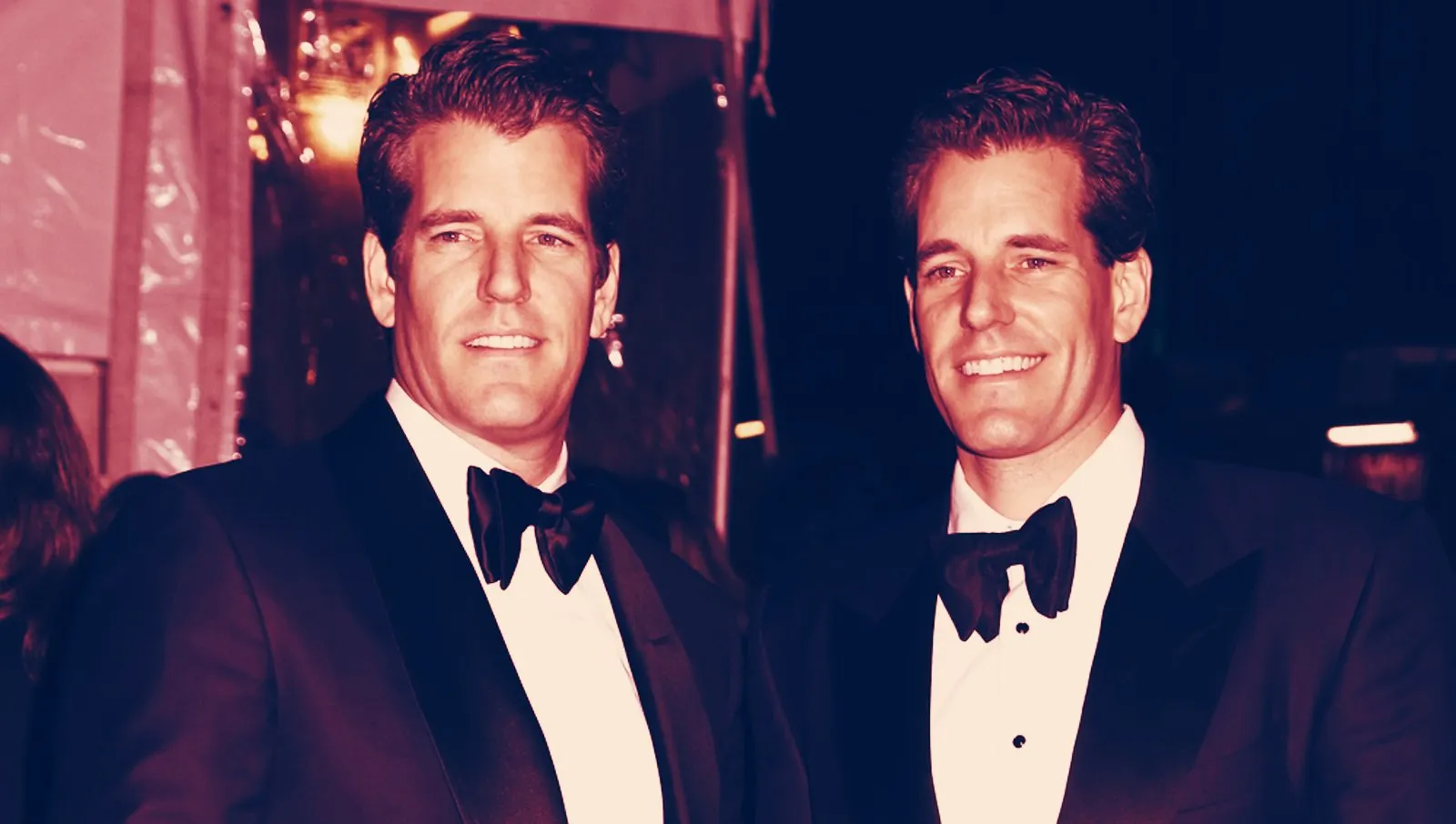

Cameron and Tyler Winklevoss, the twin inventors of Facebook, are at it again. Tired of changing the way we interact with our friends, the lovable larrikins have now debuted another invention, a stablecoin called "Gemini," of course. Once it's in circulation, folks will be able to spend Gemini on sweet, sweet, real world stuff, as opposed to just hodling crypto and hoping it grows like a colony of sea monkeys.

It works thus: the number of Gemini tokens begins at zero. A new token—worth one dollar—is minted each time an investor buys one, keeping it perfectly in line with demand. Supposedly. This will deter would-be HODLers from using the token as a store of value, since it’ll only increase/decrease in value at the rate of the US dollar (which, as Bob McElrath points out, isn’t exactly the bastion of stability it’s made out to be). Its only function, then, is to be spent.

Conceivably, this could indeed lead to real-world purchases, since buyers will have little fear of the token spiking in value after they’ve blown half of it on unappetizing sausages. And it could provide holders of Bitcoin et al with an easier way to transfer the value of their crypto stash—it takes a while to transfer between crypto and fiat, but between a crypto and another crypto that perfectly matches a fiat currency? That, my little friends, would be instant.

But as always with Winklevee and Winklevum, there’s a problem: it forgoes the “proof-of-x” verification process typical of cryptocurrencies like Bitcoin and Ether, which rely on a distributed network of independent, financially motivated “miners” to verify transactions, which supposedly keeps conglomerates from acquiring too much power.

Instead, Gemini transactions are verified on an intermittent basis by a coterie of Wall Street auditors, namely auditing and consulting firms BPM and Trail of Bits. Just the guys we were hoping to give the boot. Damn.

As Bloomberg's Matt Levine puts it, Wall Street mainstays like the Winklevii are getting cryptocurrencies all topsy-turvey—the banks just want a way to store them as a centralized commodity in the coffers of "trusted institutions" such as exchange-traded funds and futures, while companies like Gemini just wish cryptocurrencies were dollars in the first place. Seriously—what's a "medium of exchange" that people can spend anywhere on anything, and is protected by trusted central authorities, if not, uh, the dollar? Put it on the blockchain just so you can get the damn thing off the ground as quickly as possible, eh?

Still, there is, to some extent, an aura of decentralization to Gemini. It relies on not just BPM and Trail of Bits but a further expanded “network of trust” that will help maintain the system and its stability. This includes such firms as the New York Department of Financial Services, Boston-based financial services firm State Street, and, er, “The Gemini Trust,” owned by, yep, the Winklevii. Nice to know they trust themselves.

State Street has offered to hold onto the coins, in cash, while the NYDFS, a seasoned regulator, has given Gemini its “approval,” which means, according to the Gemini website, that the token is “subject to the capital reserve requirements, cybersecurity requirements, and banking compliance standards set forth by the NYSDFS and the New York Banking Law.” So essentially, it’s crypto borne of, not desperately lunging at, respectable legal bodies.

This also makes it different to existing “stablecoins,” like Tether (USDT), which are minted and audited by a single authority and yet have little kinship with state regulatory authorities. Yet this, at least, keeps tokens like Tether “true” cryptocurrencies, insofar as they exceed jurisdictional boundaries in their reach—anyone, anywhere, can trade with them.

So here’s what it boils down to: would you rather stake your crypto investments on the whims of miners—who display an increasing tendency to clump together and exert enormous leverage over networks—or Wall Street bankers, who have no reputation whatsoever for reckless profiteering.

Read Next: London police taught how to catch crypto criminals