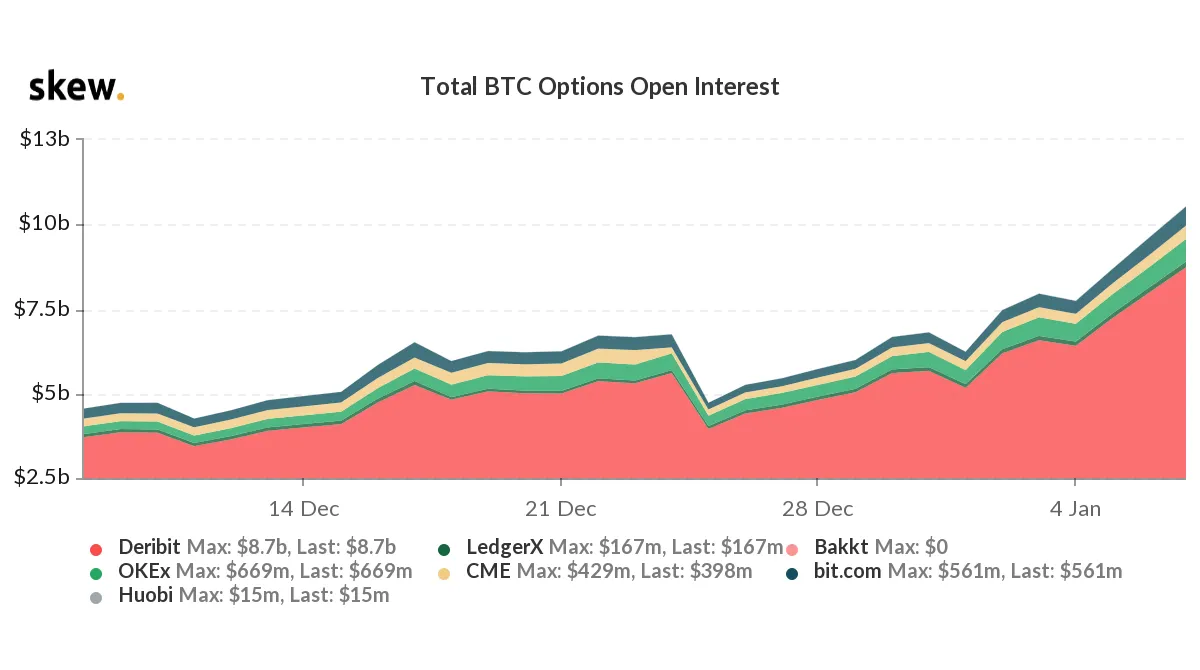

The total open interest (OI) across Bitcoin (BTC) options markets has reached over $10 billion today, as highlighted by market insights platform Unfolded.

Open interest is the total number of currently outstanding derivative contracts—such as options and futures—that have not been settled yet. Options are contracts that give buyers the right—but not the obligation—to purchase assets at a specified price on a set date in the future, for which they pay sellers a “premium.”

Futures, on the other hand, work mostly the same way, but buyers have no option to refuse the trade and are obliged to buy the asset on the specified date. Until that time comes, both options and futures are considered “not settled” and thus add to the total open interest.

According to crypto analytics platform Skew, crypto derivative exchange Deribit is still responsible for the majority of Bitcoin options OI with $8.7 billion. It is followed by OKEx ($669 million), bit.com ($561 million), and CME ($398 million). Other tracked platforms have less than $200 million in open interest.

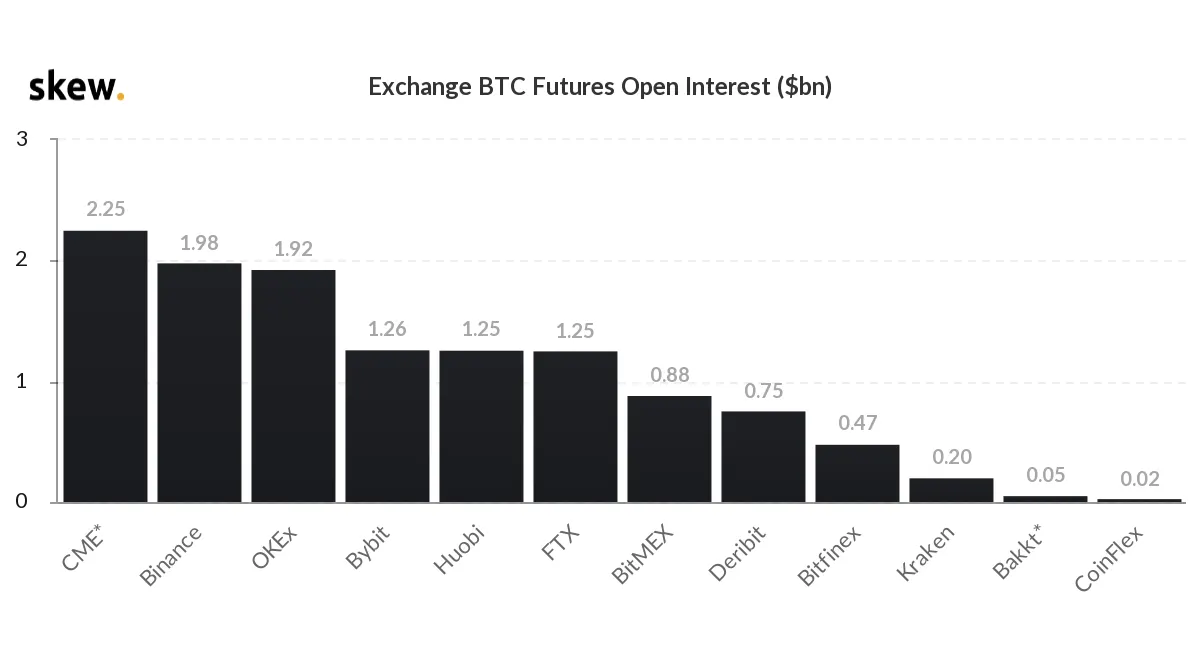

At the same time, Bitcoin options are building towards crypto futures. Skew’s data shows that BTC futures open interest amounts to roughly $12.36 billion. Distribution is more even here with CME ($2.25 billion), Binance ($2 billion), and OKEx ($1.93 billion) leading the charge.

Notably, this shows that retail investors are interested in trading options much more than institutional ones—and vice versa. Deribit is leading by far in terms of BTC options OI. At the same time, the picture is reversed for Bitcoin futures, where CME—aimed at institutional investors—is leading while Deribit remains in the lower half of the list.

“I would say that for institutional investors, one will have to track volume growth on CME. Deribit will mostly be crypto hedge funds and retail investors,” Bobby Ong, COO of crypto analytics platform CoinGecko, told Decrypt previously.