In brief

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$69,974.00

0.60%$2,048.61

1.81%$648.04

1.14%$1.38

0.20%$0.999925

0.00%$85.79

0.59%$0.289794

0.89%$1.027

-0.87%$0.092903

1.03%$55.08

-0.11%$0.999928

0.00%$0.261288

1.42%$454.42

1.45%$37.06

7.74%$9.07

-1.14%$354.78

0.58%$8.97

0.87%$0.999467

-0.01%$0.151634

2.80%$0.15868

1.48%$0.99917

-0.04%$0.00904966

1.34%$54.33

0.98%$9.61

1.07%$0.094702

0.78%$1.00

-0.01%$0.982456

3.59%$207.71

-2.62%$0.00000583

3.66%$1.34

2.98%$0.075719

0.73%$5,143.53

-0.15%$0.100335

-1.26%$5,181.23

-0.20%$1.51

1.57%$1.44

1.20%$3.89

1.61%$0.705959

1.88%$0.238783

4.35%$1.12

-0.01%$1.00

0.00%$94.87

-0.12%$206.93

6.16%$0.080871

7.81%$0.999972

-0.04%$0.997189

-0.00%$0.703994

1.56%$1.32

3.76%$109.23

-0.15%$0.99953

-0.02%$2.17

-0.54%$0.00000161

1.03%$2.57

-9.46%$0.0000033

0.69%$0.999199

-0.01%$1.11

0.26%$8.24

0.60%$0.254651

0.66%$0.00203816

2.99%$7.03

0.38%$1.96

-0.24%$11.02

0.01%$7.98

0.00%$0.098095

1.96%$0.3518

-0.20%$1.21

-0.52%$62.74

0.16%$1.84

1.14%$0.898144

0.74%$0.10496

3.86%$0.999601

-0.02%$0.03031739

0.78%$1.56

5.54%$0.04769036

-8.46%$0.01403642

0.79%$0.085849

1.25%$0.00893281

0.30%$1.00

-0.04%$114.56

0.01%$0.927166

-1.63%$2.86

-1.34%$0.867713

-0.40%$0.03296848

2.18%$1.097

0.01%$0.080553

0.41%$0.02923789

6.80%$0.00705501

0.14%$0.999994

0.01%$0.099257

0.87%$1.00

0.03%$0.163534

-0.30%$0.999805

0.53%$0.00000588

0.11%$0.999254

-0.02%$0.01258388

1.84%$27.33

-5.70%$1.089

0.10%$0.053351

3.45%$0.25375

-0.95%$0.700049

1.45%$0.254501

-3.19%$1.38

0.92%$1.16

-0.50%$0.00704115

1.57%$0.062904

1.21%$0.569026

-0.77%$1.025

-0.07%$2.03

0.67%$0.563564

13.44%$32.40

1.06%$167.51

0.08%$0.03807118

-1.28%$0.364055

0.85%$0.999839

0.02%$0.999654

0.00%$0.157812

0.31%$0.354699

-5.84%$18.05

20.19%$0.233475

-1.47%$127.59

2.00%$0.00000033

0.11%$3.38

0.98%$0.00000032

-0.41%$0.054558

-0.17%$1.024

-0.03%$1.00

0.02%$0.338423

2.10%$0.01603644

1.06%$2.98

