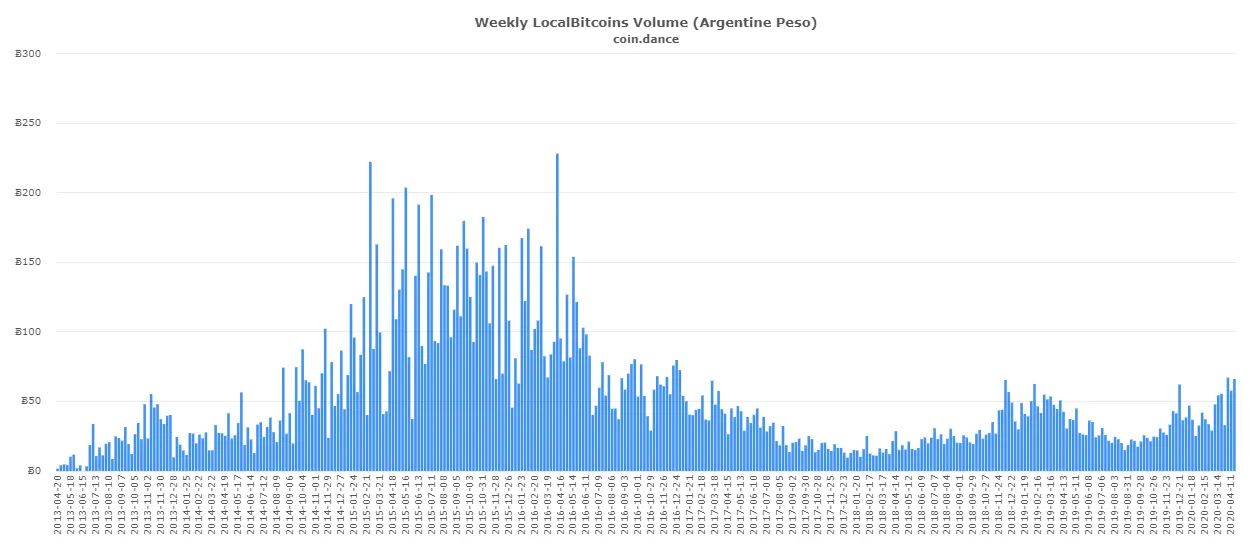

Comparing fiat volume in these countries against the amount of Bitcoin actually moved reveals a less optimistic reality, as variations are not proportional.

That is, Latin Americans are paying much more of their volatile fiat for each Bitcoin—and in a way that does not correlate to the progression of token prices against more solid currencies, such as the US dollar or the euro.

As a result, instead of demonstrating a sudden interest in crypto trading—or that long-awaited “mass crypto adoption”—the charts are merely showing a reflection of a sad financial reality that has struck the region after months of conflict aggravated by the coronavirus crisis.

In other words, it’s the inflation, stupid.

The political instability seen in countries such as Brazil, Colombia, Chile, Argentina, and Venezuela has pushed inflation to record levels in each of these economies.

Argentina and Venezuela, as usual, lead the charts as the worst economies in the region. But Chile is beginning to show signs of the sort of financial collapse that could destroy its image as the capitalist "oasis" its government promised. If it wasn’t for the coronavirus pandemic, Chile’s president, Sebastián Piñera, would likely still be on the receiving end of massive organized protests in the streets.

But all that isn’t to say that there hasn’t been some uptick in crypto trading in the region. Each of these countries has recorded slight increases in Bitcoin trading volume, measured in BTC. The figures are not proportional to the amount of fiat spent, but they do show an undeniable fact: Latin Americans are trading a little more Bitcoin than they did a few months ago.

And although the rise in prices may be partly responsible for this increase in interest, it’s also possible that the financial crisis may be leading Latin Americans into looking for ways to protect their incomes—perhaps even seeing an answer in Bitcoin.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.