In brief

- China appears to have brought its coronavirus epidemic under control, with new cases slowing.

- The global Bitcoin hashrate didn’t drop off during the peak of China’s epidemic in February.

- That’s despite China accounting for two thirds of the global Bitcoin hashrate.

China’s drastic measures in response to the coronavirus outbreak appear to have brought the epidemic under control—and the country’s Bitcoin mining industry seems to have shown no signs of slowing down during the crisis.

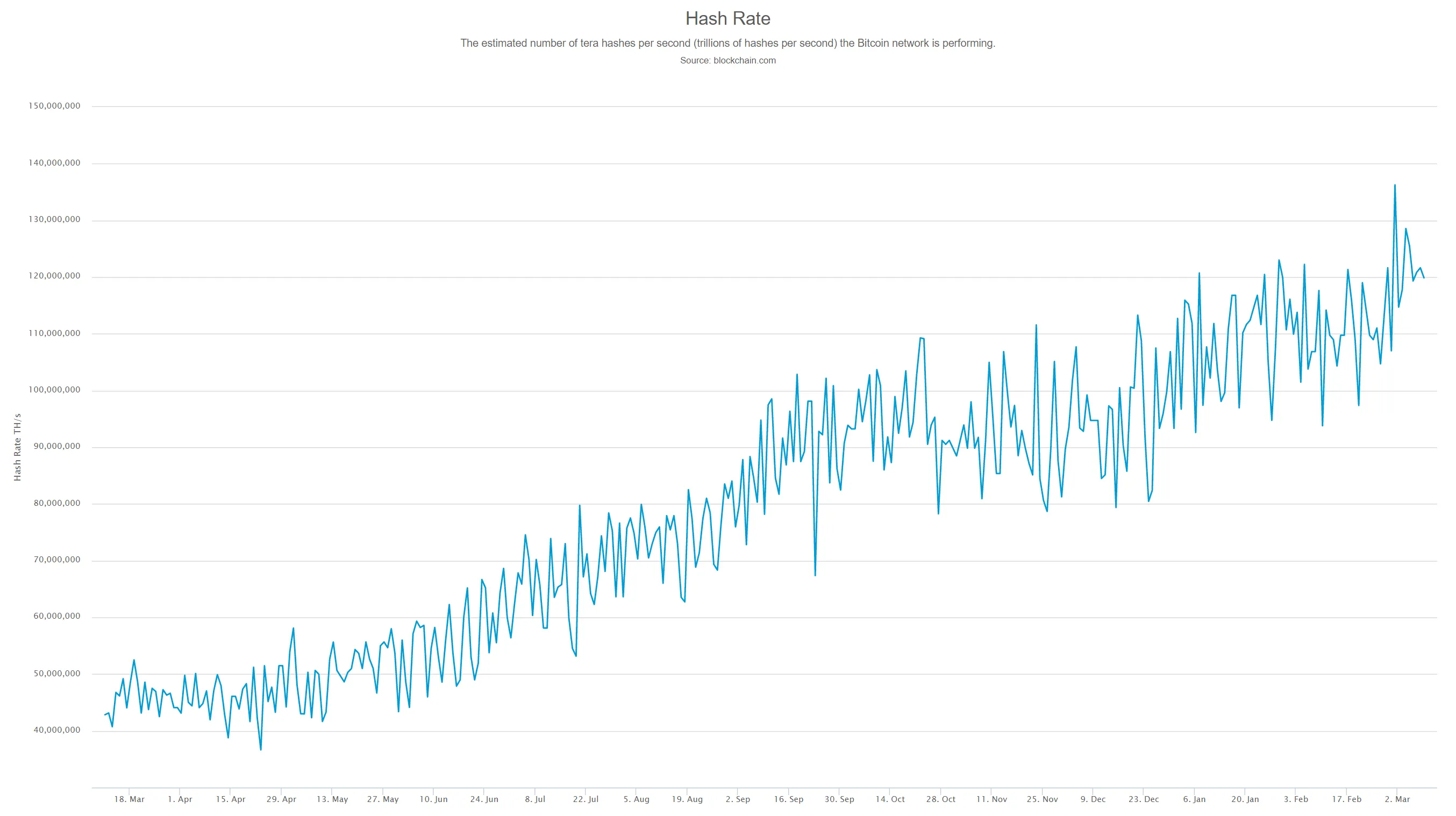

Although half of Bitcoin’s hashrate comes from Chinese mining pools, it has consistently set new highs throughout the past two months, with no major drop off during the height of the coronavirus crisis in February.

China’s coronavirus epidemic “under control”

The coronavirus epidemic is slowing down in China, with the number of new cases dropping to double digits. At its peak, China reported more than a thousand new cases per day. According to China's National Health Commission, the country confirmed 17 new cases on March 9, 15 of which were from the Hubei area.

According to the Director-General of the World Health Organization, Dr. Tedros Adhanom Ghebreyesus, “China is bringing its epidemic under control,” with 70% of the more than 80,000 confirmed cases having recovered and been discharged from the hospital.

Based on the substantial decline in the number of new cases, researchers at Guangzhou Institute of Respiratory Health said in a paper published in the Journal of Thoracic Disease that the “second peak” of coronavirus in China had already passed in February.

What does China’s coronavirus recovery mean for Bitcoin mining?

China’s recovery from coronavirus could revitalize the global Bitcoin mining market, considering the size of the local cryptocurrency mining industry.

