Grayscale Bitcoin Trust (GBTC) discount shrank to its lowest level in a year, hitting 26.7% of its NAV on July 6.

The amelioration comes amid a wave of exchange-traded fund (ETF) applications in the U.S. and the settlement of a lawsuit against one of its shareholders.

One GBTC represents the smallest unit of Bitcoin held by a U.S.-based trust. Currently, it holds BTC worth $19.07 billion. GBTC was last trading at a discount of 27.8% on the price of spot Bitcoin.

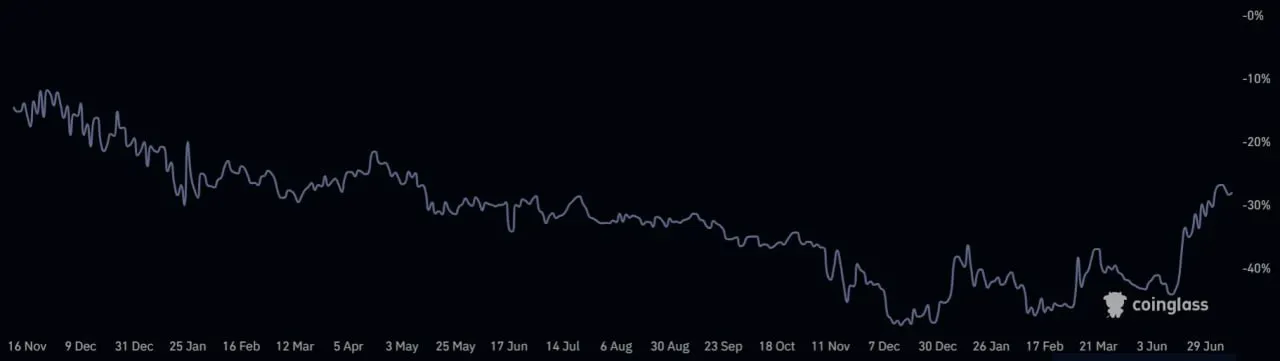

The GBTC shares have traded at a discount to Bitcoin’s market value since February 2021, reaching lows of nearly 50% in December 2022.

The primary reason for the discount in GBTC is that it is a closed-end fund, which means that investors cannot redeem GBTC for the underlying Bitcoin, making it challenging to track the fair market price and reducing its demand.

There are several alternative investment products like ProShares Bitcoin Strategy ETF, which closely tracks BTC price and has seen increasing demand since its launch last year.

GBTC also charges an annual management fee of 2%, which slowly eats into the principal value.

Grayscale: ETF or redemptions

Grayscale has attempted to convert its trust fund into an ETF to enable redemptions at Bitcoin’s market price, however, the U.S. Securities and Exchange Commission has denied approval so far.

The firm sued the SEC to contest SEC’s rejection in court. The verdict of the lawsuit is expected to arrive this fall.

BlackRock’s Bitcoin ETF filing on June 16 revived the market’s hope around an ETF approval, with hopes that approval could come for Grayscale too.

The GBTC discount dropped from around 44% before BlockRock’s filling to 26.7% in less than a month.

Another factor promoting GBTC demand is the possibility of opening redemptions regardless of ETF approval amid scrutiny by a meaningful shareholder of Grayscale, Fir Tree Partners.

Fir Tree Partners had filed books-and-records litigation against Grayscale in 2022, accusing them of mismanagement and conflicts of interest.

Yesterday, the trust fund settled outside court, agreeing to produce certain books and records in response to Fir Tree’s demand.

Fir Tree argues that Grayscale’s management has not acted in favor of its shareholders by limiting redemptions. They wrote Grayscale “failed to address our continued concerns about GBTC’s structure and the unavailability of redemptions.”

On top of that, Digital Currency Group (DCG), the parent company of Grayscale, failed to repay a $630 million loan to Genesis, and U.S.-based Gemini filed a lawsuit against DCG and its CEO Barry Silbert accusing them of fraud related to their Genesis offerings.

The events have increased the urgency among GBTC shareholders like Fir Tree to enable early redemptions, with the firm writing that it is now time for Grayscale and DCG “to facilitate GBTC share redemptions.”