In brief

- Most major DeFi assets have lost significant value in recent weeks.

- But the number of DeFi users continues to grow at an exponential pace—mostly due to Uniswap's performance.

- The total value locked (TVL) in DeFi platforms continues to growth despite the price woes.

The last month has seen practically all major DeFi assets enter a significant price decline, after many of these assets reached their all-time highest values in September.

In the top 10 by DeFi market capitalization alone, Aave (LEND) has lost 23.6%, Yearn Finance (YFI) is down 42.7%, and both UMA and Compound (COMP) are down a massive 63% in the last 30 days. Prior to this recent bearish price action, these DeFi assets were some of the market's best performers and often topped the charts in terms of daily growth.

Overall, according to recent research by Santiment, the collective market cap of DeFi assets has been cut by more than a quarter in the last day alone.

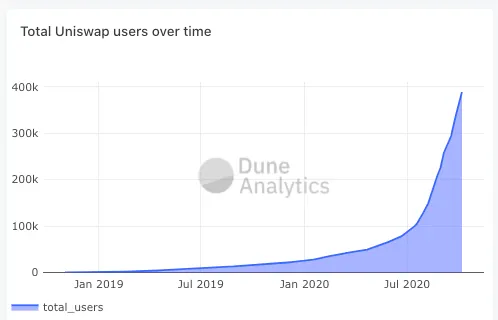

Despite these losses, DeFi as a whole continues to grow at a breakneck pace in terms of user counts. As per data from Dune Analytics, the overall number of DeFi users is now approaching above the half a million mark—more than tripling in the last three months.

Most major DeFi platforms, including Kyber Network, Compound, 1inch, Aave, and OpenSea have grown their userbase substantially in recent months, and are still experiencing roughly linear growth.

Uniswap, on the other hand, is the main driver behind the exponential growth of the DeFi industry, having experienced a meteoric surge of interest—particularly in the last three months.

There are now close to 390,000 unique Uniswap users, compared to 70,900 three months ago, and 45,780 six months ago. Roughly 80% of all DeFi users have now used Uniswap at some point, making the decentralized exchange by far the most popular DeFi protocol.

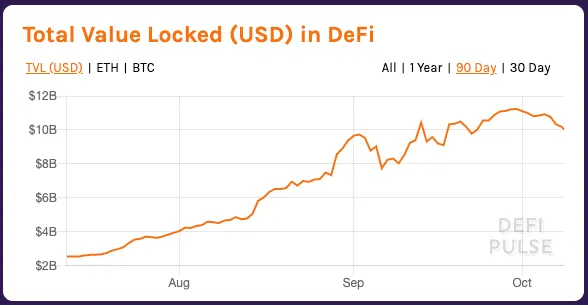

Similarly, though the price action is overtly bearish, the total value (TVL) of assets locked up in DeFi platforms has continued to growth over both 30-day and 90-day timescales—again mostly catalyzed by the success of Uniswap.

As per data from DeFi Pulse, the TVL of DeFi has increased by 17.7% in the last month and 293% in the last three. Uniswap accounts for $2.2 billion of this value and is one of the few DeFi protocols to have seen little to no TVL loss in the last week.