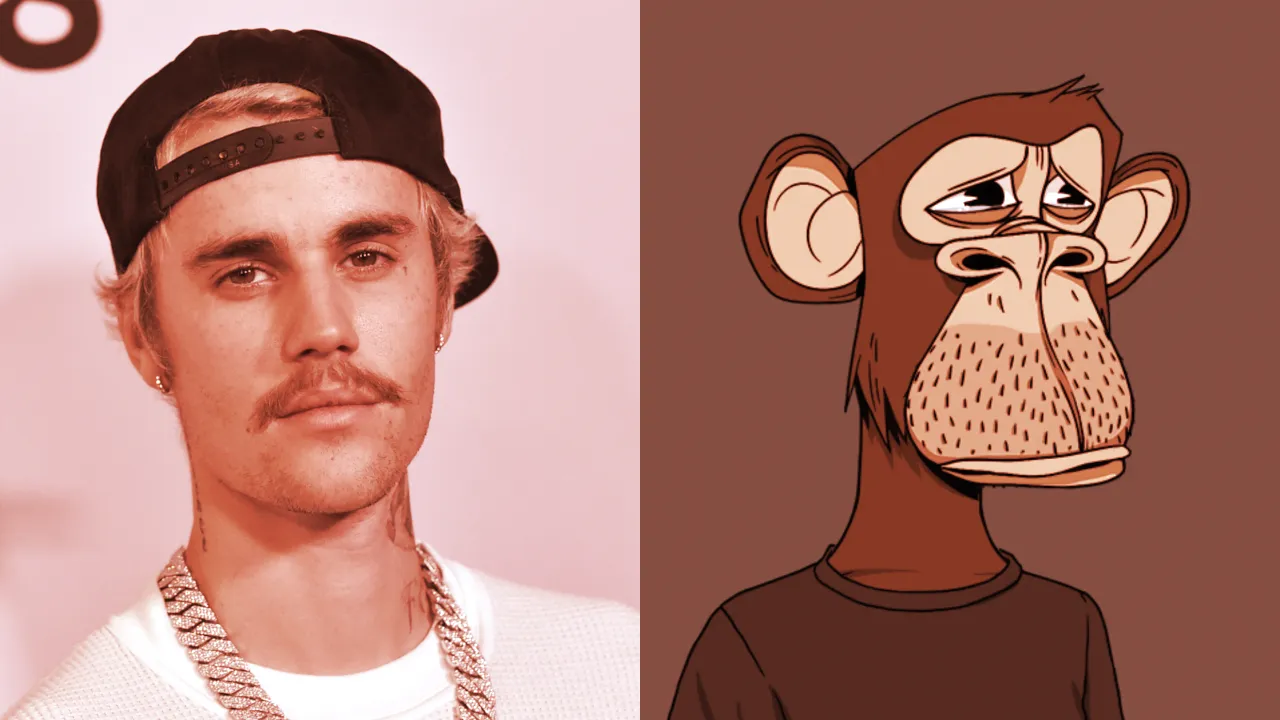

A class action lawsuit filed Thursday alleges that a slew of celebrities—including Justin Bieber, Madonna, Steph Curry, and Paris Hilton—violated state and federal laws when they promoted Bored Ape Yacht Club NFTs while failing to disclose their financial relationships to Yuga Labs.

The suit, filed yesterday in the U.S. District Court’s Central District of California, named no less than 37 co-defendants—ranging from Yuga leadership to celebrities and executives. It also names MoonPay, the crypto payments startup that allegedly facilitated those endorsements.

Though the suit lists 10 charges ranging from violations of California’s consumer protection laws to violations of federal securities laws, its 100-page filing tells, more or less, a single story.

It details an elaborate alleged conspiracy, engineered by Hollywood’s elite, to boost the value of Bored Apes with a torrent of celebrity promotions—all while secretly enriching all involved via a covert payments scheme laundered through a prominent crypto company.

The suit alleges that talent manager Guy Oseary—Madonna’s longtime representative, as well as Yuga’s—instructed his extensive celebrity network to publicly support Yuga’s products, including Bored Ape NFTs, in exchange for payments from Yuga secretly funneled through MoonPay. Oseary, also named as a co-defendant in the suit, was an early investor in MoonPay.

MoonPay, now valued at $3.4 billion, counts many of the suit’s celebrity defendants among its investors, including Bieber, Curry, Hilton, Kevin Hart, Jimmy Fallon, and Gwyneth Paltrow. The firm gained prominence in 2021 by offering a white-glove service that facilitated purchasing high-value NFTs for celebrity clients.

Thursday’s suit argues that MoonPay was instead a “front operation,” which secretly passed payments from Yuga Labs—the $4 billion company behind the Bored Ape Yacht Club—to celebrities who went on to promote the NFTs without disclosing their enrichment, at Oseary’s direction.

Yuga Labs, for its part, vigorously denies the allegations.

“In our view, these claims are opportunistic and parasitic,” a company spokesperson told Decrypt. “We strongly believe that they are without merit, and look forward to proving as much.”

The suit comes courtesy of law firm Scott+Scott, which in July announced another potential class-action suit against Yuga. That firm claimed then that Yuga Labs violated securities laws in its sale and promotion of Bored Ape NFTs and ApeCoin, the Bored Ape ecosystem’s Ethereum-based token, and sought plaintiffs for a potential lawsuit.

The law firm did not immediately respond to a request for comment.

To succeed in the suit, the plaintiff’s attorneys will have to prove that Yuga’s cadre of celebrity amplifiers engaged in unfair or deceptive practices when they endorsed the company’s products. Receiving secret payouts through an elaborate cover-up operation would almost certainly fulfill that standard; whether such a scheme can be proven, however, is another matter.

Echoing the firm's previous suit, the complaint also alleges that Bored Ape NFTs are unregistered securities. If proven, that allegation would further raise the bar for disclosure information.

While American courts have not yet ruled that so-called "blue chip" profile picture (PFP) NFT collections like the Bored Ape Yacht Club constitute securities, an October report revealed that the U.S. Securities and Exchange Commission (SEC) is investigating Yuga Labs over potential securities violations.

Editor's note: This article was updated after publication to clarify the status of Scott+Scott's previous actions.