In brief

- Markets are beginning to trade sideways as prices settle.

- Futures trading hit record highs as traders attempt to predict which way BTC will go.

- The Dow hit record highs as pent-up demand suggests more growth to come.

The crypto markets cooled overnight as the turbulence of earlier this week appears to be evening out.

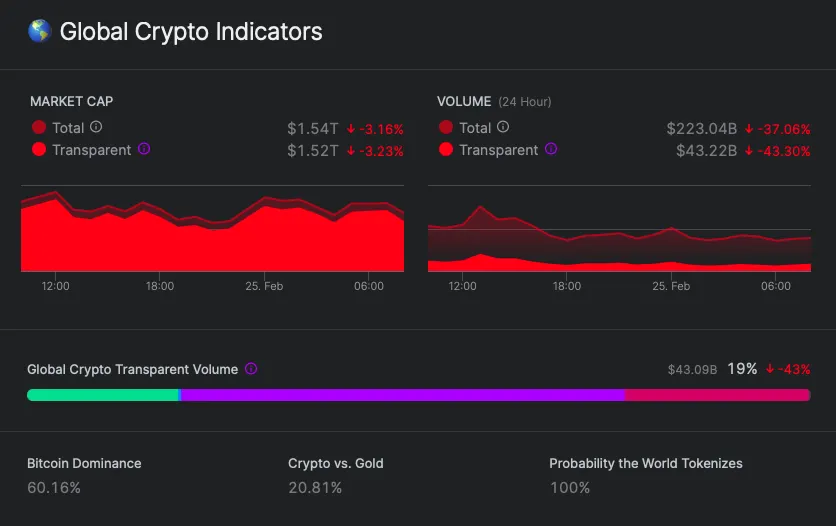

Global market cap was down 1.57% to $1.56 trillion according to Nomics. The crypto top 20 is all down less than 5%, with the only exception being Dogecoin, which managed to rack up 1.7% gains in the last 24 hours.

As the markets begin to trend sideways, i.e. short peaks and troughs, conditions have become all too tempting for futures traders to try and cash in on the uncertainty over which way the markets will head.

Indeed, the total daily trading volume on Bitcoin futures markets reached an all time high of $180 billion yesterday, according to analytics firm Glassnode.

Digging into the sky rocketing amount of money being bet on the outcome of Bitcoin, we can find some clues on which way the market reckons BTC will go.

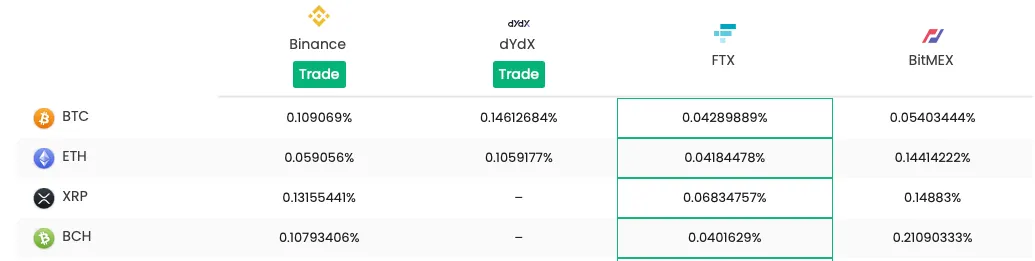

Funding rates are small amounts of cash paid between the two parties engaged in a futures contract to keep the agreement going. Depending on what the contract believes will happen to markets dictates who is paying who.

A positive funding rate means long bettors pay shorts - bullish predictions pay bearish ones - while a negative one flips that agreement. So which way are the markets favoring?

According to DeFi Rate, which tracks crypto funding rates, betters on Binance, dYdX, FTX and BitMex are all positive, suggesting that traders are hopeful the price of Bitcoin will recover.

r/WallStreetBets stocks GameStop and AMC rallied as Dow reached record highs

The stock markets continued their rotation away from tech stocks and into smaller businesses, leading the Dow to close up 1.4% reaching yet another all time closing high.

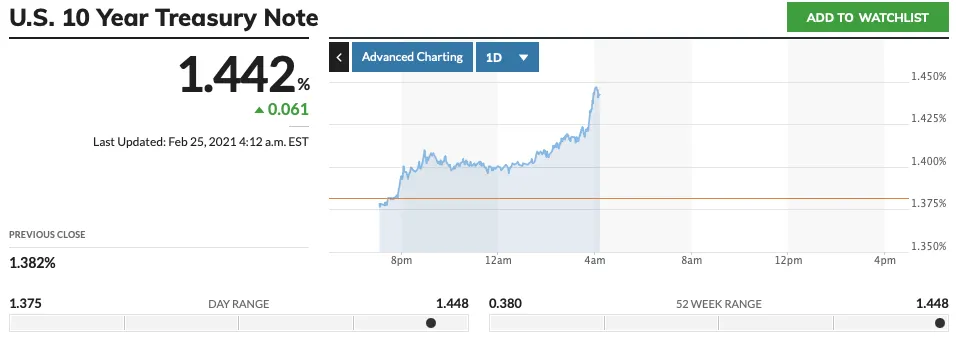

US Treasury yields, the things that spooked markets on Monday - and contributed to the crypto crash - consolidated the gains from the past week, settling at 1.4%, the highest level since February 2020.

Fed Chair Jerome Powell, in his scheduled meeting with Congress, suggested that the economy was treading a fine line between inflation and irreparable damage to the jobs market, meaning it required further assistance from the Fed.

While all that was happening, GameStop the darling of sub-Reddit r/WallStreetBets saw its stock price double in yesterday’s trading, on the news that the company’s CFO had resigned.

AMC, the beleaguered cinema chain also saw an unexpected rally as retail investors attempted to buoy the price.

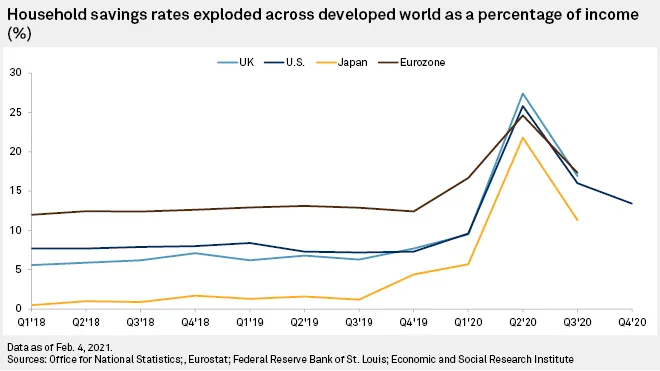

Maybe they were reacting to a spate of reports this week revealing how much pent up cash there is sitting in households across the world.

Consultancy Oxford Economics calculates that over the course of the crisis, US households saved $1.6 trillion more than they would have done.

HSBC estimates that households in the eurozone and U.K. saved €470 billion (3.9% of GDP) and £170 billion (7.7% of GDP) more in 2020 than they did in 2019, setting up each region for a major spending boom once the virus is suppressed.

Brought to you by AAX

Learn More about partnering with Decrypt.