In brief

- GD Culture Group plans to raise up to $300 million for crypto purchases, including Bitcoin and Trump Coin.

- The company recently received a Nasdaq delisting warning after reporting just $2,643 in stockholders’ equity.

- Shares surged Monday before falling sharply to close at $2.51.

Microcap firm GD Culture Group Limited plans to sell up to $300 million in stock to finance purchases of Bitcoin and Trump Coin, even as it stares down a Nasdaq delisting threat over financial shortfalls.

The company, which operates AI-driven digital human technology and livestreaming businesses, announced Monday it signed a purchase agreement with a British Virgin Islands investor to fund its new crypto treasury strategy.

The move is "a deliberate strategy that reflects both current industry trends and our unique strengths," Chairman and CEO Xiaojian Wang said in the statement, characterizing his company's decision.

GD Culture joins a growing trend of public companies, such as Strategy and Metaplanet, who have continued to incorporate crypto into their treasury operations, stocking up on Bitcoin for the most part.

Nasdaq-Listed Company Hits 'Major Milestone' as Solana Treasury Tops $100 Million

Publicly traded AI-powered real estate platform DeFi Development Corporation purchased another 172,670 Solana (SOL) for an average purchase price of $136.81, or around $24 million in total, the Nasdaq-listed company announced on Monday. The purchase brings the firm’s total holdings to nearly 600,000 SOL, valued at approximately $105 million at the current price. “Crossing the $100 million mark in Solana purchases is a major milestone—but it’s just the beginning,” DeFi Development Corp. CEO Josep...

But GD Culture's Group's decision to go all in on crypto comes just weeks after Nasdaq warned the company it no longer meets minimum stockholders' equity requirements.

According to regulatory filings cited by Nasdaq and also shared on the company's website, GD Culture reported equity of just $2,643 against the $2.5 million threshold required by Nasdaq for continued listing.

The company was given until May 4 to submit a compliance plan to Nasdaq, which grants it up to 180 calendar days to fix up, while continuing to trade under its GDC ticker.

Decrypt reached out to Nasdaq and GD Culture Group for comment but did not immediately receive responses by press time.

With a market cap of $28 million and net losses of $14 million in 2024, GD Culture's crypto ambitions raise concerns about execution and shareholder dilution.

GD Culture has repeatedly reinvented itself, previously operating as Code Chain New Continent Limited until its name change in January 2023, and before that as TMSR Holding Company Limited.

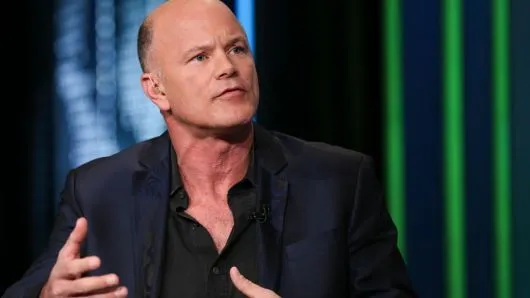

Galaxy Digital Plans to Offer Shares on Nasdaq Global Select Market

Galaxy Digital Holdings plans to list on the Nasdaq Global Select Market next month, the firm said Wednesday in a statement, a byproduct of the pro crypto pivot of U.S. federal regulators and policymakers. The listing, which is subject to shareholder approval, will tentatively go live on May 16, according to Galaxy Digital's statement. The company's Class A common stock will trade under the ticker GLXY. In listing on the Global Select Market, Galaxy Digital aims to broaden its access to capital,...

Following those rebrands, it now operates through its wholly owned U.S. subsidiary, AI Catalysis, and Shanghai Xianzhui Technology Co., Ltd, a China-based subsidiary.

Its past business activities ranged from coal processing to iron ore trading before its current focus on digital content and AI technology.

Bitcoin traded at approximately $102,500 at the time of writing, while Trump Coin was priced at $12.6, down 9% over the past 24 hours.

GD Culture’s stock (NASDAQ: GDC) closed at $2.51, after rising as high as $8.18 on Monday's open following the announcement, data on Nasdaq shows.

Edited by Sebastian Sinclair

Daily Debrief Newsletter