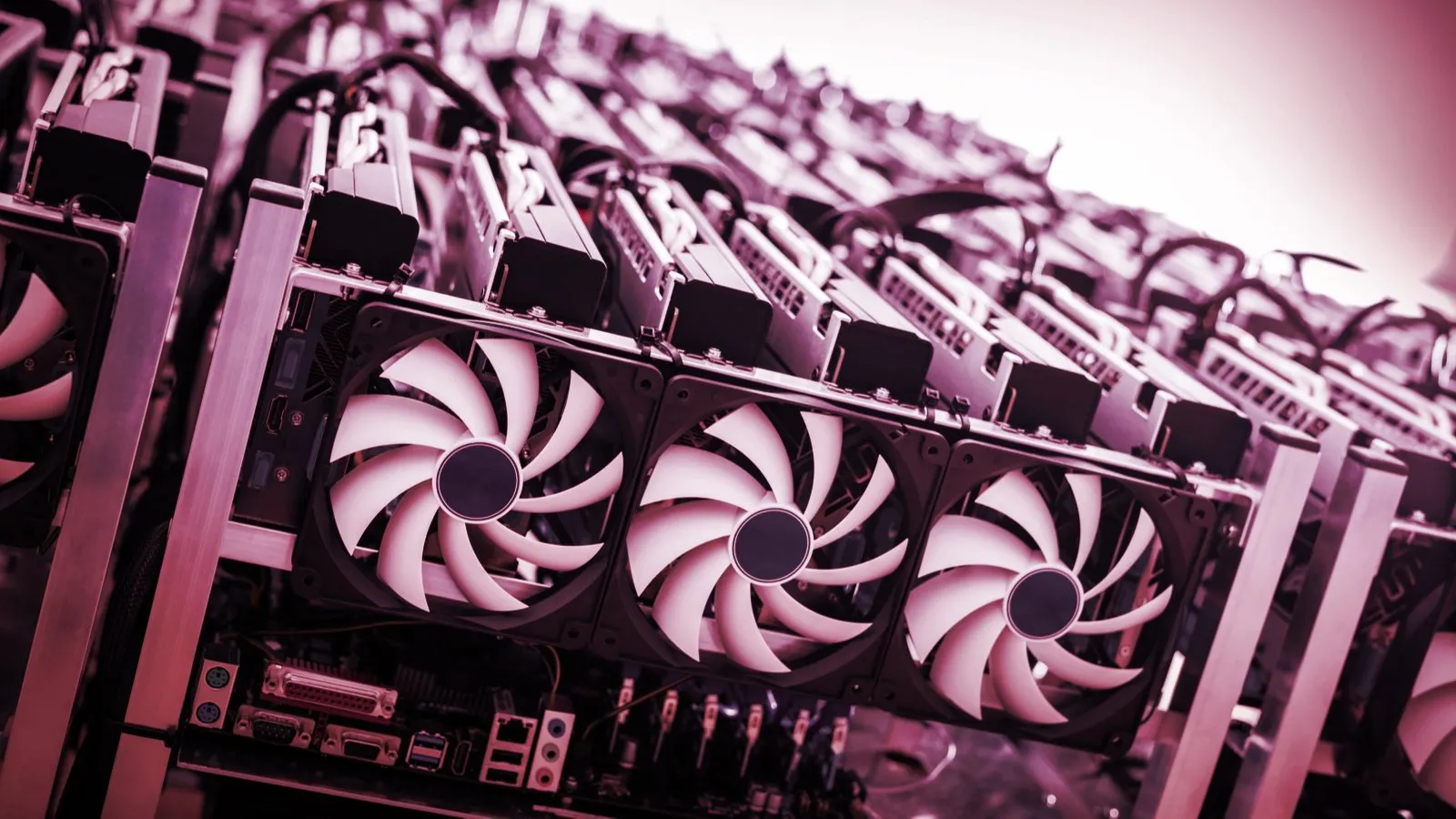

Competition among Bitcoin miners has reached a new record high as the network’s mining difficulty jumped another 3.44% on Sunday to hit a new all-time high of 36.835 trillion hashes, data from BTC.com shows.

While the latest increase is not as significant as the previous difficulty adjustment of almost 14% earlier this month, it still means there's even more pressure on miners to spend additional resources to perform the same amount of work.

Mining difficulty measures the computational power required to validate Bitcoin transactions and, consequently, how hard it is to find new blocks and earn rewards.

The network’s difficulty adjusts approximately every two weeks to reflect the level of competition among miners. Lower mining difficulty indicates less competition—and vice versa.

At the same time, Bitcoin’s average hash rate, or the computational power the network is using to process transactions, is currency at 263 EH/s, up from 258 EH/s the day before, meaning more machines are being connected.

Competition among Bitcoin miners mounts

The latest Bitcoin mining difficulty hike comes as the leading cryptocurrency continues to struggle slightly above the $19,000 level.

At the time of this writing, Bitcoin is changing hands at $19,314, up 0.2% over the day, and up 0.7% in the last week.

This means more woes for miners who need to sell more Bitcoin than they actually earn to compensate for the dwindling profits.

According to a recent IntoTheBlock report, the amount of Bitcoin held in reserve by mining companies fell this month to 1.91 million BTC—the incredible lows not seen since February 2010, when the network was just a little over a year old.