Hourly liquidations of long positions on #Binance:

- $262M at 3am UTC

- $163M at 8am UTC#Bitcoin pic.twitter.com/iVmD4TXCpZ— glassnode (@glassnode) November 26, 2020

$68,087.00

-0.13%$1,978.10

0.32%$1.42

-1.10%$624.35

-0.75%$1.00

0.00%$85.18

0.24%$0.289095

0.84%$0.097336

-3.01%$1.046

1.02%$573.05

0.63%$50.74

-0.26%$0.277024

-2.61%$0.99895

-0.10%$8.19

-5.05%$29.56

-2.52%$8.83

-0.96%$0.999203

-0.02%$0.159429

-0.21%$323.47

-2.06%$0.156841

-3.91%$0.999141

-0.00%$0.00956421

-0.25%$0.098446

-1.55%$54.77

-0.65%$252.54

-3.68%$0.999309

-0.03%$9.04

-2.33%$0.00000624

-4.98%$0.936775

-2.33%$1.33

-0.21%$0.118216

-1.70%$0.0765

-2.66%$5,094.49

0.10%$1.38

2.85%$5,131.42

0.21%$3.56

-2.47%$1.34

-3.51%$0.630549

-0.98%$1.00

0.00%$119.42

-1.05%$0.713023

-2.61%$0.996664

0.01%$0.00000411

-5.25%$178.50

-1.13%$78.35

-1.39%$2.33

-0.38%$1.00

-0.00%$1.12

0.00%$0.999835

-0.02%$0.0000017

0.02%$0.164854

-6.10%$0.065236

1.48%$8.81

-9.12%$1.031

-6.11%$0.998632

-0.04%$0.264433

-2.84%$0.00208796

-2.10%$11.00

0.00%$2.19

-2.19%$0.107651

-2.86%$2.30

-3.75%$7.24

0.95%$8.56

0.56%$0.381269

-3.75%$0.058433

-3.44%$0.0176399

-2.41%$65.45

-1.00%$1.63

3.44%$0.892568

-0.22%$0.104781

-6.19%$0.999664

0.01%$0.03082054

-1.48%$0.00940051

-0.38%$3.42

-3.07%$1.23

0.00%$0.088329

-2.39%$1.00

-0.01%$1.43

-4.09%$1.027

0.00%$0.946119

-6.11%$114.37

0.00%$0.03539529

-0.60%$1.11

0.88%$0.857158

-5.08%$0.00762302

-3.37%$0.080138

0.01%$0.587233

18.58%$1.095

0.00%$0.998118

0.07%$0.096557

-7.24%$0.00000617

-4.96%$0.999729

0.01%$0.02871892

-4.63%$0.155486

-2.35%$0.0128067

-0.95%$0.999224

-0.02%$0.999687

-0.02%$0.070436

-1.69%$1.087

0.01%$26.86

8.20%$1.18

-0.01%$0.250348

-3.11%$0.246341

4.17%$1.31

0.47%$34.14

-1.81%$0.00674861

-4.10%$0.636646

-2.53%$0.383474

-3.43%$167.45

-2.42%$0.998993

-0.01%$1.088

-1.92%$0.04283489

-0.25%$1.50

0.50%$0.162722

-3.46%$0.084036

1.05%$3.63

-5.25%$0.0343646

-5.51%$1.72

2.67%$0.234245

-4.93%$0.99962

0.00%$0.452258

-5.53%$0.00000034

-0.73%$1.021

0.02%$0.00000033

-0.56%$0.056327

-0.29%$0.01698704

0.17%$3.28

3.58%$15.95

-3.49%$120.47

