In brief

- The world’s most popular stablecoin has long been suspected of inflating Bitcoin’s market capitalization.

- Sino Capital says that a lot of demand for Tether comes from China’s over-the-counter brokers, where the stablecoin is used to hide popular BTC speculation. BTC trading is discouraged by the government.

- That could explain why Tether traders are often silent about their involvement.

One of the more titillating questions among Bitcoin watchers is, who’s buying all that Tether that’s propping it up? According to a new Sino Capital report shared with Decrypt, the answer is pretty simple: lots of Chinese investors are a part of the equation. And they don’t want you to know that they’re buying USDT, because the government frowns upon buying Bitcoin there.

That explanation helps address some of the criticisms of USDT, partly fueled by an academic paper that claims Tether was used to pump Bitcoin in 2017, and the claim that Tether’s holds fractional, three-fourth reserves. Critics have maintained that the company is merely “printing” the stablecoin without having any real buyers, and thus inflating Bitcoin’s price.

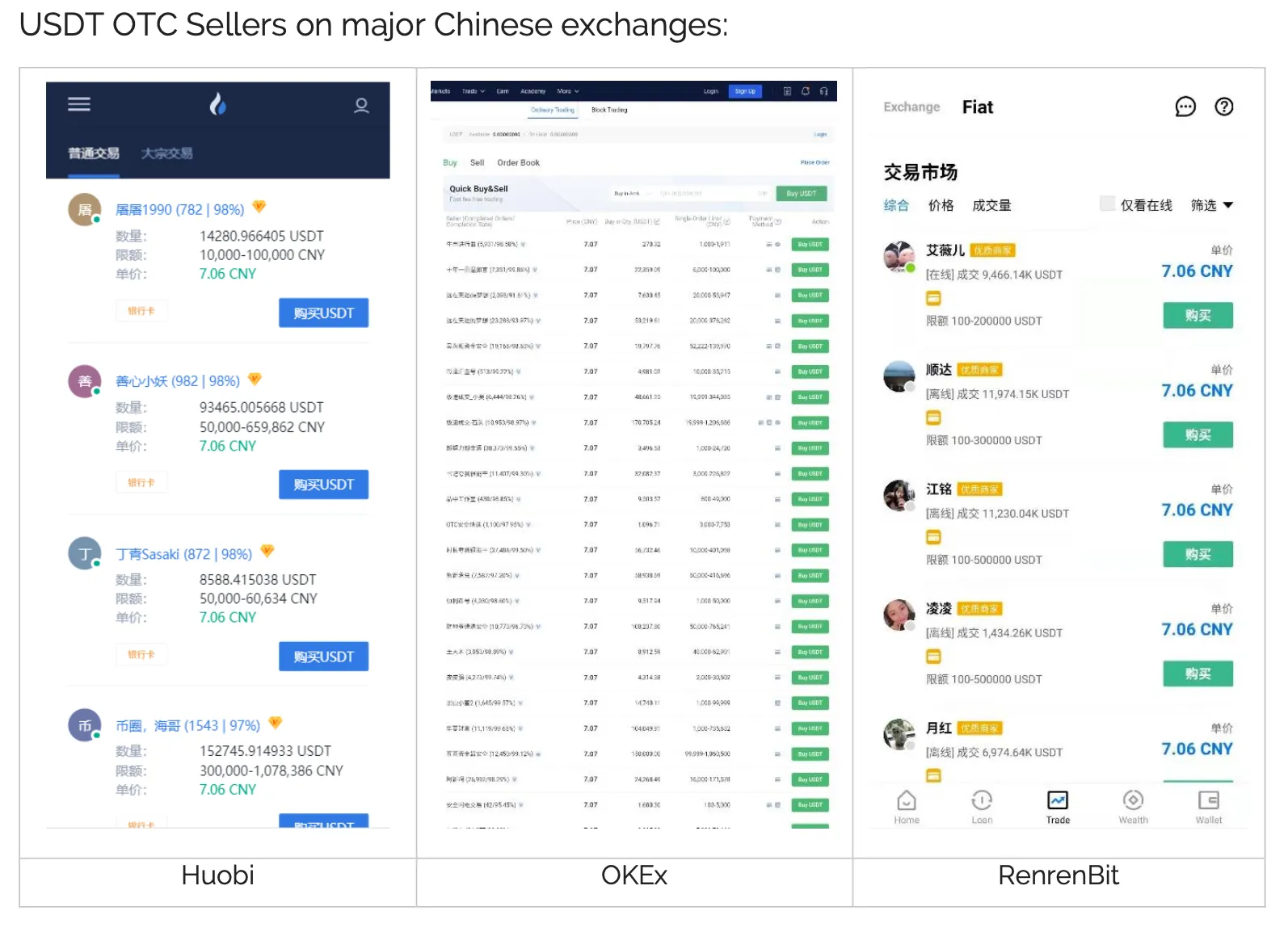

But one thing affecting the issuance of new Tether is throngs of Chinese buyers using over-the-counter brokers, according to the report.

