In brief

- Bitcoin is moving off of exchanges.

- It's increasingly being held by "accumulation addresses."

- These addresses buy but don't sell, which reduces supply and creates upward pressure on price.

Something interesting happened after the onset of the global COVID-19 pandemic in March 2020. Okay, okay, a lot of interesting (and horrible) things happened. But one of them was a switch from crypto exchanges experiencing net inflows of Bitcoin almost every month to consistently watching the amount of BTC in exchange accounts get smaller and smaller.

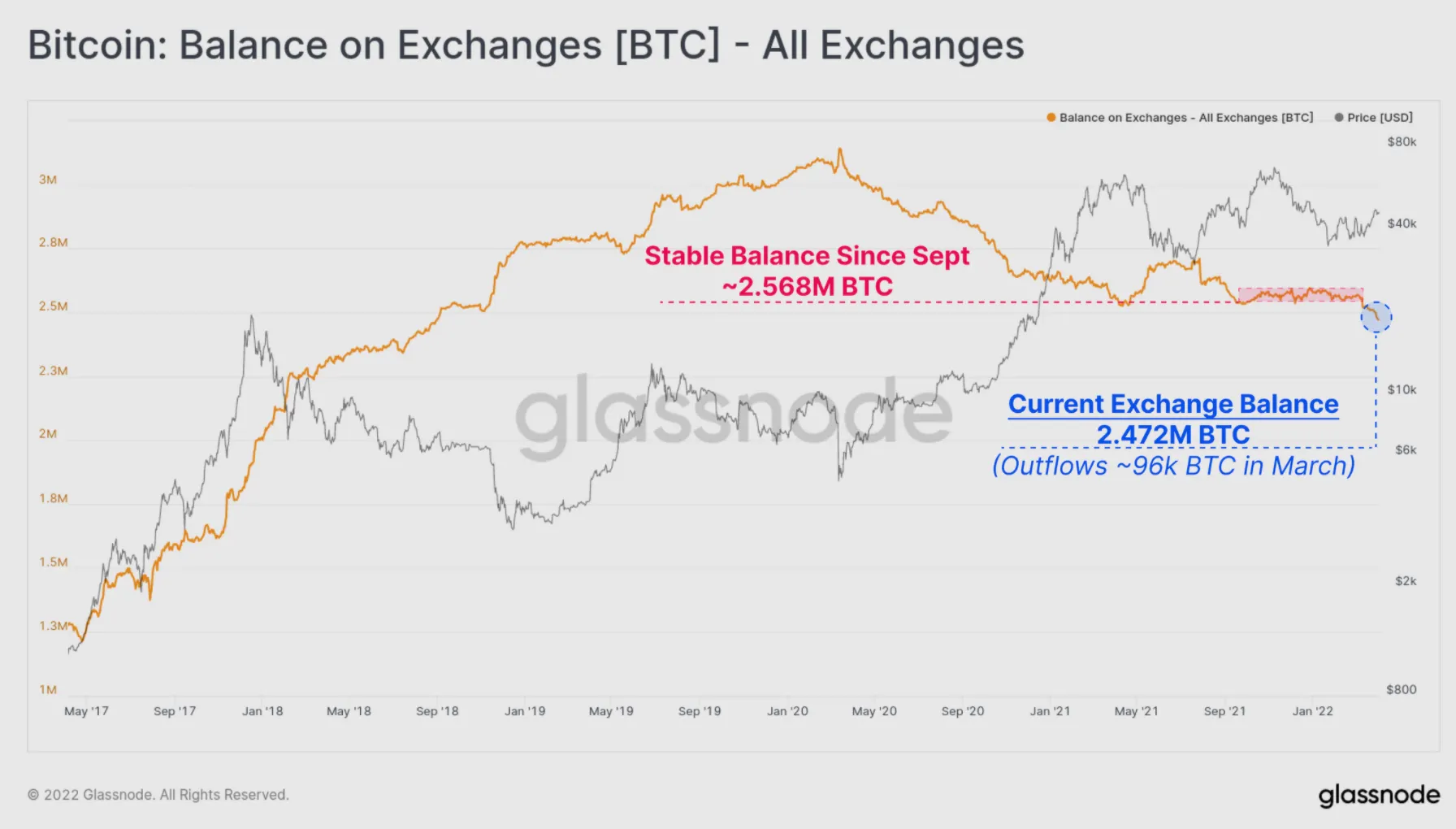

With Bitcoin net outflows averaging 96,200 coins per month for the past two years, exchanges' cumulative Bitcoin balances have hit "multi-year lows," according to a report from crypto analytics firm Glassnode. More precisely, they've fallen to their lowest level since August 2018.

The bulk of recent outflows are coming from a handful of usual suspects: Binance, Bitstamp, Bittrex, Coinbase, Gemini, and Kraken. (However, in the case of Binance and Gemini, despite their recent downward trends, the balance of their holdings has noticeably increased over the past two years, mostly at the expense of Coinbase.)

The upshot of all this, says Glassnode, is that more and more Bitcoin is heading away from exchanges and into addresses that periodically purchase Bitcoin but don't spend it—in other words, HODLers. These "accumulation addresses" can belong to individuals but also to companies and custodians. The Luna Foundation Guard, which has gobbled up $1.4 billion in BTC to back its algorithmic stablecoin, falls into this category, as does MicroStrategy subsidiary MacroStrategy.

The category isn't all Bitcoin whales, however. So-called shrimps, who carry sub-1 BTC balances, have also been taking in more than their share of the coins in circulation since late January.

Per Glassnode, since the first week of December, the balances in such accumulation addresses—both whales and shrimps and everyone in between—has increased by 217,000 BTC (nearly $10 billion). The price then was nestled between $49,000 and $50,000, whereas it currently sits just below $46,000.

Although increased HODLing should put upward pressure on the price, the price has gone down over this time period. It's best not to read too much into it, as net outflows and accumulation are just two data points among many (including the amount of money people feel confident investing amid rising interest rates and consumer prices), and the price picture can change considerably by slightly shifting comparison dates.

Still, Glassnode points out that the amount of Bitcoin being accumulated each day is much higher than the amount of new BTC being created. As such, it says, "the scarcity and pristine nature of Bitcoin as collateral may well be returning to the foreground once again."