Bitcoin mining firm Hut 8 released an update on Tuesday detailing the efficiency of its Bitcoin (BTC) production as of last month.

Having netted 111 BTC in September, the company—which trades on the NASDAQ under the HUT ticker—claims it didn’t sell a single satoshi during that time.

“We are fortunate that, unlike some single-threaded miners, we do not need to sell our Bitcoin production to finance operations,” said Erin Dermer, senior vice president of communications at Hut 8, to Decrypt via email.

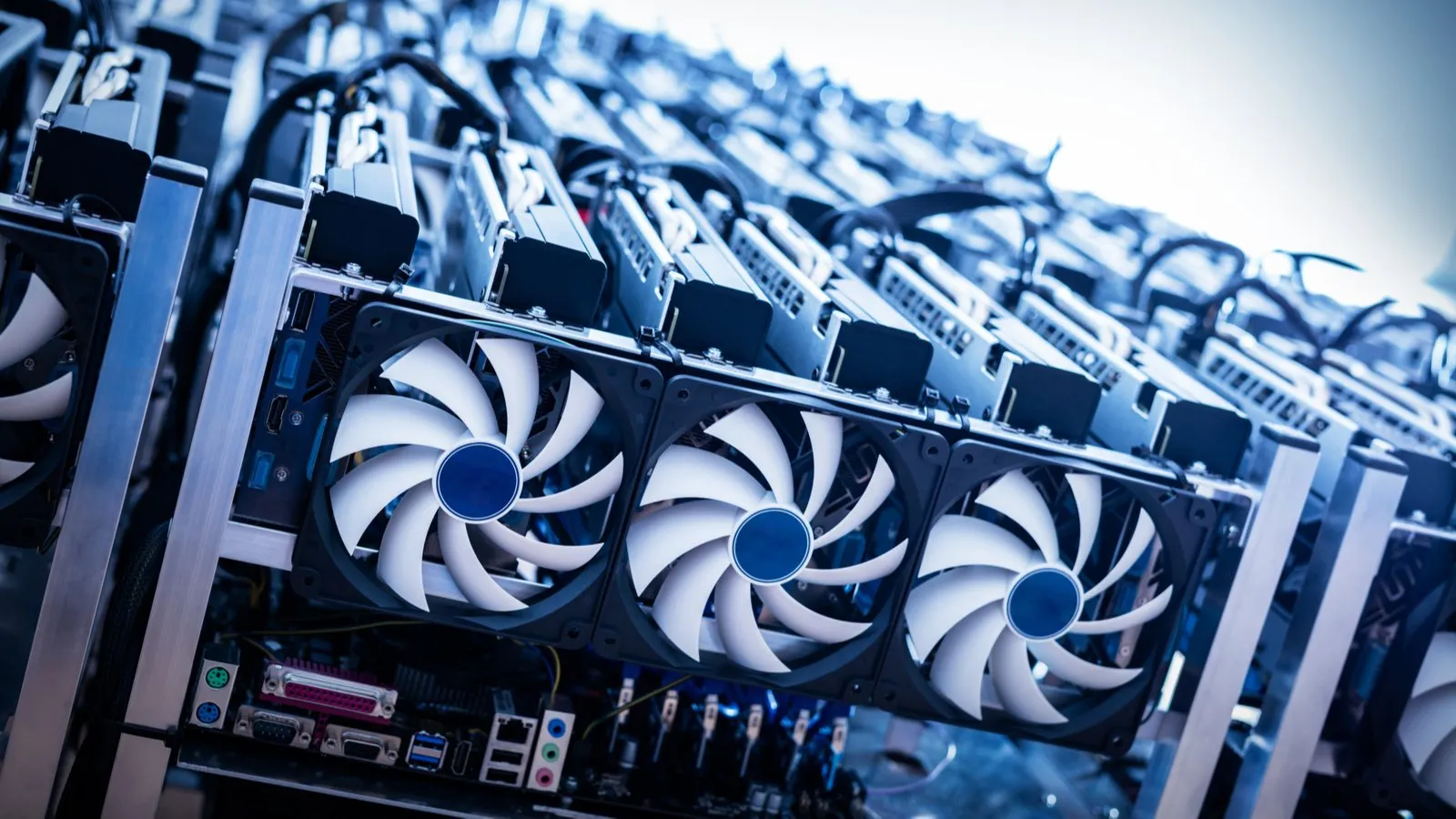

Mining companies use energy-intensive computer hardware to secure fresh BTC, which is their source of revenue. Offsetting this are the electricity costs of running such machines, and the initial cost of purchasing the machines themselves.

Generally speaking, miners who can secure the cheapest electricity (which often comes from sustainable sources) have the biggest competitive advantage. However, many miners are now diversifying their operations into high-performance computing, which industry participants say is far more profitable per unit of energy than Bitcoin mining.

Hut is also breaking into the space, which may help turn around otherwise disappointing revenue figures logged throughout the year. In the second quarter, the company netted just $19.2 million in revenue, down from $43.8 million during the same period last year.

At the time, Hut pinned the revenue drop on increasing Bitcoin network difficulty and equipment failures at some of its key facilities.

Hut may face further revenue challenges after the Bitcoin “halving” in April, which will cut the rate at which miners earn new BTC in half. While threatening in the short term, many firms have ramped up production ahead of the halving in anticipation of a Bitcoin bull market, which has historically followed the event each time it occurs.

“We believe that post-halving, some miners will face headwinds as efficiency becomes paramount, the difficulty increases, and block rewards are reduced by half,” said Derner. “Hut 8 has long been a HODLer of Bitcoin, as we are bullish that it will increase in value over time.”

Hut is now looking forward to a merger with USBTC later this year to become Hut 8 Corp, which the companies say will feature “both Bitcoin and diversified fiat revenue streams,” including services like high-performance computing.