The crypto industry uproar following the SEC’s crackdown on staking services has been heard far and wide—yet the agency’s chairman isn’t budging an inch.

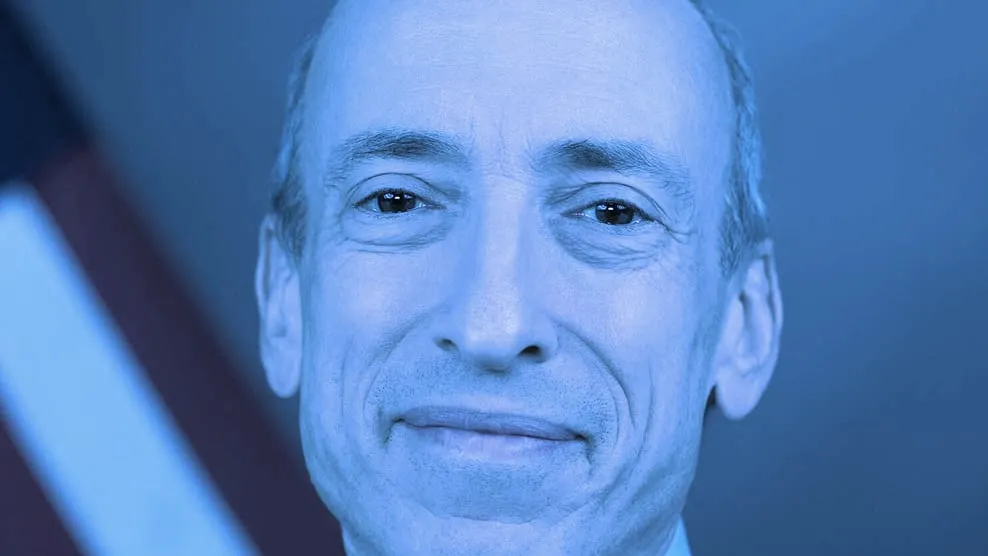

Speaking with CNBC’s Squawk Box on Friday, SEC Chair Gary Gensler blamed Kraken for failing to register its staking-as-a-service product with the Commission, and for not providing the relevant risk disclosures. He also dismissed the common criticism that there is a lack of clear rules that govern crypto, or that there is no clear path to register such products.

“There's a clear way to do this, and there are forms on our website,” he said. “I think it's just a talking point that the industry is using. They know how to do this. They are just choosing not to do it.”

Crypto staking is both how proof-of-stake blockchains secure their networks and validate transactions and how these networks issue new tokens. Kraken’s staking service, also provided by many other large exchanges and companies, allows the company to stake customer assets on their behalf.

This locks up, or pledges, these assets to their associated blockchain networks and generates yield, often between 4% and 7% APY, which is then split between all parties. On Thursday, the SEC forced Kraken to discontinue that service for its U.S. clients—and pay $30 million in penalties.

“Kraken can offer investment contracts and investment schemes, but they have to have full fair and truthful disclosure and this puts the investors who watch your program in a better position," said Gensler. “They were not complying with that basic law.”

On Wednesday, Coinbase CEO Brian Armstrong warned that a regulatory crackdown on retail staking services in the United States was coming down the pipe. He and other critics of the SEC’s actions argued at the time that staking services, in fact, do not involve securities transactions, stating that staking provides scalability and energy efficiency to the industry.

Following the enforcement action, both Armstrong and one of the SEC’s crypto-friendly commissioners, Hester Peirce, claimed that the regulator had provided “no way to register” for staking providers, calling the Commission’s offer “disingenuous.”

Crypto-friendly Congressman Tom Emmer (R-MN) was equally critical of the SEC’s action, arguing that Gensler’s “regulatory purgatory strategy” will only drive crypto investment opportunities offshore. Such has already been the case with companies seeking to launch a Bitcoin spot ETF—another product that continues to be stonewalled by the Commission, much to the industry’s dismay.

Nevertheless, Gensler made clear that his patience with non-compliant crypto firms is wearing thin, saying other industries have had little problem with registration.

“It's time for this group to do so,” he said. “The runway is getting awfully short. And we're here to try to protect the investing public.”