There’s a new DeFi project called Hotdog. There’s also Kimchi, Noodle, and Harvest, and they all sprang up in the past day or two.

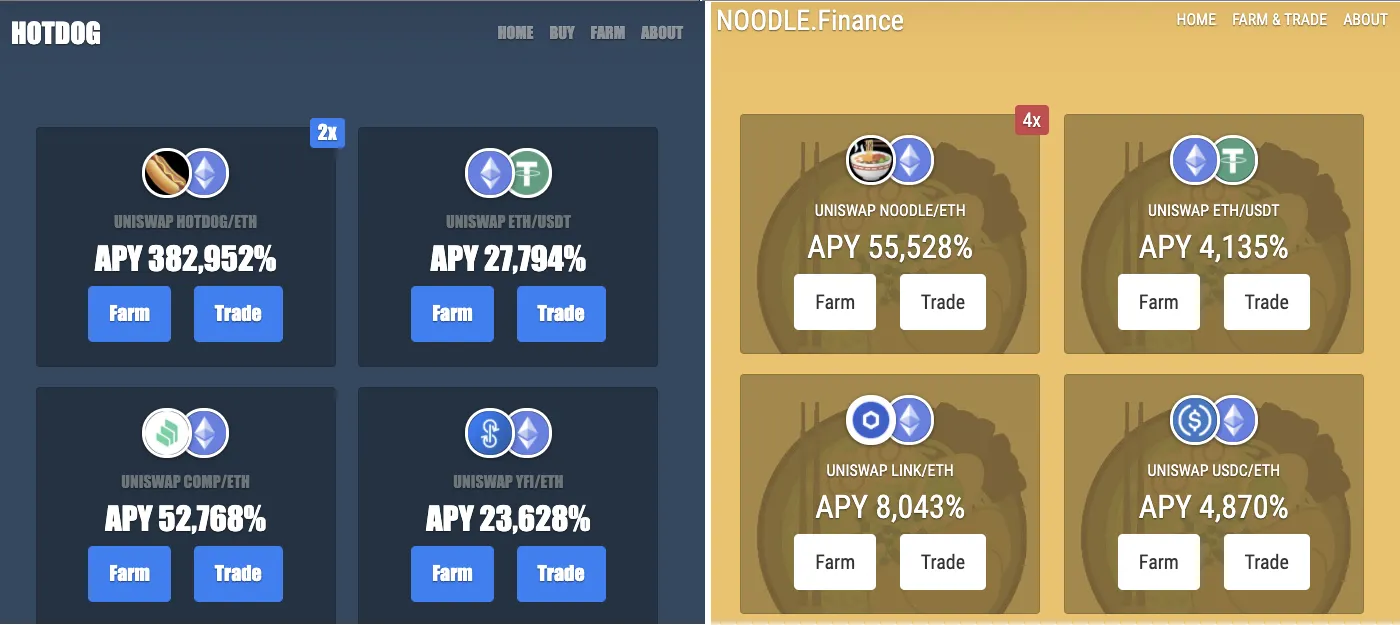

But what’s more impressive is this: Some claim to offer annual yields in the seven figures. That’s 1,000,000%

APYs. Yes: Million. Percent. Yield.

This is the latest trend in decentralized finance, which has been heating up with traders pouring hundreds of millions of dollars into platforms incentivizing liquidity by offering their native tokens as rewards. Returns have been juicy amid rising token prices. But what started out with consolidated DeFi platforms using this mechanism to draw more activity to actually useful applications, started to devolve.

YAM Opened the Floodgates

Yearn’s YFI sparked the trend of 100% community-owned tokens, a welcome change where no early investors, advisors, or even team members got allocations; only the protocols’ users did. YAM followed by combining community-owned tokens with a ridiculous food meme, and a platform made from code that was copied from other protocols, which had only one simple purpose: Farm YAM tokens.

That opened the floodgates and now there’s an avalanche of copycats promising thousands and million percent returns.

Degens Rush In

Here’s what’s actually going on.

Developers simply copy the code of those who came before it, creating websites that look identical. They mint tokens and attach a catchy name and emoji to it.

They create a market for the token on Uniswap —anyone can list any token on this permissionless DEX, by providing the token and ETH. By controlling the supply of ETH relative to the token, they’re also able to set an inflated price for a highly illiquid token.

These platforms work like this: Traders deposit tokens representing deposits in Uniswap’s liquidity pools. In exchange for those deposits, they gain (or farm) whatever the project’s meme coin is.

What happens next depends on the DeFi traders flocking to any new project, also known as degenerate farmers or degens. They’ll want to be the first ones in, driving token prices higher. The price of the token will momentarily jump. When returns from that 2x, or 3x gain is annualized, you get thousand-percent, and million-percent yields.

Musical Chairs

The flashy numbers will draw in more buyers. That’s how the early farmers, and very likely the creators of the project themselves, will be able to cash out and make a juicy profit.

“It's a bit like musical chairs,” DeFi investor Arthur Cheong told The Defiant. “The early farmers make the money while there is still liquidity to exit. The latecomers that were providing liquidity for that specific token will lose money when the early farmers start cashing out.”

Bug and Hacks

The risk isn’t only being the last one holding the bag.

It’s also that these projects are launched with no audits or tests, so the code may very well have bugs that put users’ funds in danger. There’s also the more intentional bugs: anonymous developers can create back doors that allow them to run with the funds.

Still, let’s not forget there’s innovation at the heart of this craze. Worthless projects and tokens will come and go, but the space will gain a valuable new way of raising funds and rallying communities.

Yield farming is highly risky, but the core idea of incentivizing specific behavior is *insanely* powerful.

Let's look past the Yams, Sushi, Kimchi, Spaghetti ... and let's see yield farming for what it is:

Permissionless incentive distribution pic.twitter.com/Qq30BySwlu

— Jason Choi (@mrjasonchoi) September 2, 2020

This is a free market — possibly the most free, open, permissionless market out there, and these experiments are bound to happen. Just know what you’re getting into; the story goes that the world’s original sin also started with a food item. Sometimes it’s better to resist temptation.

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]