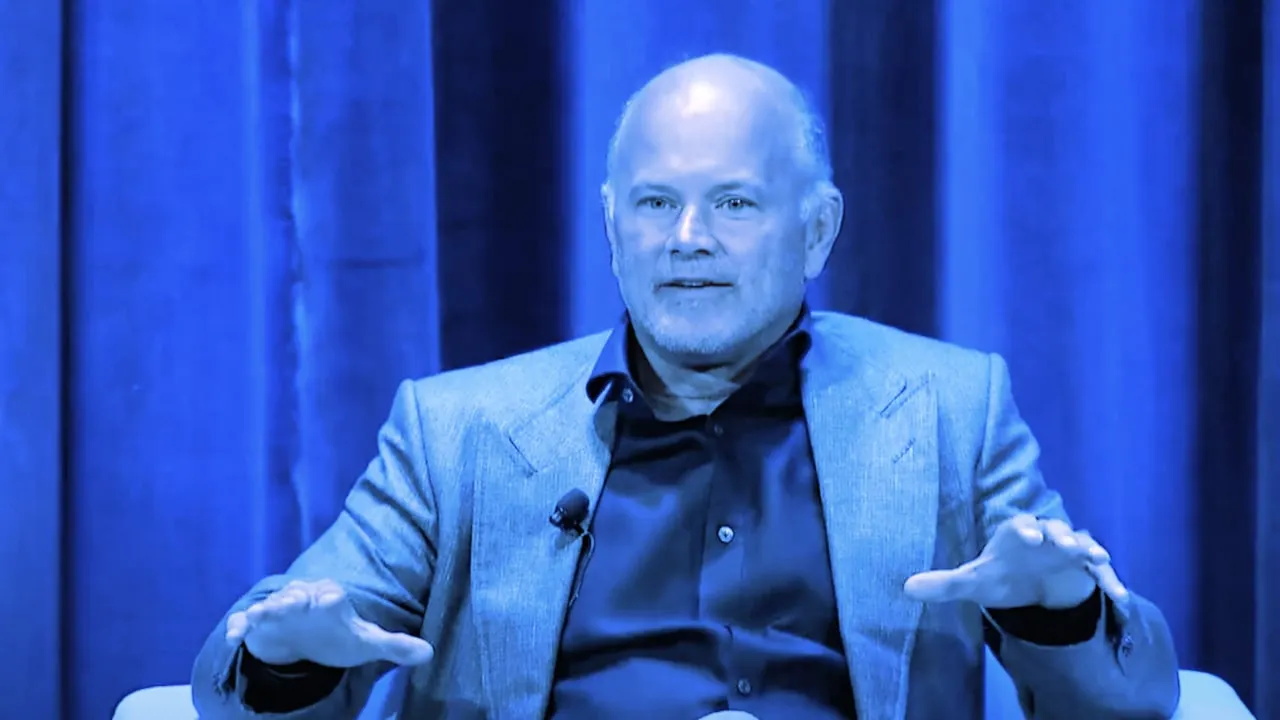

Mike Novogratz, founder of the asset management firm Galaxy Digital, expects Bitcoin to "lead" a new rally once the U.S. Federal Reserve reconsiders its latest decision to hike interest rates.

“Bitcoin will lead the markets back out of this Fed hike. The moment the Fed flinches… you’re going to see Bitcoin explode north,” Novogratz said in a recent interview with CNBC.

Amid a wider crypto market crash this week, the price of Bitcoin nosedived $20,000 on Wednesday, before staging a comeback to almost $22,900 earlier today.

However, the leading cryptocurrency has since retraced those gains, and is now changing hands at $21,150, according to CoinMarketCap.

As tech stocks tumbled in a broader market downturn, Bitcoin was dragged down to levels last seen at the end of 2020. The crypto space has faced further shocks, including the pausing of withdrawals on major crypto lending platform Celsius, growing inflation across the world’s leading economies, and the Fed upping interest rates by an unprecedented 0.75% on Wednesday.

The Fed's rate hike is the biggest in 28 years, with Goldman Sachs economists anticipating another 0.75% hike in July.

Investors still cautious

While the Fed’s decision to raise interest rates also sparked fears of a looming recession, Novogratz thinks that investors will not be in a hurry to turn to risky assets such as Bitcoin.

“Lots of guys I talk to are seeing the next time they’re going to get engaged is when they start sensing the Fed’s going to pause,” said the Galaxy Digital boss, adding that “as long as the Fed is hawkish, it's hard for any risk asset to do really well.”

Last month, Novogratz, who earlier this year dubbed himself a "LUNAtic" and was inked with a LUNA tattoo, voiced his frustration over the collapse of Terra's LUNA and UST ecosystem, in which Galaxy had invested over $400 million.

Despite his portfolio diversification, the investor still admitted that the current crypto crash is “more painful” compared to previous bear market cycles.

“This is certainly more painful because the numbers are bigger,” said Novogratz.