Circle, the fintech firm behind one of crypto’s largest stablecoins, named Heath Tarbert its new chief legal officer on Thursday, taking on the ex-regulator as an executive amid a double-tap of enforcement actions against exchanges from the Securities and Exchange Commission (SEC).

Tarbert will also become Circle’s head of corporate affairs when he officially starts at the company in July, leaving behind his role as chief legal officer at Citadel Securities, the titanic market-making firm founded by billionaire entrepreneur Ken Griffin.

Tarbert’s track record within the halls of government was noted by Circle in a press release, which said Tarbert “brings decades of experience from all three branches of U.S. government, international leadership posts, and private sector firms to Circle."

Tarbert has served as chair and chief executive of the Commodity Futures Trading Commission and held titles within the U.S. Treasury Department, U.S. Justice Department, Supreme Court, Senate Banking Committee, and the White House, according to his LinkedIn profile.

Circle’s announcement follows an appearance from the company’s CEO, Jeremy Allaire, on the cover of Forbes Magazine. An article, titled “Circle Begs Congress: Please Regulate Us,” explores how stablecoin legislation in the U.S. could impact Circle’s standing.

As crypto exchanges face SEC lawsuits, the company behind the $30 billion USD Coin believes that if regulation finally comes to crypto and stablecoins, its by-the-book approach will put it on top. It also could unleash a storm of formidable competition. https://t.co/0KSaGkV5EY pic.twitter.com/UBEITo2NSt

— Forbes (@Forbes) June 8, 2023

Allaire said Tarbert’s “legal acumen” and regulatory experience will be a boon to Circle’s ambitions in the press release, describing his hiring as an “extraordinary step in Circle’s growth as a global company.”

A spokesperson for Circle told Decrypt Tarbert is expected to “collaborate on a range of complex global regulatory and policy matters” with government entities and jurisdictions, in areas like “corporate governance, complex M&A deals, and regulatory negotiations."

Allaire’s comments come as USDC’s market capitalization continues to slide, conceding billions of dollars in ground to Circle’s main competitor Tether, since the failure of Silicon Valley Bank temporarily dislodged USDC’s dollar peg. Circle told Decrypt that legislation on stablecoins is necessary to prevents similar incidents in the future.

“Comprehensive payment stablecoin legislation will help restore confidence in both the US dollar and dollar digital assets,” the spokesperson said. “Circle has long advocated for regulation that would insulate our base layer of internet money and payment systems from fractional reserve banking risks.”

Since Silicon Valley Bank was shut down by regulators on March 10, USDC’s market capitalization has fallen 32% to $28.5 billion from $42 billion, according to CoinGecko. That represents the token’s lowest circulating supply, which tends to mirror market capitalization, since September 2021.

In March, Allaire described it as “ironic” that Circle was threatened by a tumult in America’s banking sector, despite warnings from regulators that crypto is a risky business for banks to be involved in.

While the SEC’s lawsuit against Coinbase does not mention USDC, the exchange collaborated with Circle on the token’s underlying technology. USDC was the first stablecoin added to Coinbase in 2018, and the two firms are co-founders of the CENTRE Consortium, the organization that launched the token.

Circle has been one of several stablecoin issuers lobbying on Capital Hill as two potential stablecoin bills work their way through the legislative process. Even though Tarbert’s no stranger to working within Washington D.C., Allaire said on Twitter on Thursday that his experience at international organizations like the World Bank and the International Organization of Securities Commissions will also prove crucial.

“It's a pivotal time for our company, and the broader industry, and a critical part of the path forward is building durable relationships with governments around the world,” Allaire said. “[Tarbert] can be a meaningful contributor to driving the kind of change we hope to see in the global economic system.”

5/ Most importantly, Heath deeply aligns with our company's mission and values, shows exceptional integrity and purpose in his work, and can be a meaningful contributor to driving the kind of change we hope to see in the global economic system.

