Apple is the latest and largest challenger bank—only it’s not a bank. On Monday it launched a virtual credit card, called Apple Card, and announced a partnership with Mastercard and Goldman Sachs, meaning it doesn’t have to bother with the whole banking rigamarole. So it’s left with one task: get everyone onboard.

Challenger banks like Monzo—which seek to replace your physical cards with virtual cards on your phone—have had to build up a user base from scratch, but Apple already has a legion of followers. A 2016 estimate by Credit Suisse gives it 588 million users, and as many as 43 percent are already paying for goods and services with their iPhones using Apple Pay. This provides a huge pool of potential users so is likely to boost the number of people using mobile banking.

That will lead to more mobile payments and better infrastructure surrounding them. Near-field communication (NFC) point of sale systems—which let you pay with a contactless debit card or phone—already increased to 24.7 million units in 2017. This is still too low but, with Apple in the market, it is likely this infrastructure will start building at a faster pace. And when Bitcoin mobile payments are ready, this infrastructure will be the key springboard for worldwide Bitcoin adoption.

To begin with, why is this infrastructure important? It's necessary because mobile payments are the best way to make everyday Bitcoin payments. Mobile phones fix the main issues of: storing private keys safely, receiving the payment information and sending the transaction. All of these are solved through the use of mobile phones with NFC technology, instead of sticking with legacy debit cards. Let’s go through them one by one.

First, it is important that private keys are kept securely. Nobody wants to remember a 12 word mnemonic phrase, or keep running to their safe to check their private key. In the main, private keys are better stored on users’ phones, which need to be sufficiently secure. Phone makers have already cottoned onto this and there are dedicated crypto phones, like the Sirin Finney or more mainstream phones, such as the Samsung Galaxy S10, equipped for this purpose. With these, anyone can store their coins safely and take them wherever they go. Other phones are likely to follow suit.

Second, consumers need to receive payment information straight to their phones. Doing this manually involves typing out a string of digits like 0.00004030 (which is the amount of Bitcoin being sent). NFC can be used to send this information to the phone instead of typing it manually, making the process much easier and faster. Alternatively, QR codes can be used. Mobile phones are more suited to this than debit cards or cash because they have in-built NFC communication and cameras.

Third, you need to have access to the internet to make a Bitcoin payment. Bitcoin debit cards already exist but, in practice, they make payments using fiat money—not with Bitcoin. As mobile phones can be connected to the internet, this makes them more suitable for Bitcoin transactions.

It is often argued that widespread Bitcoin adoption hasn’t happened because it isn’t accepted widely enough. But there are actually quite a few places that already accept Bitcoin. The main problem, in fact, is that the whole process is clunky because mobile Bitcoin payments aren’t quite ready yet.

Even if they were ready, the infrastructure isn’t there to fully support them. Only a quarter of point of sale systems have in-built NFC technology. And, while China is leading the way in mobile payments, research firm eMarketer estimates that just 23 percent of people in the U.S. will be using mobile payments by 2021. In an interview with TechHQ, Andrew Jamison, CEO of digital payments platform Extend, estimated it will be ten years before the U.S. moves fully to mobile payments.