"Our key point is that 1) OTC is an enormous market in China—far bigger than people think, and that 2) USDT is the crux of that flow," said Matthew Graham, CEO of Beijing-based Sino Global Capital, which prepared the report for Decrypt this week.

Shanghai Shuffle

Tether has added $5 billion worth of USDT into the cryptocurrency market since 2020, reaching a total market cap of $9 billion—10 times higher than any other stablecoin. The demand for much of that Tether is coming from—by some estimates—100,000 Chinese retail and institutional buyers who can’t access cryptocurrency market pairs otherwise.

“USDT is a very popular way for Chinese crypto investors to enter the market with most exchanges offering a range of OTC options,” the report noted.

The report explains the legal grey area that covers Bitcoin in China. While the government there recognizes Bitcoin as virtually property (and thereby does not ban ownership of the cryptocurrency), it banned exchanges. (Many of these exchanges moved their servers to other jurisdictions and still operate for Chinese citizens who use VPNs.)

Since 2018, China has also banned citizens from accessing foreign cryptocurrency services, and forbade banks from opening accounts with exchanges.

How Tether is used by Chinese investors

Cue USDT. The stablecoin is perfect for servicing a Chinese crypto clientele that has been shut out of the market by their banks and government, mainly because it’s highly liquid, integrated with all major southeast Asian exchanges, and permissionless.

These tokens are distributed by OTC trading desks, a brokerage model that became popular in China during its post-Cold War industrial boom as a way for retail investors to gain access to restricted markets. Depending on the operation, these OTCs will match buyers with sellers in China’s highly-networked, tight-knitted crypto economy or provide liquidity themselves

One anonymous OTC employee, who spoke with Decrypt, corroborated the report’s findings.

The employee pointed out that trading Chinese Yuan (CNY) for Bitcoin is not technically illegal, but anyone who does so will have their bank account locked or even closed. USDT to Bitcoin trading, then, is not wholly legal, but it is tolerated, the employee said.

“OTC transactions including and especially with respect to USDT are an ‘open secret’ in China,” Graham told Decrypt. “It’s a sensitive topic, but it’s common knowledge within China’s crypto community.”

The role of OTCs in China

The employee who spoke with Decrypt said his OTC serves around 100 large clients who account for over $5 billion in annual volume, depending on Bitcoin’s price trends. He said the OTC holds accounts with crypto-friendly banks in the west, including Silvergate and Deltec (the latter being the same Bahamian-based bank Tether uses).

The OTC also has relationships with several western exchange brokers that provide liquidity for crypto assets; it can buy from Tether directly because of business relationships between the two entities.

Dancing in a legal gray area can be tricky, but OTCs like this one have mastered the steps necessary to stay on their feet, Sino Capital’s report claims.

“There are varying levels of professionalism and scale, and many services exist in China’s grey zone of legality. At one end of the professionalism spectrum, OTC desks cater to ‘whale-level’ traders, including high-net-worth individuals and institutional traders,” Graham said. He said that larger trades are usually facilitated via “Signal and Telegram, as well as in-person meetings,” adding that this gray zone economy thrives on referrals.

“At the other end of the spectrum,” Graham said, the buying is easier because they can fly under the radar. If they run a VPN, these small account holders can deal with OTCs directly from exchanges and pay for their purchases through AliPay, WeChat or bank wire.

“Cat and Mouse”

The OTC desk employee told Decrypt that an average Tether buy-in is around 10,000 CNY (or $1,400). Over the past year, the broker has seen a 300% surge in customer volume.

