Market sentiment still bearish

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$67,618.00

-0.80%$2,029.36

-1.73%$1.40

-2.18%$626.64

-0.40%$0.999987

0.00%$85.99

-2.38%$0.28559

0.03%$0.097068

-3.87%$1.021

-0.96%$50.45

-1.18%$0.28741

-3.81%$0.999942

0.01%$480.09

-3.32%$8.77

0.12%$28.37

1.42%$0.173598

2.94%$9.12

-2.01%$344.70

0.13%$0.999353

0.01%$0.16242

-0.63%$0.999706

-0.00%$0.0094179

-0.92%$0.102817

0.84%$55.76

-1.58%$0.999789

-0.03%$9.32

-1.84%$238.74

-4.06%$0.93939

-3.24%$0.00000597

-4.76%$0.115483

-1.63%$1.30

0.86%$0.077448

-0.90%$1.62

-3.02%$5,165.54

0.38%$1.44

9.71%$5,198.49

0.37%$3.88

-4.14%$0.640109

2.26%$1.00

0.00%$1.12

-0.00%$184.19

2.53%$0.997415

-0.01%$114.37

-4.15%$0.701044

-1.28%$1.00

0.01%$77.83

0.63%$0.00000383

-7.91%$0.069175

0.50%$0.167922

-0.68%$1.00

-0.01%$2.22

-1.85%$0.00000162

-1.68%$1.13

-4.06%$8.88

-3.46%$2.44

-0.93%$0.999509

0.03%$0.266263

-3.79%$0.110324

-3.72%$11.00

0.01%$0.400525

-3.36%$8.65

-0.08%$7.16

-0.33%$0.00177928

-5.39%$1.85

1.98%$0.060262

0.49%$1.88

-3.13%$63.65

-2.04%$0.01629779

-7.41%$0.105486

-3.81%$0.866463

-0.86%$0.03143951

1.54%$1.00

-0.05%$0.820355

8.49%$0.00957992

-1.45%$3.48

-1.42%$1.24

-0.10%$0.088425

-3.62%$1.035

-4.14%$0.03652288

16.43%$1.001

0.07%$114.42

0.01%$0.966443

-3.52%$1.44

-3.46%$1.027

0.01%$1.11

-0.99%$0.03476188

0.57%$0.00761667

-3.15%$0.080466

-0.49%$0.100168

-1.51%$1.096

0.01%$0.997573

0.31%$32.05

10.55%$0.15514

-3.65%$0.00000613

-4.76%$1.00

0.00%$0.01289706

0.17%$0.999091

0.06%$0.261709

-1.90%$0.07047

-1.41%$1.088

0.06%$1.18

-0.13%$1.003

0.30%$0.253669

-8.66%$0.674401

-2.70%$0.0069692

-3.58%$1.31

-1.72%$34.25

-2.21%$0.391886

-1.66%$0.04746519

6.74%$167.28

0.82%$1.00

-0.05%$0.509632

-2.31%$1.81

95.91%$0.250011

-1.52%$0.084028

-1.73%$0.161908

-3.64%$1.43

-2.56%$1.001

-5.47%$0.999787

0.00%$0.00000035

3.05%$128.98

-1.55%$1.019

-0.00%$0.056634

-0.15%$0.03228028

-8.49%$0.00000033

0.21%$0.359238

-2.75%$1.59

4.43%$16.11

-2.45%$3.19

-2.02%$3.26

1.86%$0.01619078

-1.55%$0.052169

-4.23%$0.069462

-2.20%$0.338067

-4.13%$0.317887

-0.53%$0.00590197

0.01%$0.996895

-0.38%$0.02670542

-4.33%$0.00002911

-4.35%$0.239579