1.79%$14.76

-2.92%$0.330456

1.07%$0.307565

2.71%$0.00573278

1.79%$0.00002913

1.28%$0.787964

0.99%$0.238198

6.70%$0.991955

-0.03%$0.02550846

0.99%$0.063243

-0.49%$1.08

6.80%$0.051802

2.77%$17.15

0.23%$0.077282

1.84%$0.268104

-0.31%$0.04643888

1.85%$1.003

0.48%$1.63

2.75%$5.69

9.25%$0.11871

-0.19%$1.12

2.43%$0.295068

1.88%$11.83

0.28%$0.133898

3.75%$0.00254469

-1.91%$0.02168509

1.85%$1.85

0.02%$0.00004202

0.17%$0.00000109

-1.37%$5.96

0.89%$0.101936

4.25%$0.99946

-0.14%$0.03986687

-0.24%$0.08158

0.41%$0.984174

0.21%$1.31

4.01%$1.00

0.04%$1.16

-7.09%$0.00214639

-0.20%$22.87

0.00%$0.497554

1.49%$1.077

0.01%$4.26

-1.61%$2.16

-1.11%$0.00199354

-0.79%$0.02357258

1.34%$0.195194

0.71%$0.352055

-3.30%$1.00

0.00%$1.12

-0.59%$0.00493065

0.53%$0.051501

-0.05%$0.057498

1.84%$0.181129

0.04%$2.23

0.19%$2.56

1.63%$0.097766

-0.88%$1.00

0.00%$0.177153

-10.94%$0.078584

4.60%$0.01907297

1.32%$0.090158

-0.91%$0.073902

0.19%$2.18

1.67%$1.00

-0.01%$17.65

2.75%$4,401.14

-6.18%$0.164793

0.85%$1.79

-0.02%$47.99

-0.05%$0.600105

1.34%$0.00338718

1.37%$0.991577

-0.28%$0.04157199

-1.25%$0.156614

-0.42%$0.02158662

-4.62%$1.24

0.43%$0.154105

1.64%$0.428992

1.66%$1.004

0.46%$0.09684

-0.55%$0.315853

2.40%$0.163657

2.63%$0.276946

2.52%$0.00000692

-0.73%$0.02323021

0.61%$0.290049

0.27%$0.998911

0.04%$0.095269

1.45%$0.584364

7.14%$0.237712

2.12%$1.017

-0.08%$1,096.04

0.06%$1.083

-0.02%$0.126306

0.52%$0.00000063

-3.14%$1.57

9.47%$0.130151

-0.74%$0.075839

0.71%$0.574954

2.86%$0.999911

-0.02%$0.272986

5.69%$4.13

1.05%$0.418508

0.14%$1.004

0.00%$0.186859

1.34%$0.999938

0.02%$10.81

-1.90%$0.292894

-1.25%$0.117637

3.58%$0.999959

0.01%$0.00139002

0.49%$0.067542

-0.04%$1.78

6.24%$1.066

0.08%$10.79

0.00%$0.329823

-2.87%$2.25

-1.12%$1.003

3.99%

Some crypto traders were left high and dry yesterday after Bitcoin surged to nearly $15,800 as part of a broader move upwards in global equity markets.