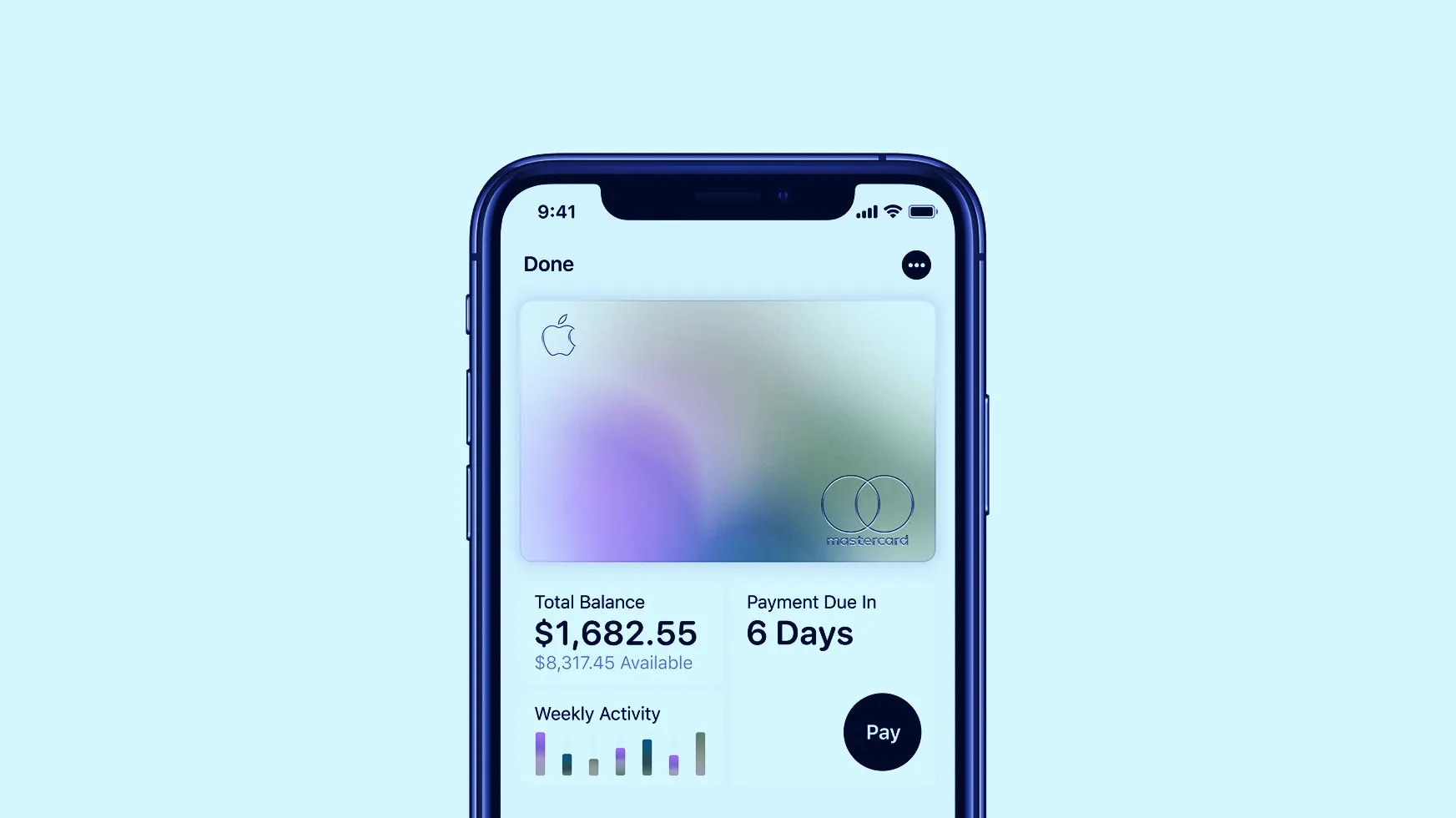

And this is where Apple Card will make a difference. It will encourage more people to ditch their bank and go mobile by providing a streamlined mobile banking system that casts shame on legacy bank apps—which are known for being limited and hard to use. While Monzo and other challenger banks have started this movement, it is likely the Apple brand will bring in legions of new users and also encourage other tech giants to provide similar mobile-based offerings.

Apple Pay is already the leading digital payment method in the U.S. and 50 percent of vendors accept it. A digital card that lives on their phone will allow more people to use Apple Pay and encourage retailers to keep up with the technology. So more retailers will introduce point-of-sales systems with NFC enabled, and thus speed up the adoption rates of mobile payments in the U.S., creating the necessary infrastructure which Bitcoin mobile payments will be able to use.

The only change for Bitcoin mobile payments is the vendor sends the payment request, or invoice, to the mobile phone rather than the mobile phone sending the vendor its virtual credit card details, as happens now. This will be much safer, as it doesn’t involve giving your details out to the vendor.

Apple Card also has a few features that will help get users into the right mindset for making crypto payments. It uses the “Secure Element” of the iPhone—secure data storage—to keep the unique number of the card safe. The same feature could be used to keep a user’s private keys safe too. In addition, with Apple Pay, you confirm transactions with your fingerprint, and this can similarly be used to confirm a Bitcoin transaction, so nobody else can spend your money.

Some see the Apple Card as a threat to Bitcoin. But, in reality, it’s a big step in encouraging the faster onset of mobile payments, the perfect breeding ground for ubiquitous Bitcoin payments. Apple may have just opened the doors to the ultimate challenger bank.