— Jeremy Allaire (@jerallaire) June 8, 2023

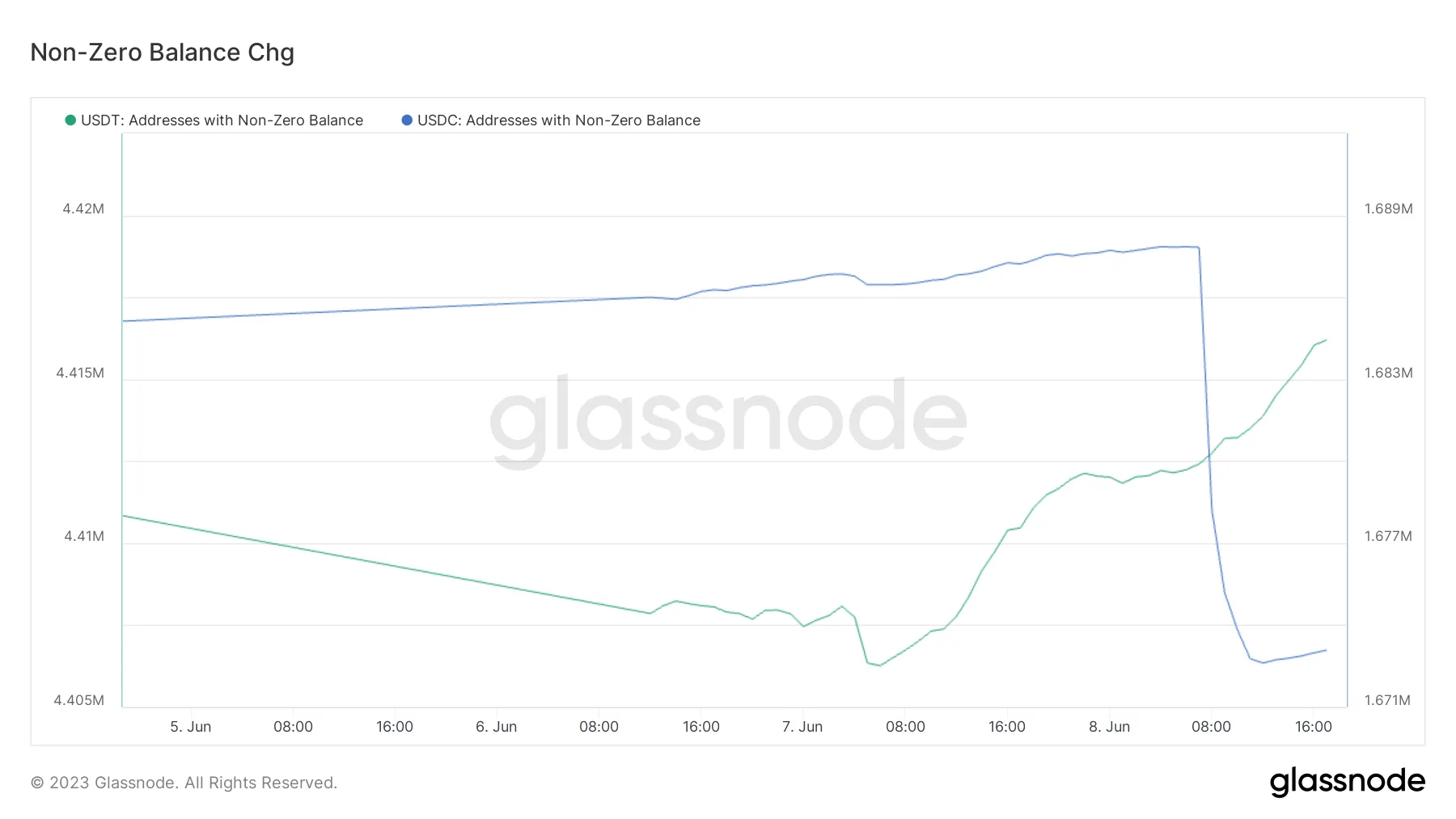

Meanwhile, on-chain data related to USDC suggested the crypto market could soon face some turbulence, Brett Singer, an analyst from the blockchain data firm Glassnode, told Decrypt.

Around 15,000 wallets completely sold their USDC within a five-hour window on Thursday, something that he said has historically happened just a few times.

“Something's going on—hopefully it's not related to USDC, particularly,” Singer said. “It's rare to see that much outflow of key holders for a token.”

Drops of a similar size in the number of digital wallets holding USDC happened in June of last year around the collapse of Terra’s algorithmic stablecoin, when FTX was wiped out last November, and when USDC lost its dollar peg this past March, he added.

“It's unusual, to say the least,” Singer said, noting that the number of digital wallets holding Tether increased on Thursday. “I'm kind of just sitting here, bracing to see if anything has happened, or anything will happen.”