1.37%$0.053224

-3.38%$0.331876

1.48%$0.16386

0.83%$0.318912

-2.16%$0.068154

-3.35%$0.02727305

-6.15%$0.998586

0.05%$0.00002979

-3.86%$0.324504

-6.19%$0.00569209

-3.52%$1.49

-0.32%$0.995282

0.14%$0.321305

-4.36%$0.052305

-3.74%$17.22

-1.36%$0.125361

-6.74%$0.00278181

2.35%$1.63

0.55%$0.227487

0.06%$6.57

-6.07%$0.01951636

-3.86%$0.071428

-3.40%$0.00247079

1.07%$0.04423874

-4.56%$0.998951

-0.09%$1.32

-1.05%$0.083222

-3.79%$1.075

0.00%$0.999803

-0.02%$0.02018726

-4.28%$0.988303

0.00%$0.217274

-4.66%$0.999703

0.01%$0.516644

-1.36%$22.86

0.00%$5,471.81

-4.42%$0.280625

25.47%$0.00000097

0.19%$0.00207649

-3.59%$0.09399

-5.52%$1.60

2.82%$1.21

-2.31%$0.197695

-5.98%$0.00003609

-3.05%$0.197018

2.07%$2.72

-2.01%$1.00

0.00%$0.05276

-0.89%$0.00500399

-2.18%$0.095922

-4.05%$0.07904

-3.06%$4.17

-2.00%$0.181475

-3.35%$0.0038129

-5.15%$0.02194086

27.69%$0.120087

-2.11%$1.00

0.00%$0.791384

4.61%$0.175802

4.18%$2.19

-1.90%$0.908629

-20.57%$1.89

-4.87%$0.999884

-0.02%$0.635816

-2.97%$17.65

-3.84%$0.053448

-0.96%$1.81

0.62%$0.166332

-1.85%$2.10

0.55%$0.04308045

-2.23%$8.28

-0.12%$47.99

0.00%$0.00000793

-1.86%$8.10

61.68%$0.990176

-0.43%$1.27

-0.31%$0.02150142

-8.19%$13.76

-0.95%$0.652392

15.28%$0.998598

0.05%$0.340169

2.81%$1.014

0.06%$1.001

0.09%$0.310113

-0.66%$0.415847

8.57%$0.405165

-2.73%$0.320459

4.59%$0.165554

-3.12%$0.647912

-5.26%$0.134771

7.00%$0.134623

2.04%$0.076284

3.06%$0.081792

-2.02%$0.325811

0.88%$0.264565

-4.83%$4.50

-3.76%$0.09316

-1.64%$2.00

-4.44%$1,097.13

0.00%$0.604118

2.90%$0.260817

2.07%$8.46

-5.72%$0.00149955

-1.31%$0.125961

1.01%$0.995668

0.02%$0.077935

-4.53%$0.130786

0.09%$0.00401981

-2.16%$0.215707

3.90%$0.990378

-1.04%$0.995734

0.00%$0.0022654

-2.45%$0.340657

-3.93%$2.32

-2.12%$2.46

-1.66%$1.00

-0.04%$0.999725

0.00%$1.062

-0.02%$0.18474

-6.82%

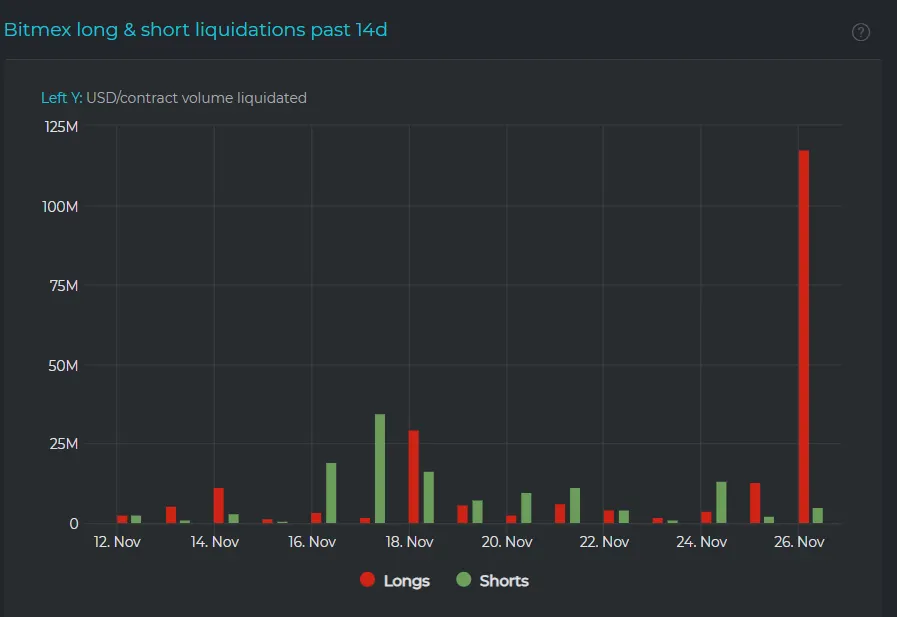

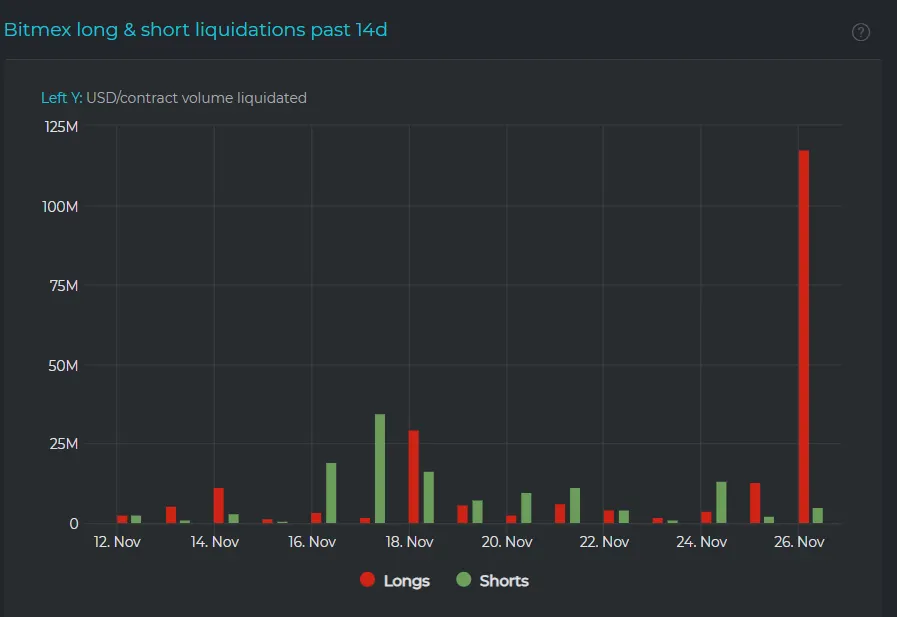

Bitcoin’s not called a volatile asset for nothing. Just as the overall sentiment among crypto circles was turning from bullish to extremely bullish, Bitcoin did its thing and dropped over 11% this morning—liquidating nearly $556 million across three popular crypto exchanges along with it.

