Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$72,506.00

5.56%$2,125.79

6.97%$653.86

2.78%$1.43

4.61%$0.99995

0.01%$91.10

5.68%$0.284676

0.51%$1.023

-0.99%$0.096441

8.09%$52.14

5.15%$0.274193

4.37%$1.001

0.09%$458.97

4.07%$9.00

-2.29%$31.77

1.27%$365.97

6.50%$9.27

5.27%$0.158199

2.04%$0.999041

-0.05%$0.159334

5.78%$0.999248

-0.00%$0.00921787

0.09%$0.100666

2.27%$56.23

2.67%$1.00

0.11%$9.43

3.92%$236.81

7.84%$0.955167

5.40%$0.00000564

3.27%$1.32

4.28%$0.077447

2.53%$5,132.17

-0.07%$0.103718

-0.63%$5,174.36

-0.16%$1.53

0.25%$4.01

2.41%$1.39

-1.41%$0.705697

3.70%$1.00

0.00%$1.12

0.01%$0.192777

12.32%$186.16

1.84%$0.077156

8.27%$0.722459

3.37%$115.79

3.78%$0.997555

0.02%$0.999954

0.01%$1.29

-4.35%$78.10

3.38%$0.999913

0.01%$2.17

2.55%$0.00000358

3.61%$0.00000159

0.46%$2.54

1.84%$8.76

4.11%$0.999288

0.04%$0.267064

3.86%$0.00204701

6.96%$0.41581

6.86%$7.26

4.88%$0.1029

1.43%$8.04

3.21%$11.01

0.01%$1.89

-2.13%$0.060769

1.16%$0.118113

6.34%$64.96

4.19%$1.88

1.94%$1.11

0.07%$0.888557

4.01%$0.998993

-0.12%$0.03112615

1.45%$0.01497838

-2.64%$1.22

-0.10%$3.42

2.25%$0.088305

2.68%$1.003

0.75%$0.0091665

0.16%$1.022

2.01%$114.48

0.01%$1.026

-0.21%$1.40

4.13%$1.00

0.03%$0.03496733

0.86%$0.195019

8.40%$0.0074368

4.62%$0.103329

0.96%$0.080168

0.15%$0.999987

0.00%$0.02829582

-6.30%$1.096

0.01%$0.996695

-0.07%$31.87

6.57%$0.00000621

4.47%$0.99996

-0.04%$0.270216

6.28%$1.00

0.08%$0.01242223

-2.97%$0.738514

0.69%$1.089

0.03%$1.40

3.69%$1.16

-0.14%$0.068142

1.18%$0.00718285

3.50%$0.999931

0.02%$34.70

1.44%$0.239206

5.16%$0.04822105

-1.08%$0.383858

3.42%$0.547524

3.79%$0.03861572

6.48%$166.09

-0.07%$1.89

1.52%$0.254477

-0.23%$1.00

0.11%$0.999772

0.00%$135.28

3.55%$1.63

51.57%$0.15372

3.26%$17.09

-11.69%$0.36091

3.35%$0.00000034

2.10%$0.357957

7.69%$0.00000034

0.84%$1.32

3.40%$0.328658

-0.74%$1.021

0.15%$0.054757

2.62%$0.066884

-0.08%$3.10

2.45%$3.16

-2.36%$0.015948

0.48%$0.869323

4.57%$15.10

2.54%$0.339631

2.25%$6.63

7.14%$0.067802

3.32%$0.05047

3.97%$0.02676959

