In brief

- The UK's Financial Conduct Authority has proposed banning the use of credit to purchase crypto assets.

- The regulator is accepting comments on the rule from the public until June 13.

Britain’s top financial regulator has proposed banning the purchase of cryptocurrency with any sort of borrowed funds, including credit cards.

A new discussion paper from the UK’s Financial Conduct Authority floated a plan this week to outlaw crypto firms from allowing British customers to buy crypto assets with a credit card. The proposed rule would also ban the purchase of crypto with any other form of credit, including loans and digital currency credit lines.

The move appears largely driven by the regulator’s concern that UK adults are going into debt to buy crypto, a “risky” practice, given the inherent volatility of digital assets.

“We are concerned that consumers buying crypto assets with credit may take on unsustainable debt, particularly if the value of their crypto asset drops and they were relying on its value to repay,” the FCA said.

A YouGov survey recently commissioned by the Authority found that 14% of UK crypto users reported using credit to buy digital assets in August 2024. That figure marked a 133% uptick from two years prior.

The proposal, if passed, would not necessarily impact all crypto assets, however. The FCA said that stablecoins authorized by its regulatory regime would likely be exempt from the credit ban.

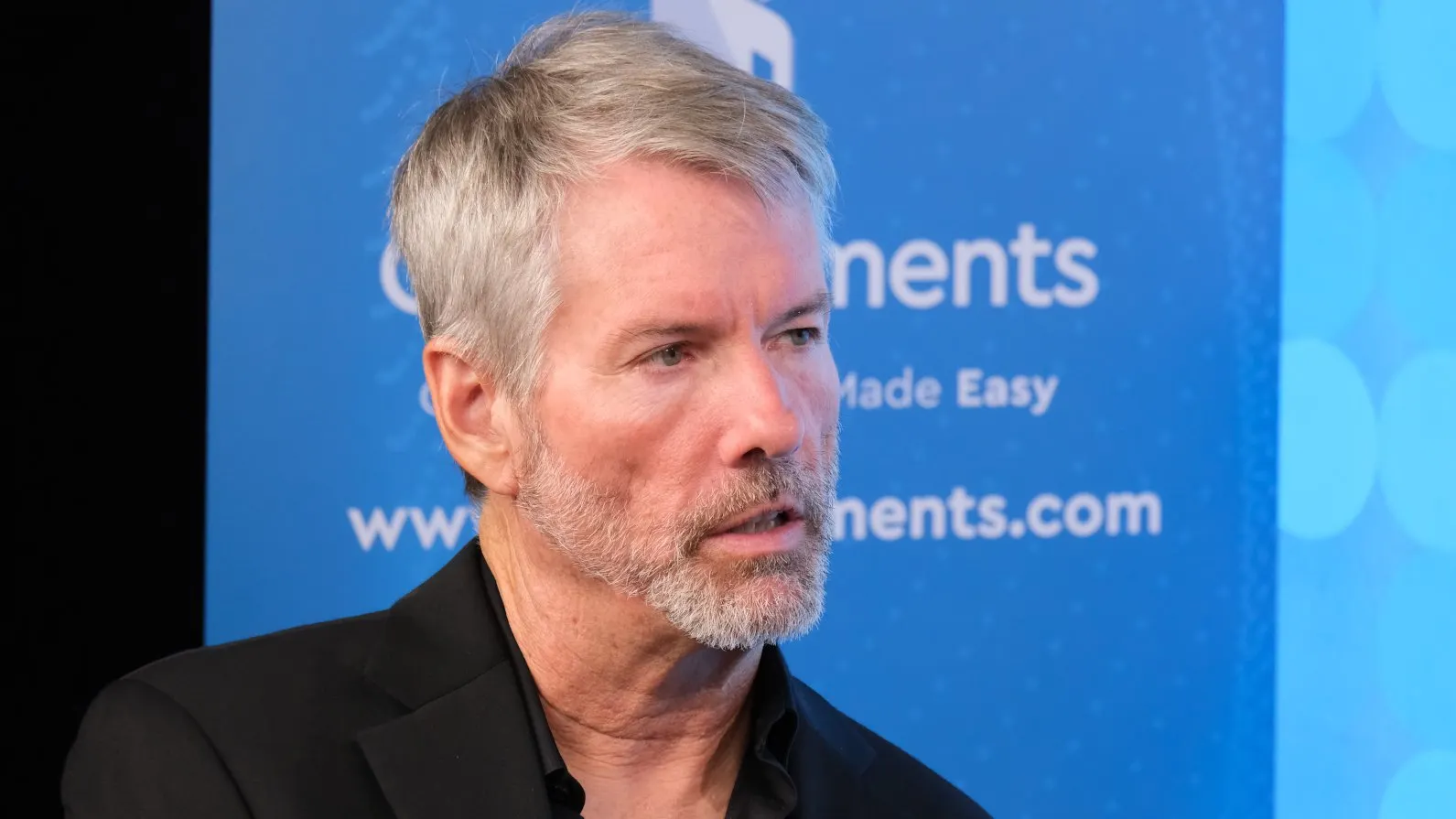

Public Keys: Strategy Doubles Down on Bitcoin Plans, Robinhood Glitters With Gold

Public Keys is a weekly roundup from Decrypt that tracks the key publicly traded crypto companies. This week: Strategy goes full laser-eyes on its Bitcoin play, even as it posts a fifth straight quarterly loss; Cboe pats itself on the back for its “really nice” crypto ecosystem; and Robinhood sees crypto transactions take a dip while its premium Gold service continues gaining steam. Bully for Strategy Bitcoin treasury and software company Strategy, which trades on the Nasdaq under the MSTR ticke...

The FCA has now opened the rulemaking to public comment. It says it will accept input on the proposal until June 13.

Other crypto-related proposals put forth by the FCA include a rule that would make crypto staking firms liable for financial losses suffered by retail consumers where the firm has “inadequately assessed its technological and operational resilience, including third-party dependencies,” along with a ban on all crypto lending and borrowing platforms.

Edited by Andrew Hayward