Of that, over $262 million in Bitcoin longs were liquidated on crypto exchange Binance in a single hour alone.

Hourly liquidations of long positions on #Binance:

- $262M at 3am UTC

- $163M at 8am UTC#Bitcoin pic.twitter.com/iVmD4TXCpZ— glassnode (@glassnode) November 26, 2020

Liquidations are a process in which futures trading positions are automatically closed by the exchange, due to traders borrowing high amounts—i.e. using leverage—from bourses to bet on amounts bigger than their capital. When the price reaches a predefined threshold, such leveraged positions are closed, and can cause a cascading effect that, in turn, drives market prices even lower.

Today's liquidations were those of "long" positions, meaning of those traders who borrowed capital to bet Bitcoin's price would go up. But Bitcoin's downward moves spoiled all that.

Binance oversaw the most liquidations this morning, with over $425 million gone in the wee hours. Meanwhile, traders on crypto exchanges BitMEX and Bitfinex lost over $117 million and $14.7 million respectively in the same period.

The correction came after consecutive weeks of rising prices and Bitcoin nearing its all-time highs earlier this week. However, some technical and sentiment indicators were pointing towards an upcoming drop anyway.

The “Fear and Greed” index—which calculates market sentiment using data from multiple social media sources—was suggesting the market was being too “greedy” with a >90 rating over the past week.

In addition, a popular indicator called the Relative Strength Index (RSI), a momentum-based technical tool that tracks the growth of an asset’s prices, suggested Bitcoin was “overbought” and hinted at a correction.

Meanwhile, the general sentiment among traders on microblogging platform Twitter remains unfazed. They point out Bitcoin—which famously crashed over 30% in three instances before reaching its all-time high in 2017—will eventually recover from this dip and surge towards newer highs.

Or that’s the hope, at least.