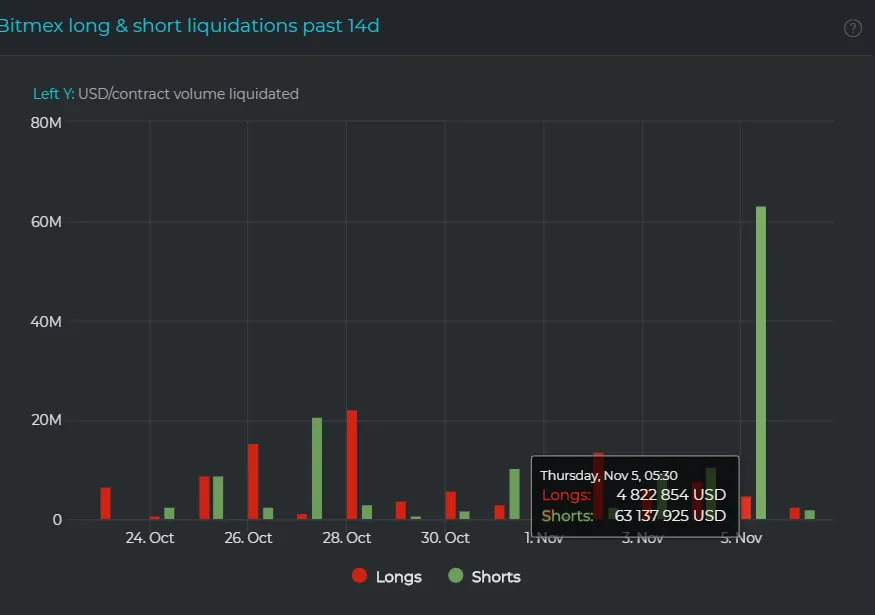

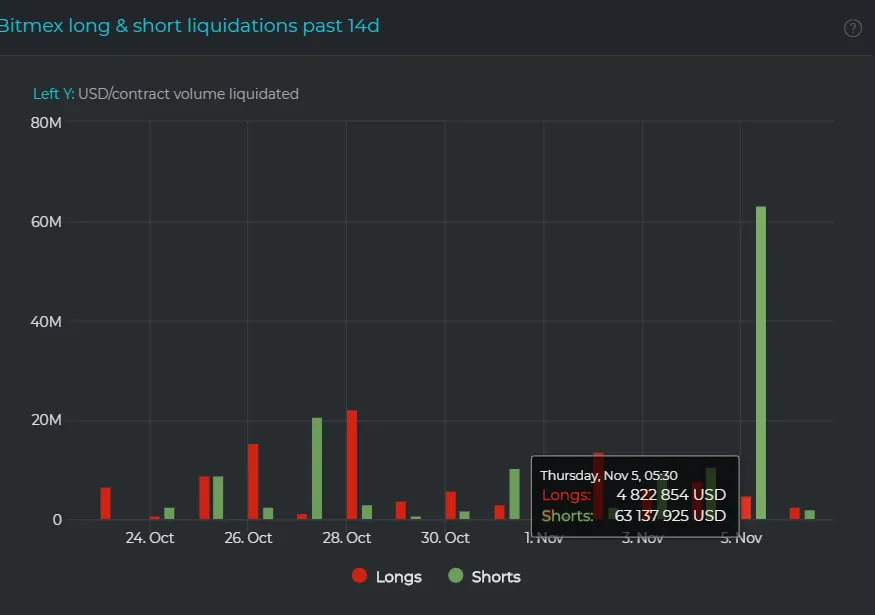

As per data from tracking site Datamish, over $63 million worth of Bitcoin futures belonging to short sellers on derivatives exchange BitMEX was liquidated as the asset pumped by nearly $1,400 in the space of four hours on Thursday.

Bitfinex, another crypto exchange that offers derivative trading, also saw short sellers lose over 389 Bitcoin (a comparatively lesser $6 million).

Short sellers are traders who bet on falling asset prices, often using leverage to borrow additional capital—putting up stablecoins or other cryptocurrencies as collateral—for a chance to make more returns. However, sudden moves can cause exchanges to sell off that collateral to cover an overexposed position, a process known as liquidation.

Data shows Thursday was not the only instance of a Bitcoin move upwards causing short sellers to lose money. On Wednesday, BitMEX traders lost over $10.5 million on the short side while $2 million from this morning was liquidated as well.