3.37%$0.0057496

3.51%$0.387554

-9.75%$0.00002915

4.03%$0.241128

4.47%$17.46

0.42%$0.989049

-0.16%$0.128407

1.25%$0.999888

0.15%$0.314506

3.26%$0.00274799

7.05%$0.050466

5.01%$1.57

-0.96%$0.072827

1.81%$0.111612

-0.05%$0.136667

9.82%$0.02248915

7.33%$0.00004398

3.16%$6.26

5.70%$0.235957

10.65%$0.00238426

-0.85%$1.87

-0.16%$0.086499

3.38%$1.23

-0.26%$0.997966

-0.19%$0.04085556

1.51%$0.00000105

1.50%$0.00224369

9.70%$0.984022

0.00%$0.999918

0.02%$1.30

2.97%$0.214849

5.95%$1.076

0.01%$0.502045

1.17%$22.75

0.00%$1.20

1.57%$0.197464

3.56%$0.200256

3.92%$0.099266

4.07%$1.00

0.00%$0.189609

4.93%$0.099174

-0.19%$0.052274

0.24%$2.64

4.63%$0.059372

8.42%$4,899.97

-0.29%$0.079726

2.77%$0.00478602

3.67%$2.28

6.35%$1.00

0.00%$1.94

4.06%$0.01903847

3.28%$18.03

3.30%$0.173313

5.51%$2.13

4.61%$0.073296

0.27%$0.999016

-0.05%$0.00356576

1.00%$1.82

0.81%$3.58

1.27%$0.02023284

-2.71%$0.616168

2.76%$48.08

0.17%$0.04203766

1.88%$0.106123

2.87%$0.994384

-0.16%$0.289592

1.06%$0.436555

6.71%$0.0211478

1.72%$1.23

-1.07%$0.997783

-0.34%$0.148309

2.73%$0.319404

3.47%$0.998627

-0.00%$0.00000702

1.38%$0.249453

10.74%$0.08009

2.34%$0.09848

5.15%$0.272477

-0.24%$1.014

0.04%$0.157834

-0.82%$0.350377

23.37%$0.132222

3.83%$0.02314411

4.22%$0.285273

-0.12%$1,094.15

-0.06%$0.609905

0.61%$11.66

6.46%$0.199788

5.37%$0.07852

2.05%$12.16

12.28%$4.22

2.12%$0.250939

2.05%$0.130568

0.06%$0.303646

2.37%$0.536343

-0.70%$1.56

8.59%$0.275142

2.07%$0.00693501

16.15%$0.00144408

2.50%$1.081

0.04%$0.00392291

3.25%$0.999883

-0.22%$0.998731

-0.16%$0.307935

-14.19%$2.36

3.69%$0.999709

-0.02%$0.335031

6.18%$0.365744

-4.23%$0.549778

7.21%

The price of Bitcoin has bounced back up towards $11,000. As a result, its market cap has broken back above the $200 billion mark, a figure breached yesterday—but otherwise not seen since August 2019.

The rally started earlier this week, when Bitcoin broke above the $9,200 mark. It swiftly rose to highs of $11,300 before falling back down. Then after dropping as low as $10,560, it has suddenly powered back up.

