Editor's note: An earlier version of this story incorrectly reported that Alameda Research had moved funds. The wallet in question was incorrectly labelled by Nansen and Etherscan. We regret the error.

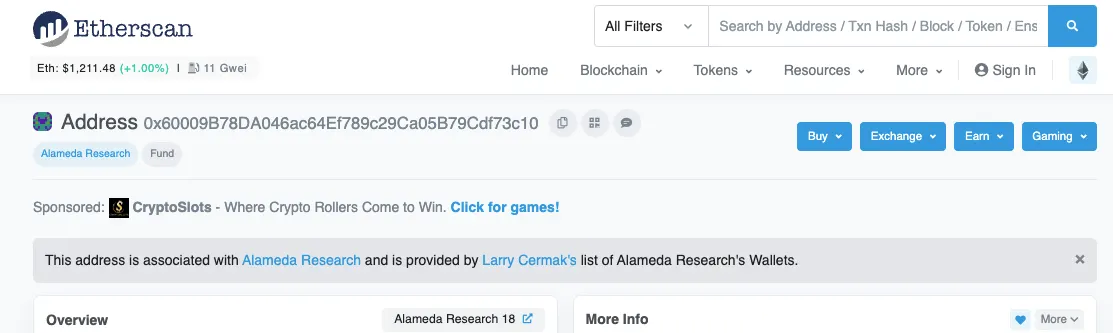

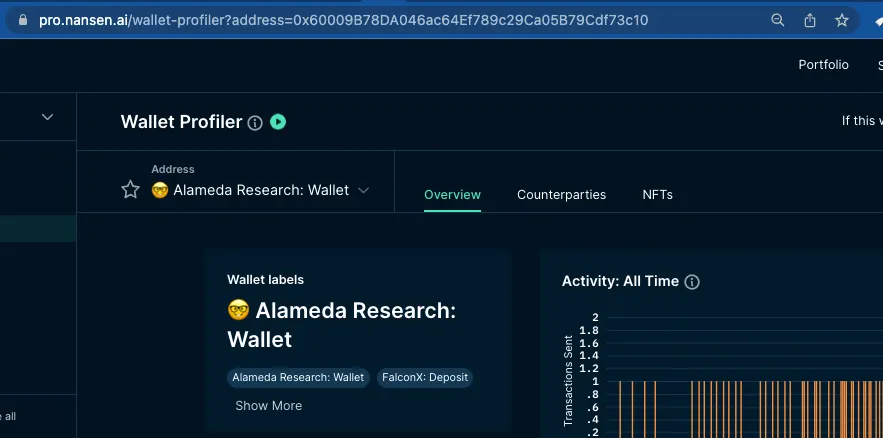

A $17 million USDC transfer Friday afternoon from wallets labeled by blockchain researcher Nansen as belonging to Alameda Research triggered alarms in light of recent "unauthorized" transfers of FTX and Alameda funds amid the bankruptcy of Sam Bankman-Fried’s empire. But the wallet labeled as Alameda belongs to institutional crypto exchange FalconX, and was mislabeled as belonging to Alameda by both Nansen and Etherscan.

A person familiar with FalconX told Decrypt that the wallet, labeled as “Alameda Research 18” by Etherscan and “Alameda Research: Wallet” by Nansen, actually belongs to FalconX.

The source said that the first wallet, labeled as Alameda Counterparty: 0xe31 by blockchain analytics firm Nansen, is a FalconX client that’s not related to Alameda Research or FTX. That wallet sent $17 million USD Coin (USDC) to one of FalconX’s wallets (0x600), which was misattributed to Alameda Research on Etherscan and Nansen. That wallet then sent the funds to another FalconX wallet.

It wouldn’t have been the first time funds moved out of Alameda or FTX wallets after the bankruptcy filing. Newly appointed FTX CEO John J Ray noted in his affidavit that, on the same day FTX filed for bankruptcy, $372 million worth of funds were moved out of its wallets in what the company says were unauthorized transactions.

Now, Ray believes at least some of those funds were transferred at the direction of Bahamian officials.

“[There is] credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors' systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases,” Ray wrote in the court filing.

Earlier this year, institutional crypto trading platform FalconX doubled its valuation to $8 billion after raising a $150 million Series D round of funding from GIC and B Capital. In 2021, the company raised $210 million. And so far, the company seems to be relatively unscathed by FTX’s collapse.

FalconX CEO and co-founder Raghu Yariagadda said on Twitter that FalconX has no exposure to Genesis, which itself said it has $175 million worth of funds stuck on FTX and suspended withdrawals on its platform yesterday citing “unprecendented market turmoil.”

1/ FalconX has no exposure to Genesis.

It's sad to see the industry (customers, partners, and competitors) in pain from FTX fallout... Trust is broken, and we need to rebuild differently. Is the new world order trustless in the centralized layer of Crypto?

— Raghu Yarlagadda (@2Ragu) November 16, 2022

Other on-chain data shows that Alameda has sent $3.6 million worth of Game of Gods (GOG), Covalent Query Token (CQT), ETH, Render (REN), FTX Token (FTT) and Polygon (MATIC) tokens to a multi-signature WalletSimple account over the past couple days.

The multi-sig wallet, so named because multiple people need to authorize transactions, has so far accumulated $94.5 million since it started transacting on the Ethereum network on November 12. It’s the same wallet to which Alameda sent $89 million worth of crypto over the weekend.

It’s possible, but not yet confirmed, that the multi-sig wallet is where Alameda is pooling its funds as it undergoes restructuring.