We do the research, you get the alpha!

$66,689.00

-0.61%$3,095.31

-1.12%$6.96

-2.80%$576.77

-0.71%$172.92

-0.71%$0.999747

0.01%$3,093.62

-1.06%$0.512929

-1.78%$6.34

-1.33%$0.151322

-2.68%$0.469502

-2.65%$0.00002386

-4.45%$36.05

-4.25%$0.121366

-0.80%$66,818.00

-0.52%$16.95

3.47%$487.43

-1.07%$7.94

-0.35%$0.687873

-3.35%$83.33

-1.14%$12.69

-5.14%$7.80

-1.33%$2.24

-3.06%$5.90

0.12%$27.92

-2.76%$0.111629

-2.77%$0.00000932

-2.39%$10.06

-3.79%$3,211.09

-1.16%$8.19

-5.55%$1.001

0.06%$2.25

-4.73%$0.12333

-1.30%$8.25

-3.82%$49.03

4.61%$5.58

-6.02%$0.106245

-2.01%$0.942683

-3.73%$3,051.66

-0.84%$49.11

-2.10%$0.308594

-1.49%$0.122342

-1.63%$1.96

-5.03%$2.47

-4.59%$2.59

-1.04%$0.970609

-5.35%$2,776.41

-2.22%$368.14

-4.85%$0.03449861

-2.77%$1.001

0.08%$134.30

-1.25%$0.865921

-4.69%$1.033

-4.88%$24.45

-2.49%$6.75

-0.70%$2.18

-2.54%$0.00019481

-5.34%$3,421.68

-1.24%$0.00002533

-8.88%$1.18

-5.62%$8.68

-8.90%$1.76

-5.58%$1.72

-3.50%$0.04293289

-7.43%$1.091

-0.54%$0.521781

-5.13%$3,194.46

-1.29%$0.17625

-3.19%$9.84

-0.38%$95.04

-3.09%$0.926408

-1.15%$0.877671

-3.75%$65.19

-2.80%$86.47

-2.35%$5.44

-5.90%$0.02536046

-2.12%$0.935444

-2.89%$0.00000118

-2.52%$0.02702365

-4.19%$1.94

-5.71%$0.02116551

-7.19%$18.94

-1.20%$0.718869

-4.37%$14.88

-4.49%$205.00

-0.61%$7.12

-4.66%$0.115996

-3.75%$12.93

-1.29%$7.87

-0.44%$38.04

-6.09%$4.78

-4.49%$0.430104

-4.38%$0.00004912

-5.88%$2.24

-0.51%$0.533841

-6.25%$0.01969826

-4.41%$9.71

-0.81%$0.789407

-3.11%$0.920878

-3.26%$0.814657

-0.63%$0.219522

-5.46%$2.71

-3.70%$0.770605

-5.83%$2.57

-4.68%$40.22

-3.65%$204.03

-0.71%$3,072.28

-1.66%$0.42158

-4.03%$3,123.19

-1.09%$0.797676

-4.05%$297.75

-1.72%$1.064

-8.29%$5.01

-0.06%$0.01116513

-5.22%$1.20

-5.23%$4.52

-3.30%$1.31

-2.14%$1.001

0.18%$12.66

-3.93%$0.66342

-1.58%$17.62

-1.91%$0.01553306

-5.57%$2.59

-4.11%$0.206852

-4.54%$0.1025

-4.05%$0.982852

-3.68%$0.998506

0.10%$0.176743

-3.28%$36.12

-5.39%$2.01

1.66%$19.66

3.56%$3,079.05

-1.12%$0.938216

-2.85%$0.00010461

-3.80%$2,434.72

0.83%$0.00000028

-7.58%$0.088122

-5.71%$0.708627

-4.87%$3,259.36

-1.29%$0.353476

-6.23%$3,309.97

-1.20%$0.299494

-2.12%$0.372145

-15.38%$0.83203

-3.79%$1.94

-5.90%$0.03633377

-1.60%$0.53262

-0.30%$4.36

-2.02%$4.57

0.81%$82.00

-3.67%$1.46

-2.65%$2.36

-1.59%$0.421213

-3.62%$1.001

0.05%$0.088349

-4.93%$3,354.70

-1.12%$1.84

-3.22%$0.00000047

-1.87%$1.033

-4.55%$0.549341

-9.39%$0.04399572

-2.93%$0.04869319

-5.84%$1.006

-1.10%$0.312333

-4.72%$0.275432

-2.74%$0.42901

-6.21%$14.43