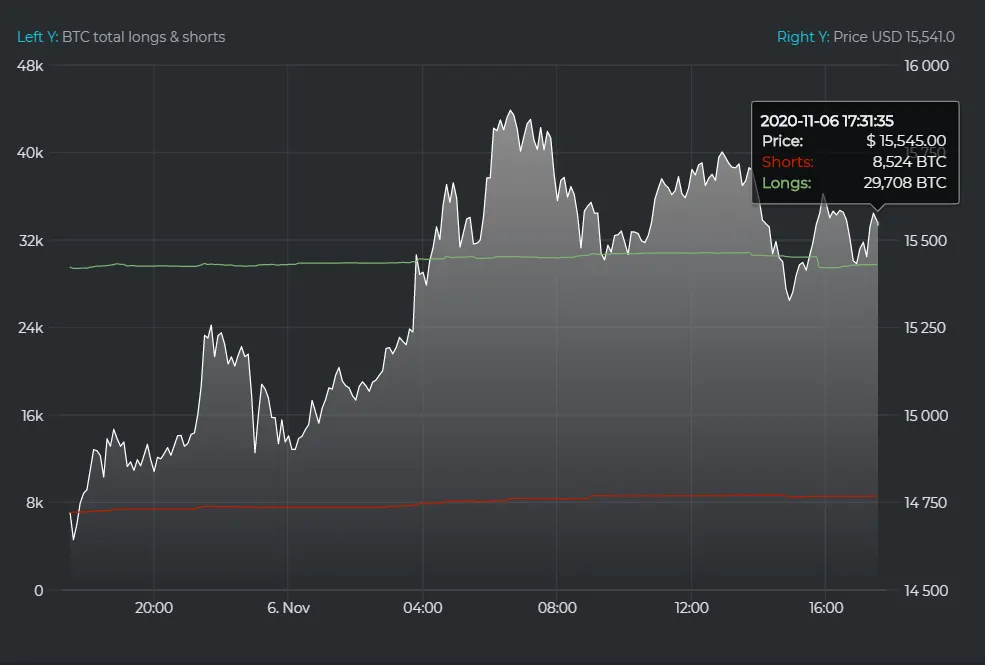

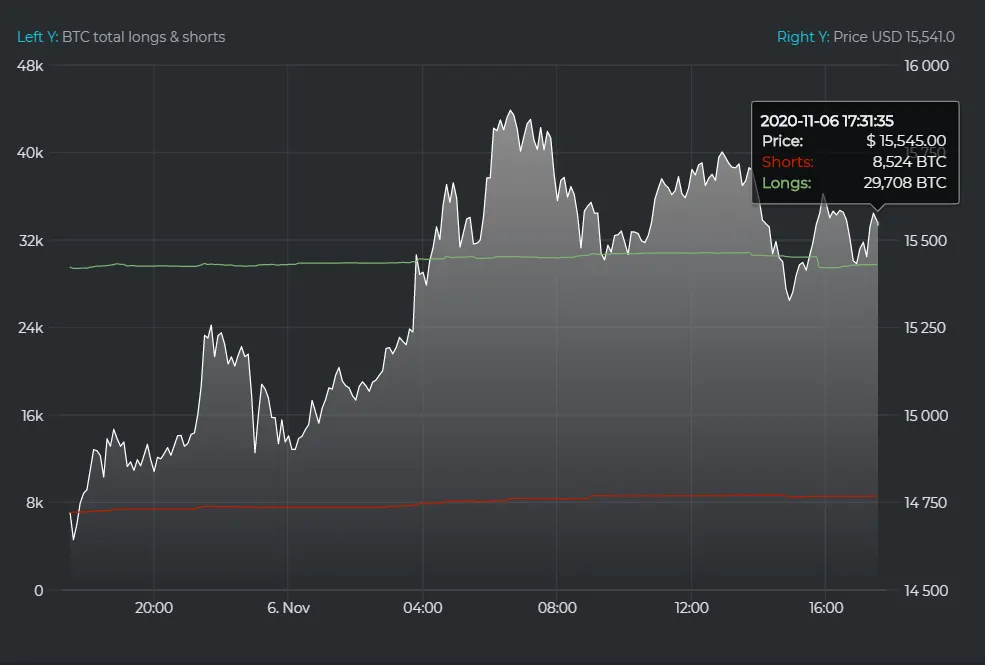

The liquidations have seemed to put the brakes on shorts for now. Datamish shows the open interest—the outstanding amount for trades that have not been settled—for shorts on Bitfinex stands at 8,524 Bitcoin ($132 million) at press time, compared to a much greater 29,708 Bitcoin ($461 million) on the long side, suggesting traders are expecting prices to move further upwards instead of correcting.

But that could change soon. Data released by on-chain analytics firm Glassnode yesterday showed 97% of all Bitcoin addresses are currently in profit—with yesterday’s prices last seen only in January 2018. However, this means there may be selling pressure on Bitcoin in the near future, should holders want to cash some of their gains out.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.