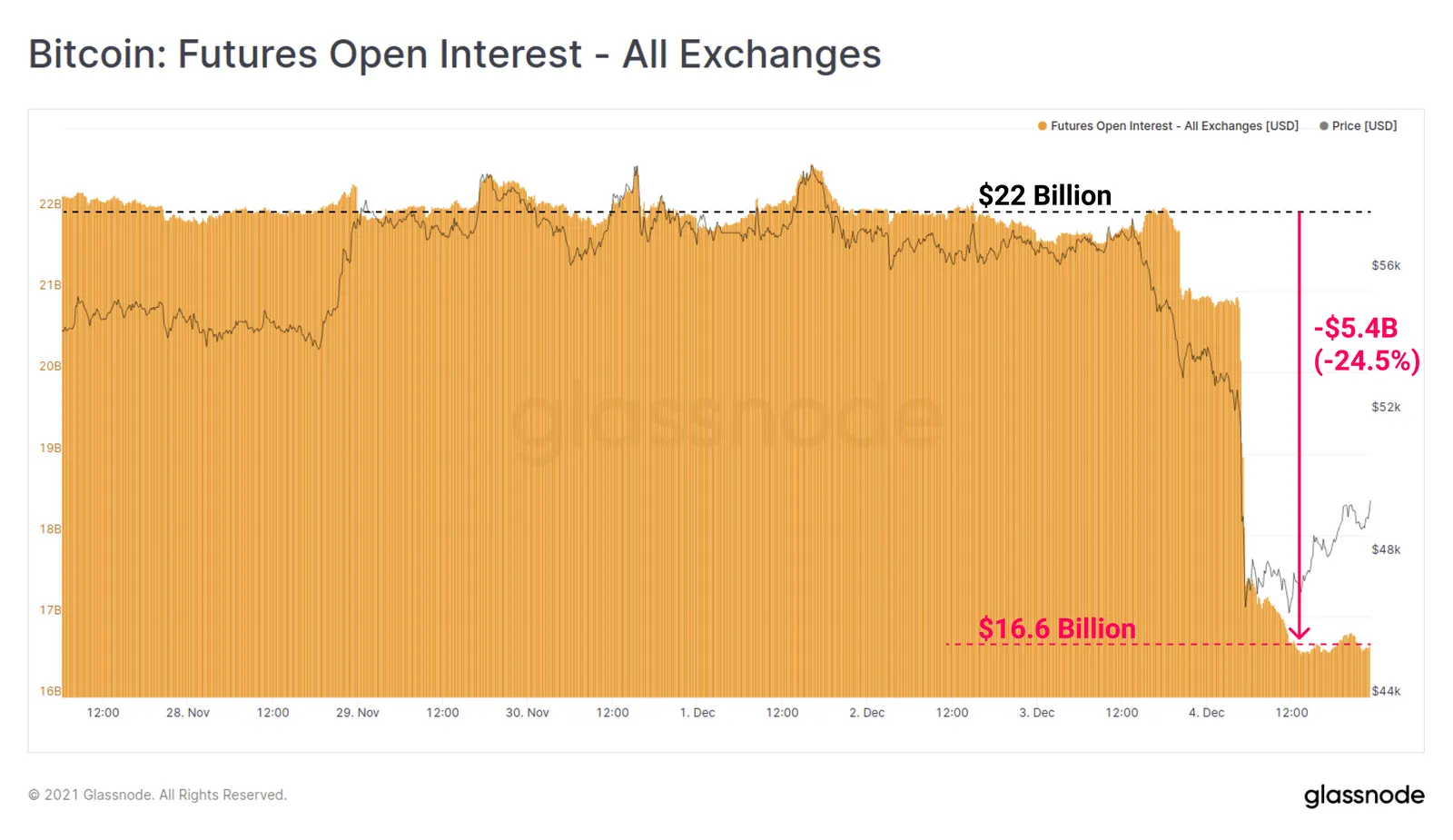

In only a few hours on Saturday, $5.4 billion of Bitcoin futures contracts were liquidated, draining the market of 25% of its value, according to Glassnode’s weekly report. It was the second largest single day change in the futures market this year, behind only the massive sell-off of May 19.

It was only a week ago that Glassnode found futures trading was on the rise and the Chicago-based CME derivatives market accounted for 20% of global volume. But when open interest rises, it can lay the groundwork for a lot of volatility.

Open interest refers to outstanding futures or options contracts that have yet to be settled. Options function as their name suggests, giving the buyer the option to buy an asset at a predetermined price when the contract expires. Futures are more binding, locking the buyer into buying an asset at a predetermined price when the contract expires.

Both types of derivative contracts can be used to speculate on price movement or as a hedge, allowing the buyer to recoup some portion of their losses if the underlying asset, in this case Bitcoin, moves in an unfavorable direction.

The leveraged positions—so called because investors can place these bets with a relatively small amount of capital—can cause big market swings when prices fall.

“The chain of contract closures on Saturday amounted to a total rinse of 58,202 BTC in value,” Glassnode writes in its report. “In BTC denomination, this liquidation was the second largest single day change in Futures Open Interest in 2021, bested only by the historic sell-off on May 19 that totalled 79,244 BTC.”

Other notable big market swings in open interest were May 12, the day Tesla said it would no longer accept Bitcoin as payment; July 26, when a short squeeze helped reverse prices out of their summer doldrums.

A short squeeze occurs when investors who have shorted an asset, or bet against it, liquidate their positions to cut their losses. The squeeze usually begins when the price rises unexpectedly. The liquidated short positions accelerate the rate at which an asset’s price rises, which of course leads more people to abandon their short positions. Wash, rinse, and repeat.

The other day for significant open interest movement occurred on Sept. 7, when Bitcoin officially became legal tender in El Salvador, according to Glassnode.

But even a big drop in open interest can spur other activity. It’s why Glassnode has said previously that it’s worth keeping an eye on the derivatives market. For example, last week’s sell off was accompanied by the second highest hourly options volume, $1.7 billion per hour, since the mid-May sell off.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.