3.64%$17.61

1.26%$0.991058

-0.35%$0.078285

3.52%$0.313728

-4.41%$1.40

0.36%$0.04996457

-3.67%$1.58

-1.04%$0.119645

-4.58%$0.00262139

-5.11%$0.339164

-3.39%$6.22

-6.75%$0.00240609

-3.21%$0.04277807

-4.27%$1.36

-2.25%$1.84

2.83%$0.9987

-0.22%$0.02104923

-2.56%$0.085183

-3.82%$0.122417

-8.49%$0.999999

0.00%$0.985613

-0.00%$11.02

18.31%$0.999669

0.01%$1.30

1.65%$1.075

0.01%$0.094751

-8.38%$0.209634

-2.34%$0.49856

-3.22%$22.79

0.00%$0.00000098

2.55%$0.00003772

2.72%$0.00207077

-4.31%$0.099134

1.49%$0.902287

5.05%$2.78

-0.53%$5,163.06

-0.91%$0.05385

0.59%$0.193518

-3.24%$0.082162

2.75%$1.00

0.00%$0.097168

-3.20%$0.18872

-3.53%$0.01987584

-0.86%$18.91

1.42%$0.182415

-3.52%$0.00489005

-3.20%$4.08

1.58%$1.00

0.00%$0.0247571

8.38%$0.0037059

-5.81%$0.999297

-0.14%$0.114143

-7.69%$0.053691

-2.10%$0.167237

-0.10%$0.02016482

2.37%$2.10

-2.44%$1.79

-1.22%$0.612189

-4.39%$2.04

-2.94%$48.00

-0.00%$1.75

-9.21%$0.994894

5.03%$1.27

0.71%$3.32

-6.00%$0.00000772

-3.57%$0.04071346

-5.06%$0.999124

0.01%$0.99852

0.02%$0.321504

-4.80%$1.012

0.03%$0.167655

-4.18%$0.40599

-2.66%$0.307814

0.06%$0.141067

6.75%$0.652166

-0.80%$0.137425

-8.68%$0.095532

-1.06%$0.619485

-1.66%$0.133207

1.34%$4.48

-3.37%$0.080913

-2.48%$1,096.67

0.00%$0.260163

-1.71%$0.073216

0.43%$0.255106

-0.17%$0.310844

-0.81%$11.43

3.41%$0.00408787

0.90%$0.131836

2.54%$0.077289

-3.95%$0.00147391

-2.15%$12.97

6.89%$0.220313

0.54%$0.279388

-4.93%$0.02111582

-7.22%$1.001

0.00%$0.342975

-6.89%$1.50

2.13%$2.35

-3.06%$0.194457

-1.34%$7.65

13.19%$0.995435

-0.01%$1.079

-0.04%$0.113662

5.86%$0.999792

-0.03%$0.02996128

7.48%$1.00

0.11%$0.331918

-3.64%

Bitcoin (BTC), the world's largest cryptocurrency by market capitalization, has retaken the $30,000 level after a bout of volatility over the weekend.

The leading crypto trades around $30,408, up roughly 1.7% over the past 24 hours. Despite this minor recovery, Bitcoin is still 55.76% down from its all-time high of $68,789 in November last year, according to data from CoinMarketCap.

Investor interest in the asset has also picked up, with Bitcoin's global trading volume up 20% to $ 24.36 billion in the past 24 hours.