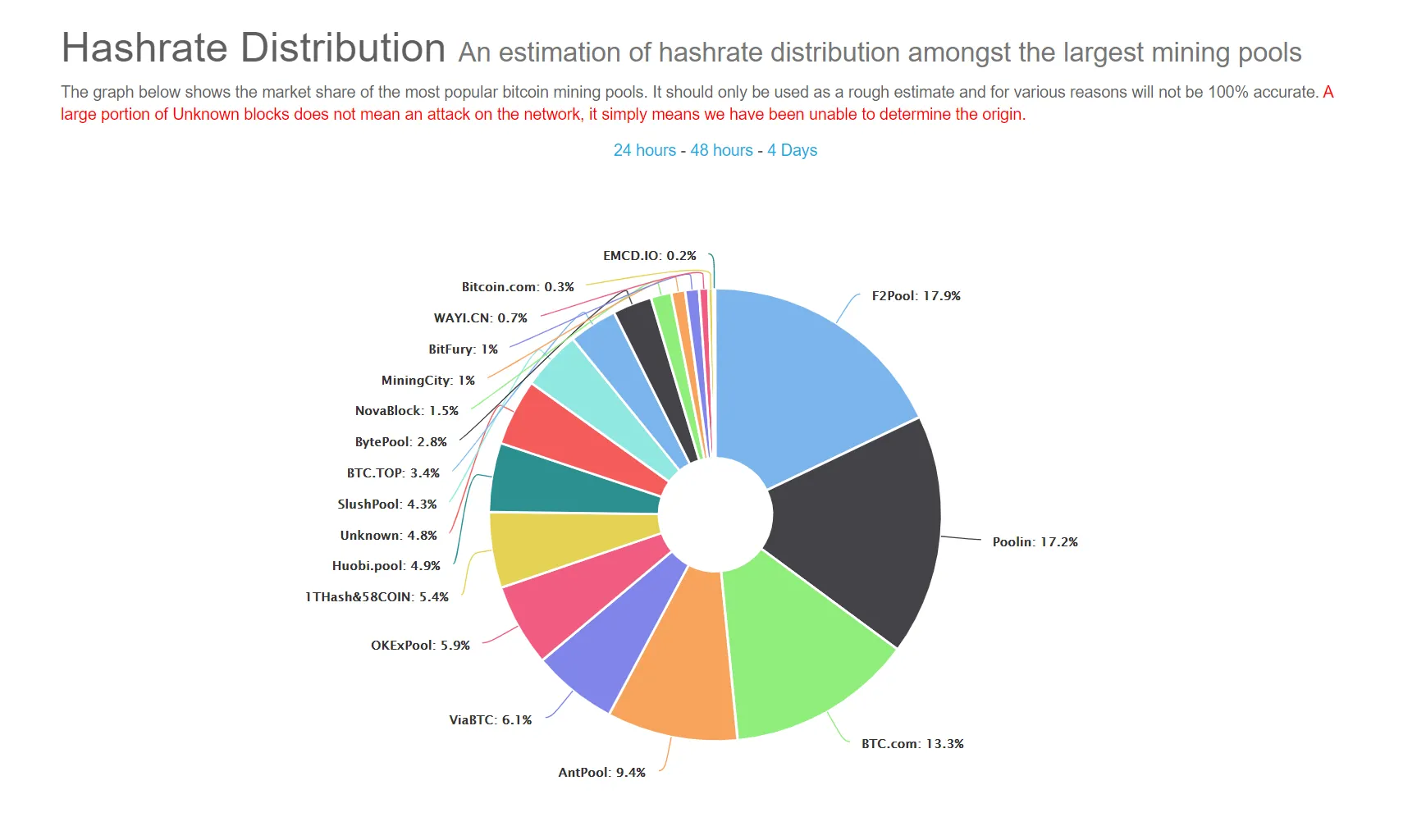

The Chinese Bitcoin mining market dominates the global mining landscape, with China accounting for two-thirds of the Bitcoin blockchain network’s total hashrate. Just four Chinese Bitcoin mining pools—F2Pool, Poolin, BTC.com, and AntPool—account for more than half of all Bitcoin’s hashrate.

Remarkably, despite China’s coronavirus epidemic peaking in February, the global Bitcoin hashrate did not significantly drop off; instead, it’s consistently set new highs throughout the past two months.

As China begins to roll back strong quarantine measures following a decline in new coronavirus cases, the local Bitcoin mining sector is also expected to stabilize.

Coronavirus didn’t impact Chinese Bitcoin miners

When the coronavirus epidemic initially hit Wuhan and the Hubei area, leading to the lockdown of 55 million individuals, there were concerns that the decline of China’s cryptocurrency mining sector would lead to a decline in the hashrate of Bitcoin.

In February, several major mining firms in China expressed concerns around the instability of operations and an abrupt drop-off in the supply of mining equipment, putting the Chinese Bitcoin mining industry at risk of a slump.

Btc.top founder Jiang Zhuoer said that the company was forced to shut down Bitcoin mining equipment to help with quarantine measures. In a statement on Weibo, Zhuoer said that if the company has to close down its mining centers for extended periods, it would significantly affect the firm and the livelihood of its employees.

While several mining companies like Btc.top were asked to halt operations in certain areas, mining equipment manufacturers struggled to distribute products across China.

The cut in the mining equipment supply chain and the struggles of mining centers in China intensified instability in the entire Bitcoin mining sector.

Although China’s Bitcoin mining industry appears to have ridden out the coronavirus storm, there could be more pain ahead. The impending Bitcoin halving is expected to hit just as miners will need to upgrade to new 7-nm chips, which could lead to smaller mining farms being priced out of the market if the price of Bitcoin stays flat or drops further.