The Argentine Football Association’s crypto fan token ARG plummeted as Argentina played Saudi Arabia in the FIFA World Cup Tuesday, going from roughly $7.20 at the start of the match to a low of $4.96, according to CoinGecko data.

Since the match ended, ARG’s price has recovered slightly to around $5.36. In the past 24 hours, the token is down 18%. But it’s worth noting that ARG is actually still up 17% in the past month, and reached a new all-time high of $9.19 just four days ago.

But Argentina’s loss was bad enough that plenty of fans sold off their tokens, which were created by the crypto company Chiliz and launched on its exchange Socios in an official partnership with the Argentine Football Association.

ARG is a type of ERC-20 token, which is Ethereum-compatible. In order to buy any token on Socios, fans first have to buy Chiliz’s token CHZ (which is down 33% in the past two weeks) and then trade it for their desired token. Fan tokens like ARG don’t give holders any type of shareholder status or partial team ownership.

So what is ARG for? According to the Chiliz company, fan tokens give owners the right to vote on “fan-led decisions” and join a “secure, exclusive inner circle of fans.”

“The more tokens a fan holds, and the more they vote, the higher the clout rating of that fan, moving them upwards through different reward tiers until they have access to the biggest VIP benefits that are on offer,” the Chiliz website reads.

It’s also certainly possible that some fans are using tokens like ARG as an indirect way to bet on a team’s victory or loss with the hopes that token price increases after a win.

As Argentina copes with its loss, Saudi Arabia’s victory has led to a fluctuation in the NFT market. An Ethereum NFT collection called The Saudis—which was launched back in July and has no affiliation with the football team—saw a modest uptick in sales Tuesday. The profile picture-style avatars appear to be an unaffiliated “derivative” of the CryptoPunks NFTs.

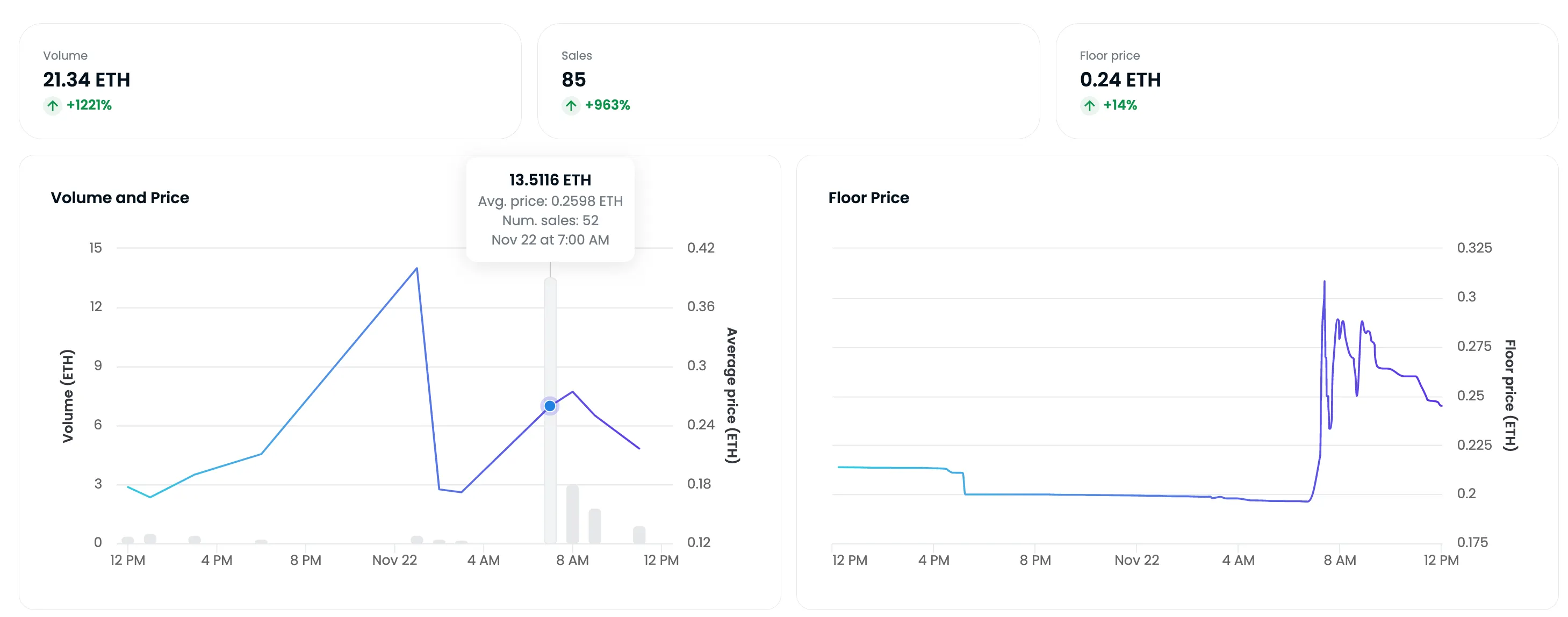

After Saudi Arabia won, 52 NFTs sold from the collection on OpenSea for an average of 0.2 ETH each, which is about $280. But that small pump appears to have been short-lived, as the collection’s floor price has already declined from its daily peak of about 0.31 ETH back down to 0.24 ETH on OpenSea. Sales volume has already slowed significantly in the hours following Saudi Arabia’s victory.

While a 1,200% trade volume increase in 24 hours might seem like a lot, it’s put into perspective by the very low number of sales before the peak early Tuesday. There’s only been 21.75 ETH (roughly $24,000 worth) traded for the collection in the past day across marketplaces. And at time of writing, OpenSea is the NFT marketplace with the most Saudis NFTs listed (180) for sale, according to Gem data.

NFT collections and cryptocurrencies named after real entities, whether official or not, sometimes see volume or price spikes when said entity makes the news—like how Johnny Depp’s NFTs surged during his highly publicized trial against his ex-wife Amber Heard.

But that volume and price spike is often little more than a quick flash in the pan. For example, Depp’s NFTs did not see sustained trading volume, and their floor price and volume quickly returned to pre-spike levels.