-5.27%$1.079

-2.65%$2,422.65

1.80%$4.51

-2.23%$0.02431707

-7.00%$0.382091

-3.61%$0.818157

-5.59%$2.55

-6.45%$0.04344535

-4.88%$0.210964

-5.91%$0.00831888

-10.67%$5.06

-7.49%$0.02277992

-3.89%$0.534871

0.45%$4.21

4.06%$1.56

-7.91%$0.00715657

-0.83%$0.29877

-7.27%$0.02902371

-5.07%$0.999582

0.02%$3.43

-3.34%$0.570441

-3.26%$3,175.60

-1.24%$0.00217433

-4.54%$0.00685959

-2.63%$0.00111759

0.18%$55.60

-2.77%$3.29

-4.65%$3.60

-3.48%$0.519609

-1.63%$0.38551

8.09%$18.43

-6.26%$0.072409

-3.93%$1,339.82

-0.71%$62.25

-1.28%$0.785925

-3.96%$1.43

-9.96%$7.70

-8.42%$0.04188264

1.46%$3.30

-6.09%$0.03659033

-3.67%$0.236401

-3.86%$23.37

-1.32%$0.862824

-4.94%$0.70274

-3.32%$29.01

-2.76%$0.03751858

-3.81%$59.49

-4.18%$0.02783398

-0.29%$4.18

-4.16%$5.03

-2.93%$0.744187

-3.63%$7.85

-1.12%$0.031725

-1.91%$3.27

-3.19%$0.252112

-4.03%$0.849742

-7.93%$19.47

-6.08%$29.91

-1.62%$43.31

-2.14%$0.883395

-1.43%$116.20

-2.90%$8.18

5.24%$0.00377691

-6.63%$2.52

-0.38%$2.02

-0.08%$0.318688

-2.47%$0.898102

1.61%$0.433486

-8.71%$3.49

-3.01%$0.00006992

39.80%$29.12

-1.58%$0.306668

-2.92%$0.334649

-1.61%$41.29

-4.41%$3.68

-2.98%$68.12

-1.03%$3,214.83

-1.55%$0.341222

-8.24%$0.00292482

-11.10%$28.92

-7.01%$0.380766

14.10%

Bankrupt crypto lender Celsius Network will unstake its existing holdings of Ethereum in order to "ensure ample liquidity" when distributing assets to its creditors.

In a tweet, Celsius Network announced that it "has started the process of recalling and rebalancing assets," in preparation for asset distributions.

It added that it would unstake its existing ETH holdings, "to offset certain costs incurred throughout the restructuring process," noting that its staked ETH has "provided valuable staking rewards income to the estate."

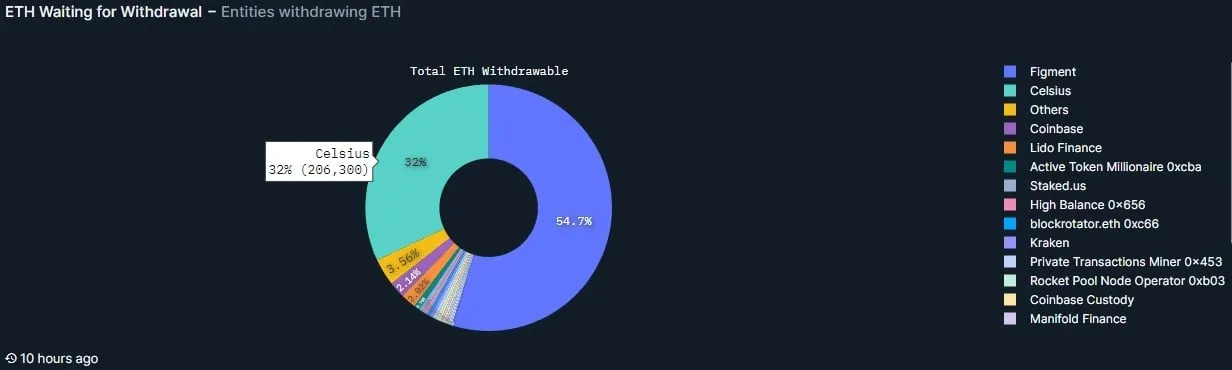

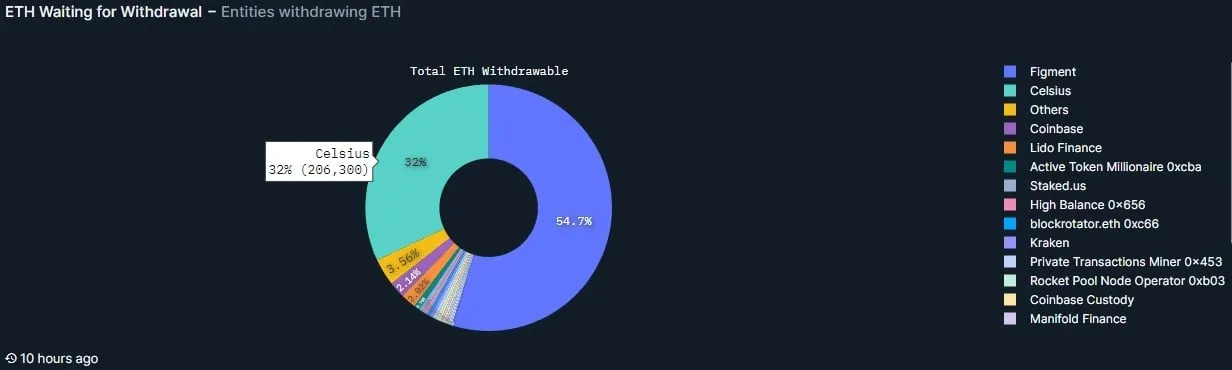

Per data from Nansen, Celsius accounts for 32% of ETH awaiting withdrawal—some 206,300 ETH, worth over $466 million at current prices.

Celsius filed for Chapter 11 bankruptcy protection in July 2022, amid the crypto market downturn sparked by the collapse of Terra.

A customer repayment plan which would return between 67% and 85% of creditors' investments was approved by a judge in November 2023, with approximately $2 billion worth of Bitcoin and Ethereum to be distributed among the firm's creditors.

The company's former CEO Alex Mashinsky was arrested in July 2023, and indicted with seven charges including securities fraud, commidities fraud and wire fraud. His trial is set for September 17, 2024.