Founded in 2018, Figment provides a variety of staking services and infrastructure to institutions that want to stake crypto at scale. At time of writing, it is one of the largest non-custodial staking providers on Ethereum—accounting for nearly 5% of total ether (ETH) staked. In addition to staking infrastructure, Figment provides users with staking data, liquid staking options, developer tools, and a few other offerings that make them stand out from the wider institutional staking ecosystem.

In addition to Ethereum, Figment supports a plethora of other Proof-of-Stake (PoS) protocols, including Avalanche, NEAR, Polkadot, Cosmos, Cardano, and many others. Focused on servicing institutional clients, it provides solutions for crypto asset managers, crypto exchanges, crypto wallets, crypto foundations, and more.

Figment’s staking services

Since its inception, Figment has built out a variety of staking services to support various protocols and accommodate its institutional clientele.

Staking Data and APIs

Although often overlooked, sourcing on-chain staking data is a critical part of the staking ecosystem. Figment pulls, processes, and stores staking data for its users. This is intended to provide Figment’s clients with standardized and relevant data that can be utilized for their staking initiatives without the need to build out their own in-house staking solutions.

This data can be used to calculate staking rewards, measure specific staking validators’ performance, or to provide indications of when a slashing event has occurred—which can help to determine its root causes and thus mitigate against future occurrences. It can even be used as a source to secure insurance for one’s staking activities.

Common throughout the blockchain ecosystem, application programming interfaces (APIs) act as bridges that facilitate communication between computers and various networks. For example, crypto trading APIs allow crypto investors the ability to more easily trade crypto. This could be done via a crypto exchange’s built-in API—or the integration of a third-party API. Figment APIs simplify staking-related processes in a similar manner.

Built for developers, these APIs are designed to make the staking process simpler, faster, and cheaper. For example, the Figment Staking API abstracts away network-specific elements of the staking process, allowing staking through the API to be carried out practically identically across blockchain networks. Figment’s data and staking solutions can be outsourced to institutional users in order to reduce setup times and costs.

Validators

Staking validators—also commonly referred to as staking nodes or validators—are the core infrastructure of Proof-of-Stake (PoS) blockchains. These validators are responsible for a PoS blockchain’s security and are also where assets are staked by users in order to earn staking rewards.

Figment’s institutional-grade validators can be integrated with major crypto exchanges, wallets, and related institutions. Figment’s validators are designed to simplify staking integrations, optimize staking rewards, and reduce the staking risks of slashing.

Slashing Coverage

Insurance coverage that is catered to blockchain-based processes is a burgeoning subsector of the crypto industry. While staking-specific coverage is not commonplace, Figment offers an extra layer of security through its optional insurance coverage (via partners) that protects against double-signing—which can result in reduced rewards or staking penalties.

Figment’s “safety over liveness” staking strategy

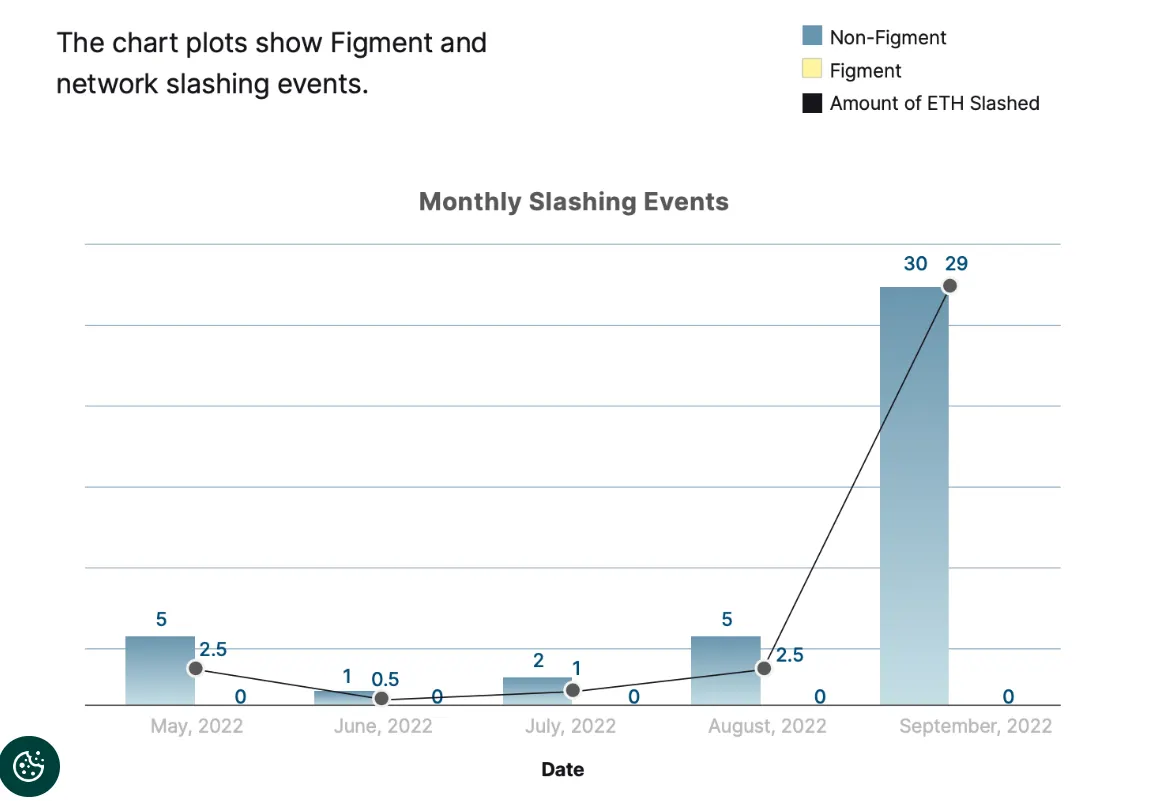

While maximizing uptime is ostensibly the best approach to maximize staking rewards, a balanced examination of the rewards and risks of staking shows a different picture. The aphorism “It is better to be safe than sorry” could be repurposed for Figment’s staking approach into prioritizing safety over liveness.Slashing penalizes stakers for undesirable network activity, primarily double-signing—when a validator signs two blocks at once, either intentionally or accidentally.

Figment’s staking infrastructure is specifically designed to help prevent double-signing incidents, employing an approach that achieves high uptime while mitigating the risk of slashing penalties. Whereas penalties incurred for double sign slashing are at least 1.06 ETH, downtime penalties are far less significant. In fact, one hour of validator downtime would only incur a loss of 0.0007 ETH. An infrastructure strategy that prioritizes maximum uptime can lead to risky infrastructure practices—such as automatic validator failover—that could result in double-signing.

In the next article, we’re going to run through the process for signing up and using the Figment dashboard

Cheat Sheet

- Figment was founded in 2018 and provides staking services and tools to institutional users.

- Figment has staking data metrics and APIs for institutional clients.

- Figment’s supported staking validators allow users to stake crypto while maintaining full control of their staked assets.

- Through its insurance partners, Figment offers insurance that offers protection against double-signing slashing incidents.

- Figment’s “Safety of Liveness” values staking security over overall validator uptime as a means to optimize staking rewards.