In brief

- Trading volumes for Bitcoin grew exponentially this week.

- Bitcoin Futures have also seen strong gains.

- Stock markets worldwide had one of their busiest days as traders emerge from safe havens.

It’s been a busy week for traders. More than $2 trillion worth of assets have been bought, sold and swapped, according to Reuters, as optimism around an end of COVID comes into sharp focus.

After a lacklustre October for Bitcoin trading volume, this week things have gone into overdrive. Since November 3, trading volume is up 270%, according to new data published by Arcane Research.

Daily trading volumes have hit $3 billion as crypto’s improving stability as an asset class - not to mention it’s growing price - has proved irresistible to investors.

It's no wonder the number of active Bitcoin addresses sailed passed 1.18 million earlier this week. The number, according to Ikigai asset management, is the seventh-highest amount of active addresses in Bitcoin’s history. But the number of sending addresses (people actively moving Bitcoin out of their wallets) was at an all-time high.

On top of daily volumes going up, futures contracts are having their day in the sun, too. Open interest contracts of Bitcoin futures - how many contracts have yet to be settled - are up 169% from last week.

That takes the tally to more than $900 million, coming just shy of the all-time high of $948 million set August 17.

Arcane Research notes that not only is there increased volume, but the size of the contracts has gone up too. Only 40 traders were placing big bets - defined by how many traders had placed more than 5 contracts worth at least 25 BTC - at the beginning of the year. This month that number is now at 99. Belief in Bitcoin is real.

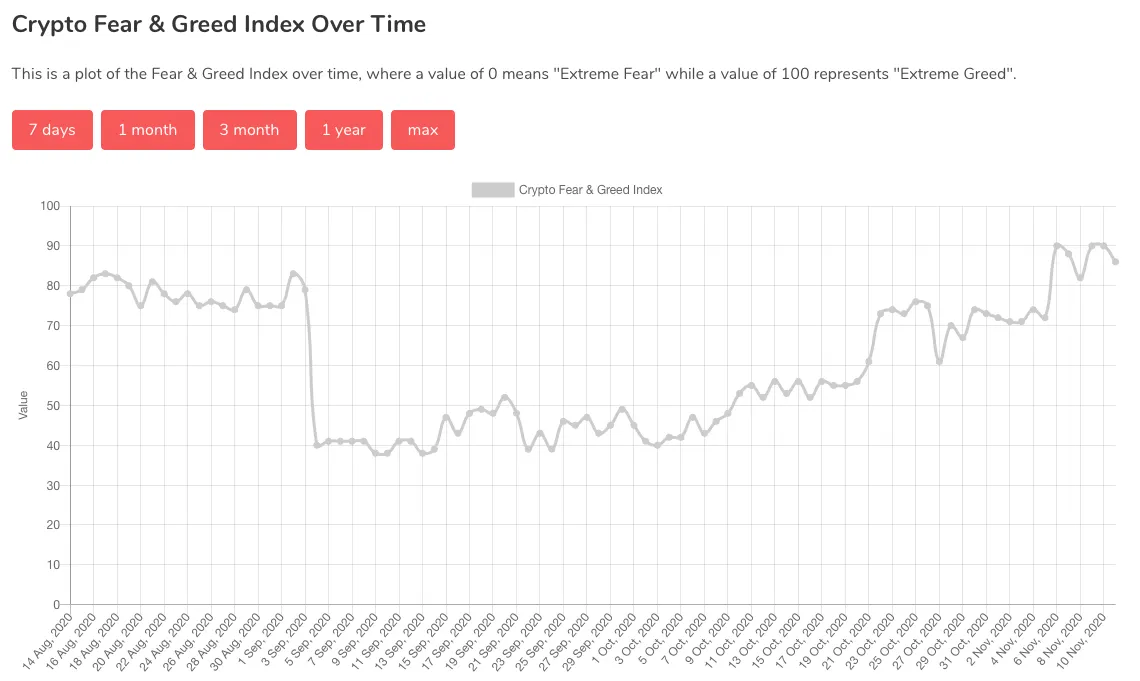

Bitcoin's continued boom has helped crypto's global market cap chalk up its third straight day of growth, up 0.3% on the day before. While no currency inside the top 20 moved by more than 2%, according to the Bitcoin fear and greed index, sentiment is firmly in the “Extreme Camp”, surpassing August’s highs.

Stock Markets See Record Trading Days

Traders have been falling over themselves trying to get their money out of safe havens like tech stocks and back across the markets.

Interactive Investor, the UK’s second-biggest retail investment platform, recorded its busiest day in history, as the FTSE 100 opened 0.4% higher on Wednesday, while the CAC 40 was trading up 0.5% in Paris and the DAX was up 0.3% in Frankfurt.

Overnight in Asia, Japan’s Nikkei rose 1.8% on, South Korea’s KOSPI climbed 1.3% and Australia’s ASX 200 stepped up 1.7%.

US markets have been following suit, but not quite as enthusiastically. S&P 500 futures were up 0.1%, Dow Jones futures ticked 0.5% higher, but Nasdaq futures were down 0.1%. That’s largely due to the performance of FAANG Stocks.

Facebook was down 2.3%, Amazon saw 3.5% and Google dropped 1.3%. Even Apple, who unveiled its in-house processors yesterday, dropped 0.3%. That's because these stocks have been a bulwark against broader market volatility in 2020. But now there's hope on the horizon, traders are venturing back out into the markets in search of a bargain.

Sponsored post by AAX

Learn More about partnering with Decrypt.