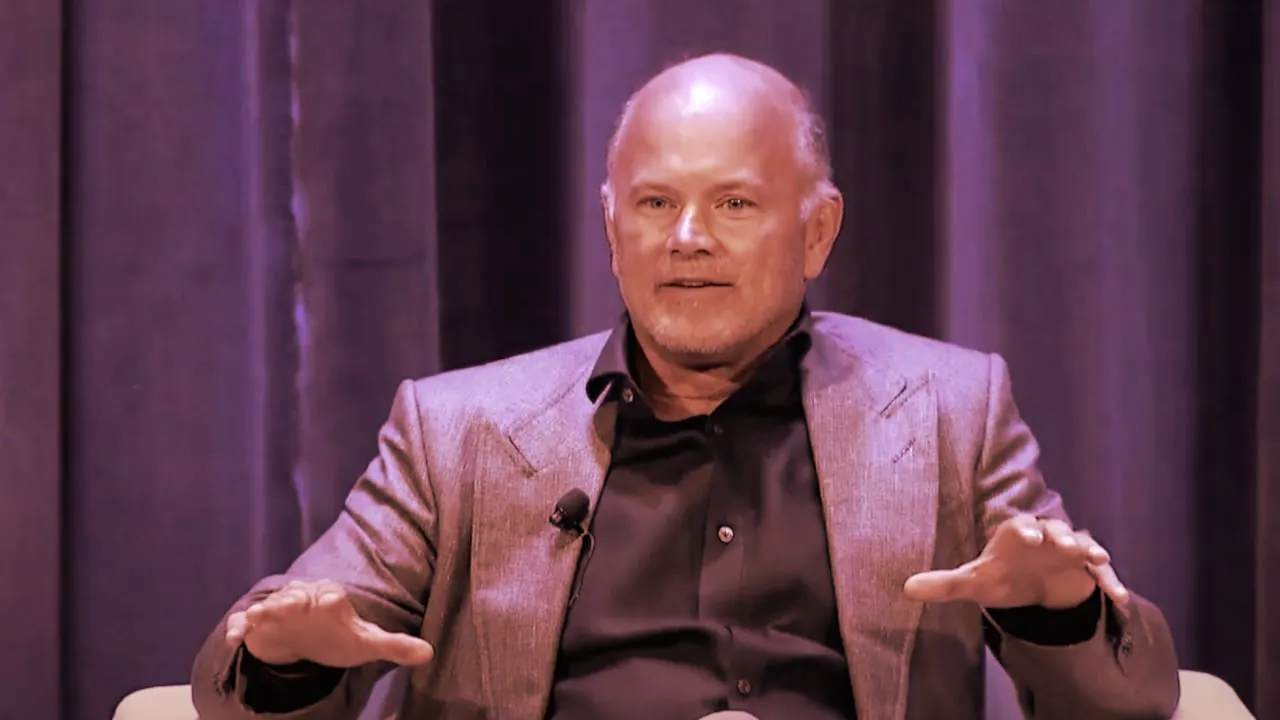

Galaxy Digital, the crypto investment firm run by billionaire Mike Novogratz, today announced it would terminate its proposed deal with crypto custodian BitGo.

According to Galaxy, the firm has exercised its right to terminate the previously announced acquisition agreement “following BitGo's failure to deliver, by July 31, 2022, audited financial statements for 2021 that comply with the requirements of our agreement.”

The termination of the deal will not result in any fee, Galaxy said.

"Galaxy remains positioned for success and to take advantage of strategic opportunities to grow in a sustainable manner,” Galaxy CEO Mike Novogratz said in a statement. “We are committed to continuing our process to list in the U.S. and providing our clients with a prime solution that truly makes Galaxy a one-stop shop for institutions."

Galaxy first disclosed its intention to acquire BitGo in a $1.2 billion deal in May last year. Were the deal to have successfully closed, it would have become one of the biggest in the crypto industry, bringing Galaxy about 400 new global clients and allowing the firm to expand geographically.

A year after its announcement, the deal had yet to close; by May 2022 Galaxy was claiming that it expected to finalize the acquisition by the end of the year.

In an SEC filing that month, Galaxy also said it would "issue incremental shares of its common stock to BitGo's shareholders in exchange for BitGo's net digital assets at close." The firm thus implicitly confirmed media reports that the purchase price included BitGo's Bitcoin and Ethereum holdings, making the actual value of the custodian significantly less than the previously announced $1.2 billion.

Galaxy eyes public listing on the Nasdaq

Today’s news follows Galaxy’s Q2 earning report last week, which saw the firm report $554 million in unrealized losses on its crypto holdings.

Although the 2022 bear market has taken its toll, Galaxy also reported that by the end of June it held $1.5 billion in liquidity, mostly in cash.

In today’s announcement, the firm reiterated plans to reorganize as a Delaware-based company.

The move—providing Galaxy gets a regulatory nod—will enable the firm to go public on the Nasdaq exchange in addition to its existing listing on the Toronto stock exchange.

The firm also said it is working on the planned launch of Galaxy One Prime, a new product offering for institutional investors that will combine trading, lending, and derivatives services.