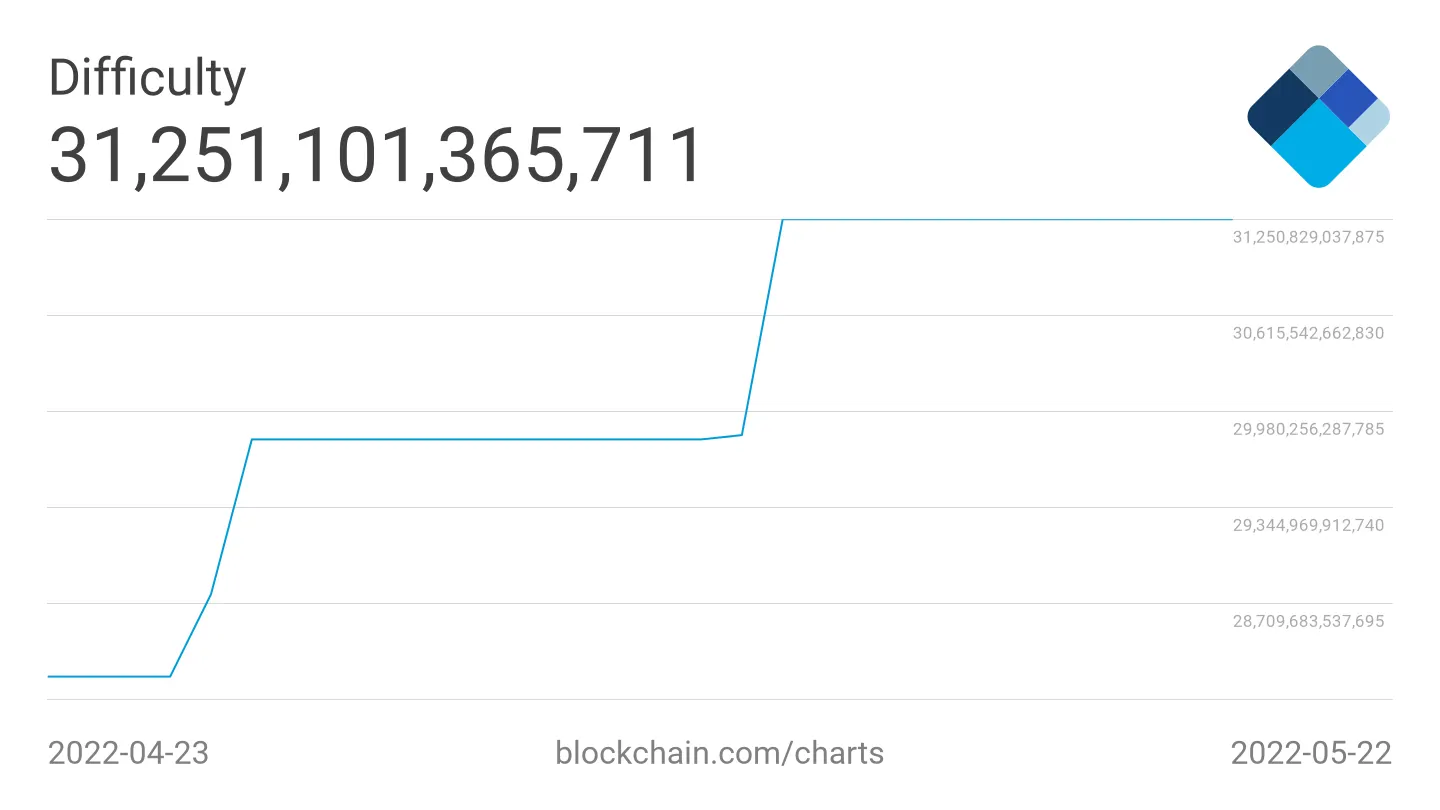

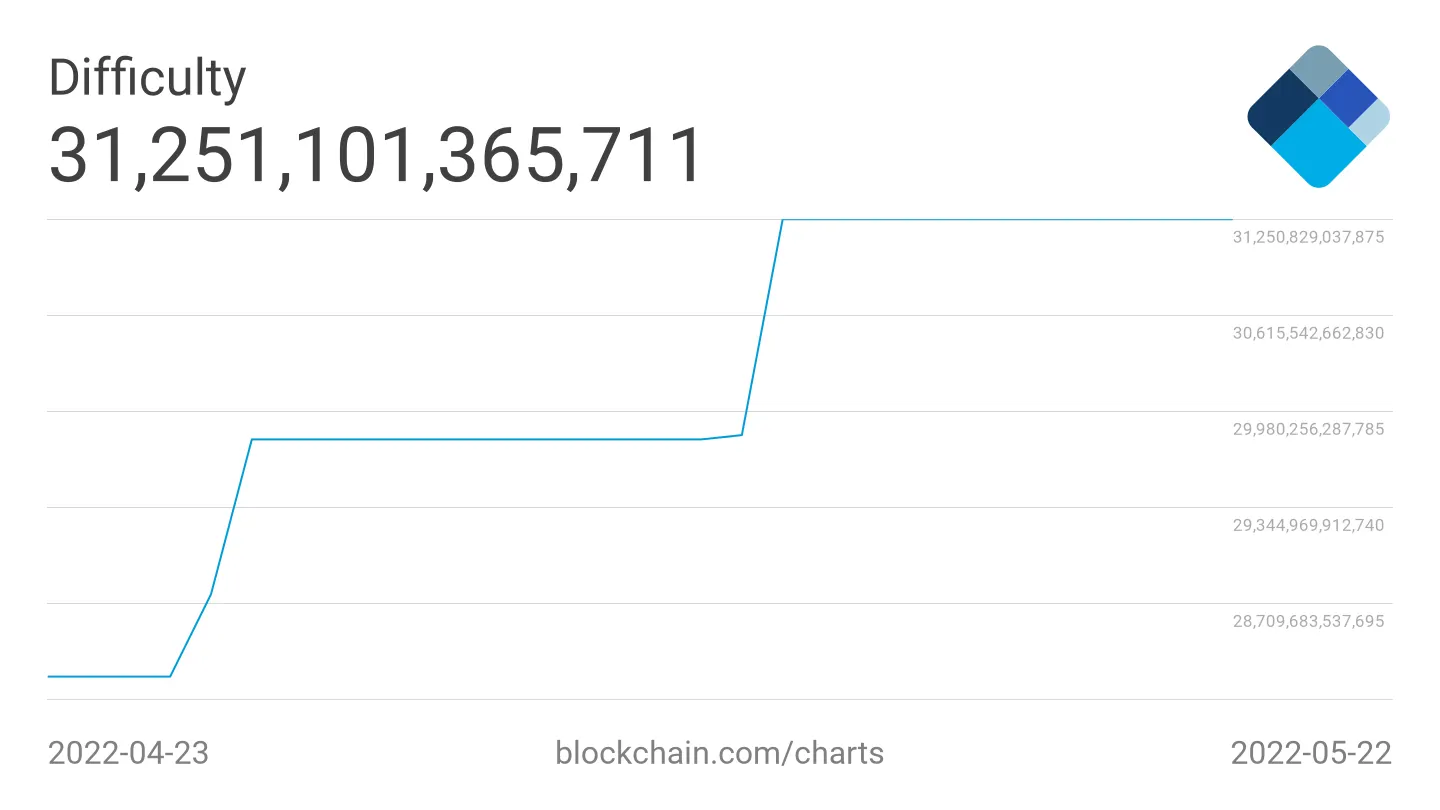

Beyond sheer price action, technical aspects of the Bitcoin network, specifically an upcoming mining difficulty update, paint a slightly more bearish picture.

On May 11, Bitcoin's network difficulty hit an all-time high of 31.251t, according to data from Blockchain.com.

Network difficulty measures how computationally hard it is to mine a Bitcoin block, with a higher difficulty demanding more power to do so. This metric is updated, either by increasing or decreasing, roughly every two weeks.

Increased mining difficulty also means the cost of mining Bitcoin significantly increases. The current cost of production per Bitcoin stands around $26,252 according to mining analytics platform MacroMicro.

Despite the potential for turning a profit at today's prices, it would appear that many miners have nonetheless turned off their machines recently.