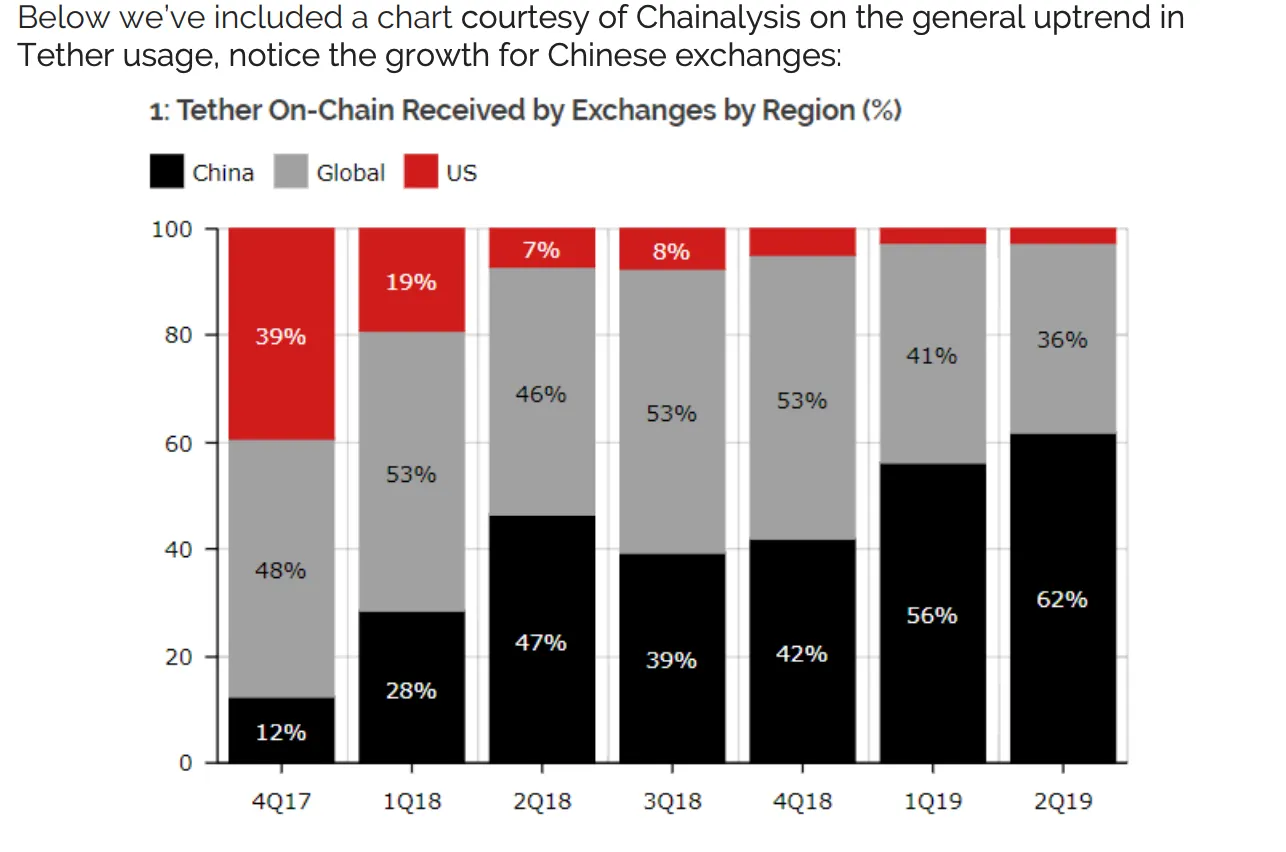

This trend is, supposedly, typical at the half dozen major OTCs that serve China. And, according to Sino Captial’s report and Chainalysis data, this trend has only grown since trading bans have made Tether an indispensable cog in China’s Bitcoin trading machine.

Drawing on data from Morgan Stanley, Sino Capital asserts that, before the Chinese government started paying attention, CNY (and earlier, USD) was the preferred payment method in China for intrepid Bitcoiners. But as the government started clamping down, USDT quickly subsumed that volume.

Most of this trading is done via referrals and knowing-a-guy-who-knows-a-guy connections, according to the report.

Messaging platforms are watering holes for the OTC users, Sino Capital’s report says.

“Dampening” the price of BTC

Our OTC source estimated that some 100,000, mostly retail investors engage in the Tether-BTC swap. Sino’s Graham said “he could not corroborate [this figure] directly,” but that it’s “not an at all outlandish” estimation.

“In China the smartest and most successful businessmen are often also the quietest,” the report said. And that’s why you have no one speaking publicly about purchasing Tether; it’s not because Bitfinex/Tether is pumping unbacked-USDT into the market, it’s because the ones that are doing the buying don’t want anyone--most of all their government--to know.

Until Bitcoin trading becomes legal for CNY, don’t expect the USDT buying pressure from China to stop anytime soon.

But if you think that the Tether-Bitcoin connection only drives up the price of BTC, that's not exactly true. While the USDT-BTC exchange does allow far more Chinese to buy and sell, “actually in our view USDT inflows are to some extent dampening bitcoin price appreciation,” Graham said. “For those whose primary purpose is to be ‘off the grid,’ it provides an alternate place to land and without the volatility. Previously the similarly motivated would have been more likely to buy bitcoin.”