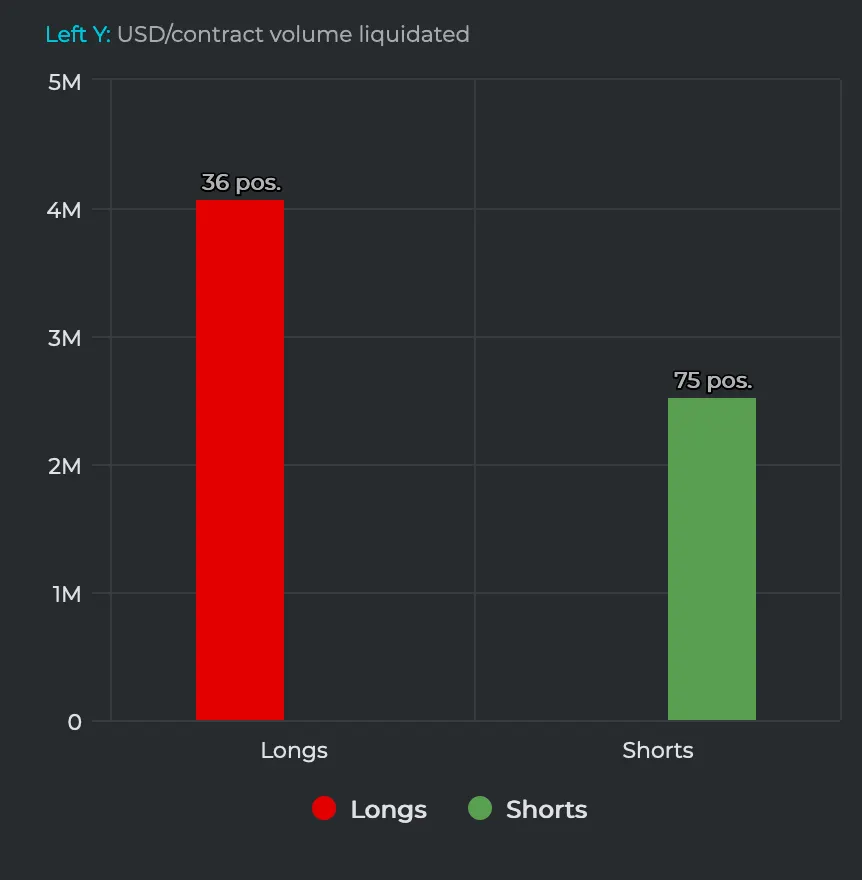

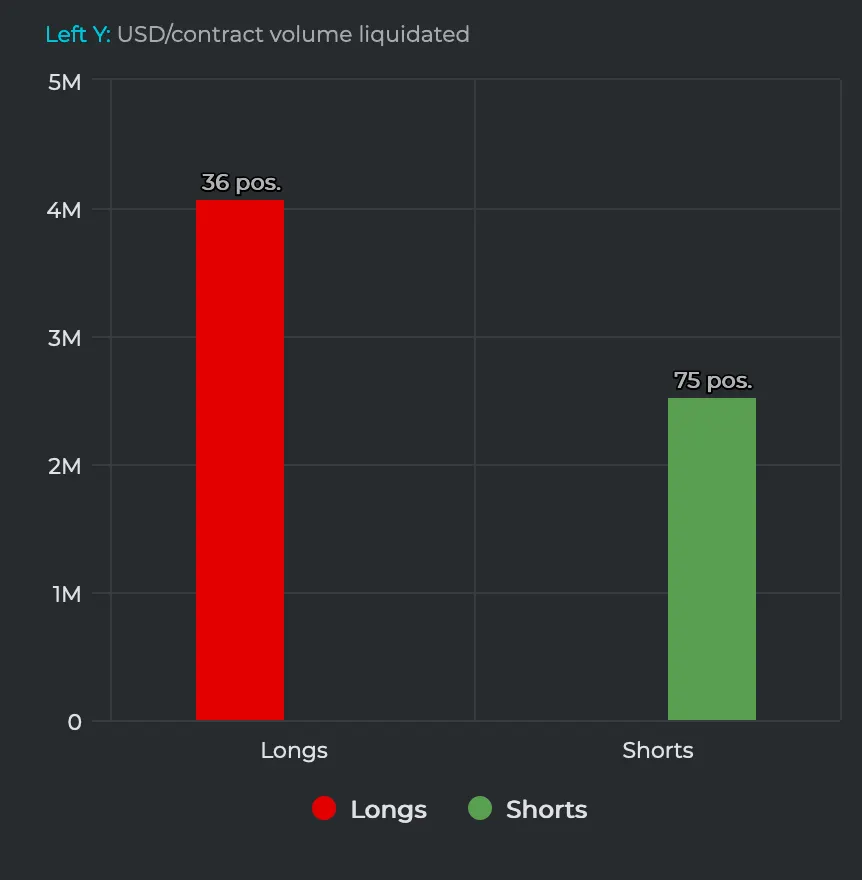

The sudden reversal has liquidated both short and long futures traders—those betting the price of Bitcoin will go down and up respectively. On futures trading platform BitMEX, traders going long saw $4 million of liquidations, while those going short suffered $2.5 million of liquidations.

Those figures, however, pale to the $120 million in short positions that were liquidated yesterday when Bitcoin significantly broke upwards.

Bitcoin's trading volume has rallied along with its price. Just three days ago, its trading volume had fallen as low as $16.6 billion per day. But today its reached a recent high of $35 billion—a 110% increase.

Bitcoin's market dominance—the percentage of Bitcoin's market cap relative to the entire crypto market cap—has rebounded too. Having fallen to 60% of the market, a figure not seen since June 2019, it has bounced back up to 63%. That's nearly two-thirds of the market.

Other coins are also in the green today, although with a wide spread. Some coins are unchanged on the 24-hour chart, such as Cardano, while others are shooting up, such as Litecoin—up 11% today. And the global crypto market cap now stands at a combined $321 billion.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.