In brief:

- Cryptocurrency hedge funds doubled their exposure to Bitcoin and other cryptocurrencies during 2019.

- A report shows those funds which went long produced the best median returns for investors.

- The most popular cryptocurrency is Bitcoin by a large margin.

Crypto-focused hedge funds doubled their exposure to Bitcoin and other cryptocurrencies in 2019, with total assets under management exceeding $2 billion by the end of 2019. That’s according to a new report by PWC-Elwood, which conveys a marked increase in investment by crypto hedge funds compared to the previous year.

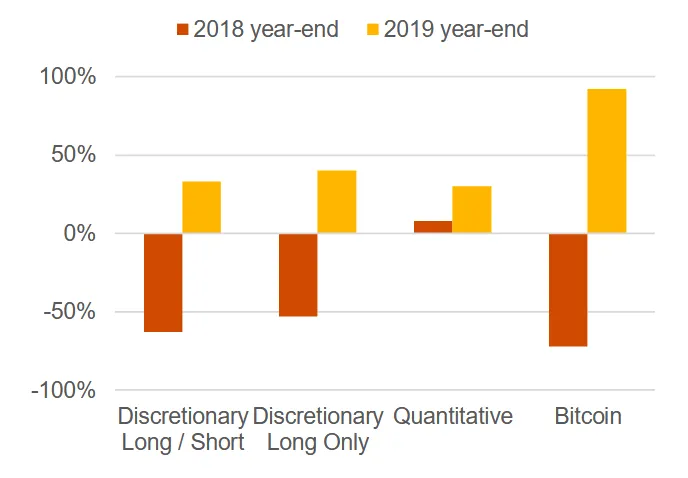

While 2018 saw hedge funds record average losses of 46%, the upturn in Bitcoin’s market performance saw a reversal of fortunes across 2019. As a result, crypto hedge funds saw medium returns of 30%.

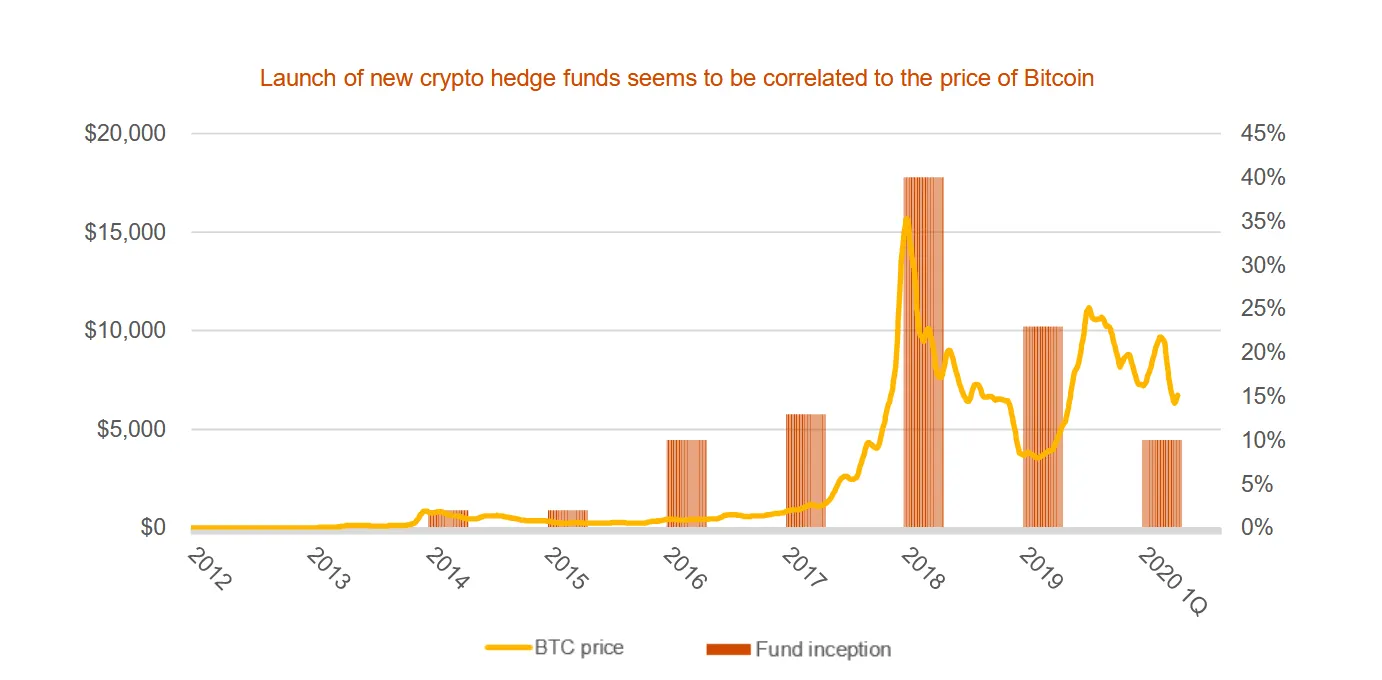

Indeed, the report speculates that the launch of cryptocurrency hedge funds appears to be correlated to the price of Bitcoin—as is shown in the graph below.

Bitcoin’s dominance is again reflected in the trading statistics of the funds surveyed—97% trade BTC, versus 67% for Ethereum; 38% for XRP; 38% for Litecoin; 31% for Bitcoin Cash, and 25% for EOS.

Trading strategies were broken down into quantitative, discretionary long/short, discretionary long-only, and multi-strategy. Despite the quantitative approach being most popular among hedge funds (48% of funds surveyed), the best median performance came from those taking a discretionary long approach—which returned 40% across the year.

Yet Bitcoin alone outperformed every one of those approaches by a large margin. If the funds in question had followed Bitcoin throughout the year, their median returns would have been more than doubled, as seen below.

The report states, “It is clear that Bitcoin (+92%) outperformed all hedge fund strategies in 2019. While these strategies were able to mitigate the effects of the 2018 crypto bear market, they did not succeed in replicating the upward trend of 2019.”

Despite being ranked 7th by market cap, Litecoin ranks as the fourth most traded cryptocurrency among funds surveyed. The report notes the apparent discrepancy, stating, “It is interesting to note that Litecoin was mentioned by funds as one of their top traded altcoins despite its market cap being relatively smaller than the other mentioned altcoins,” adding, “This also applies to ZCash and Ethereum Classic but to a lesser extent.”

As for who’s putting their money in cryptocurrency hedge funds, the report finds that the vast majority of investors come from either family offices (48%), or high net-worth individuals (42%). Over one-third of funds now control assets exceeding $20 million—that’s up from 19% the previous year.

The crypto hedge fund sector is clearly on the rise. But as the report surmises, their chosen investment strategies have not yet been optimized: “In summary, they acted as volatility-reducing tools rather than performance-enhancing catalysts.”

But will the Bitcoin halving—due today—entice them in?