That's because the network difficulty is expected to fall by 4.1% at its next auto adjustment on Wednesday, according to CoinWarz.

This means the cost of production will also drop as it is slightly easier to mine Bitcoin. And assuming the price of Bitcoin doesn't fall with it, it may also become profitable enough to entice new machines to return to the network.

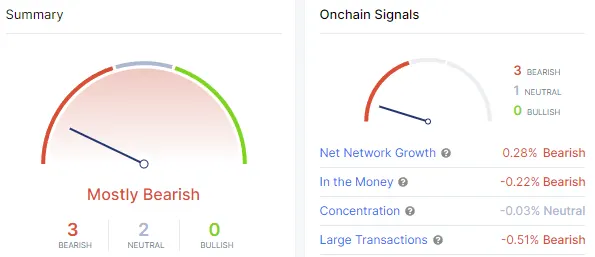

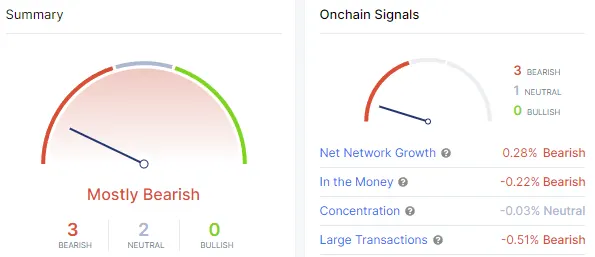

According to data from IntoTheBlock, various on-chain signals and general sentiment also indicate the market remains bearish.

Fears of growing inflation and a recent interest rate hike from the Fed led to a worldwide slump across the stock and cryptocurrency markets.

Despite once being recommended as a hedge against inflation, Bitcoin has so far emerged as being highly correlated with the stock market (specifically tech stocks).

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.