In brief

- Stablecoin usage is “off the charts” in East Asia, the world’s biggest crypto market, according to Chainalysis.

- Over $50 billion in crypto traveled from East Asia addresses to addresses in other regions in the past year.

- This could be because people are using currencies like Tether for capital flight.

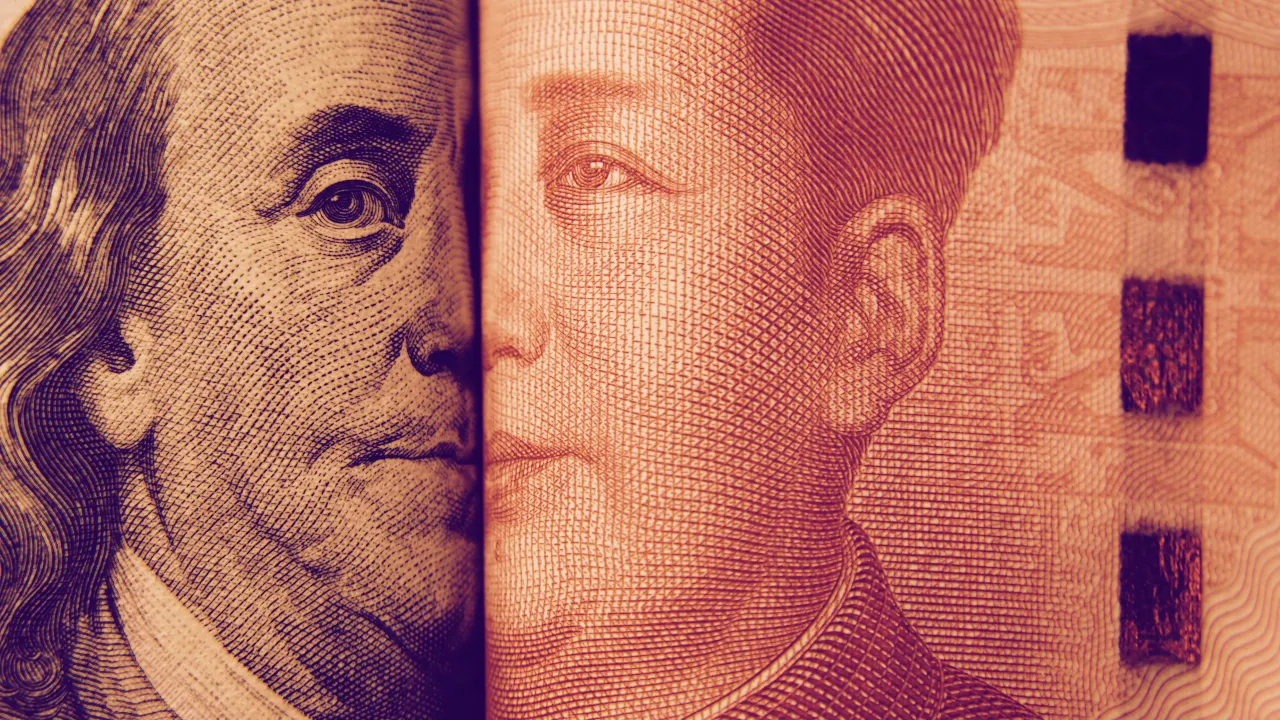

East Asia continues to be the world’s largest cryptocurrency market—but it isn’t just Bitcoin that’s driving the industry.

Stablecoin usage in the region is actually what is “off the charts,” according to a report published today by blockchain analysis firm Chainalysis.

The report, “East Asia: Pro Traders and Stablecoins Drive World’s Biggest Cryptocurrency Market,” claimed that 33% of all value transacted on-chain (meaning the value of transactions occurring on the blockchain) comes from stablecoins. And Tether is the biggest player: in June, it beat Bitcoin to be the most-received cryptocurrency by East Asia-based addresses.

Out of all the stablecoins, Tether is by far the most popular in East Asia—accounting for 93% of all stablecoin value transferred by addresses in the region, the report said.

This is because the Chinese government—which has long been hard on Bitcoin—has banned direct exchanges of yuan for cryptocurrency. Tether has become the “de facto fiat stand-in for Chinese cryptocurrency users,” Chainalysis said.

And buying Tether with Yuan is also banned but East Asian users get their hands on the currency through other means—such as a foreign bank account, the report added.

Another preview of our Geography of Cryptocurrency Report is here! This week, we cover East Asia, the world's biggest crypto market by transaction volume. Read to learn about professional trading strategy in the region, the role of stablecoins, and more! https://t.co/wG9lmVfSfj

— Chainalysis (@chainalysis) August 20, 2020

The analysis firm’s findings jibe with previous reporting by Decrypt which found that over-the-country trading activity in China (i.e. informal trading conducted directly between two parties) is what drove Tether’s $5 billion surge in demand earlier this year.

Despite the strict rules in countries such as China, the market is still huge and crypto traders are seemingly dodging rules: more than $50 billion traveled from East Asia addresses to addresses in other regions in the past year, according to Chainalysis. In Western Europe, which doesn’t have the same regulations as East Asian countries, the figure was little over $38 billion.

Typically, China is strict on capital flight. Citizens are able to move the equivalent of $50,000 or less out of the country. But as the government cracks down on people getting around the rules—with foreign investment in real estate, for example—it could be Tether that is coming to the rescue, the report said.

“Stablecoins are particularly useful for capital flight, as their fiat currency-pegged value means users selling off large amounts in exchange for their fiat currency of choice can rest assured that it’s unlikely to lose its value as they seek a buyer,” noted Chainalysis.

“Tether has become a U.S. dollar replacement for many people in China,” Dovey Wan, a founding partner of cryptocurrency investment firm Primitive Ventures, was quoted saying in the report.

Chainalysis also noted that East Asia-based addresses have received $107 billion worth of cryptocurrency in the last 12 months—77% more than Western Europe, the second-highest receiving region.

East Asia has the lowest share of on-chain volume devoted to Bitcoin at 51% of transfers by volume, added the report.

And while East Asia is still the biggest cryptocurrency market by far, its share of overall activity has declined since October 2019—mainly due to scams putting people off getting involved in digital assets.