In brief

- A new report from investment platform eToro provides insight into a wild 2020 for the market so far.

- It examines Bitcoin's digital gold narrative, and Ethereum's DeFi movement, and the major stress tests they are undergoing.

- Investor sentiment, despite market uncertainty, is on the up, even as crypto markets see significant price correlation with the stock market.

There’s one word that perhaps best describes the crypto market during the first quarter of 2020: unprecedented.

In an effort to make sense of the madness, investment platform eToro today released its State of Digital Assets report for Q1 2020. It’s a 50-plus-page document that goes deep on market insight, community sentiment and macro trends.

And we’ve read it so that you don’t have to. (Of course, if you really want to, head on over to eToro to dig in.)

Here are the key findings:

Everyone thinks Bitcoin is like gold, but it’s not acting like gold

The report opens with eToro’s own Bitcoin market. It found that 35 percent of eToro’s users hold Bitcoin, and 97 percent of them are long on the asset.

Twitter data compiled by eToro partner TheTie reflects this positive investor sentiment: Bitcoin-related tweet volume is up 47 percent in Q1, 60 percent of which is positive. This all despite recent market turmoil as a result of the global coronavirus pandemic.

And in the face of this economic crisis, Bitcoin’s foundational narrative as digital gold is undergoing its first major test. After all, as the report points out, Bitcoin was born out of the worst global financial crisis since the great depression as an alternative to central bank monetary policy. So how is this narrative holding up?

Based on social media sentiment, the perception among Bitcoin acolytes is that this narrative is sound.

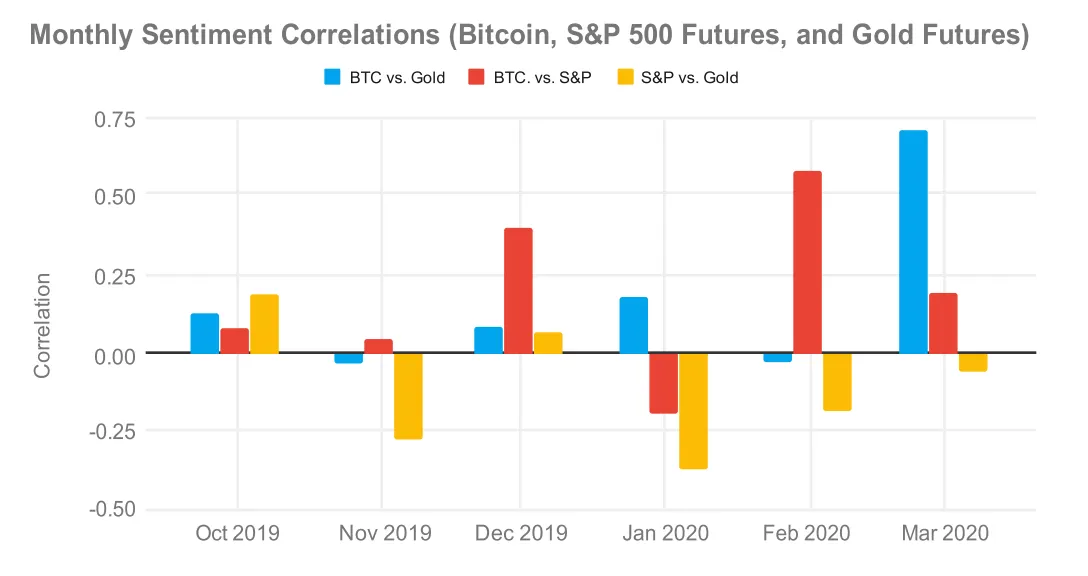

According to TheTie’s data, monthly sentiment correlations between Bitcoin and gold have grown significantly from December 2019 to the present, while sentiment correlations between Bitcoin and the S&P 500 index have shrunk.

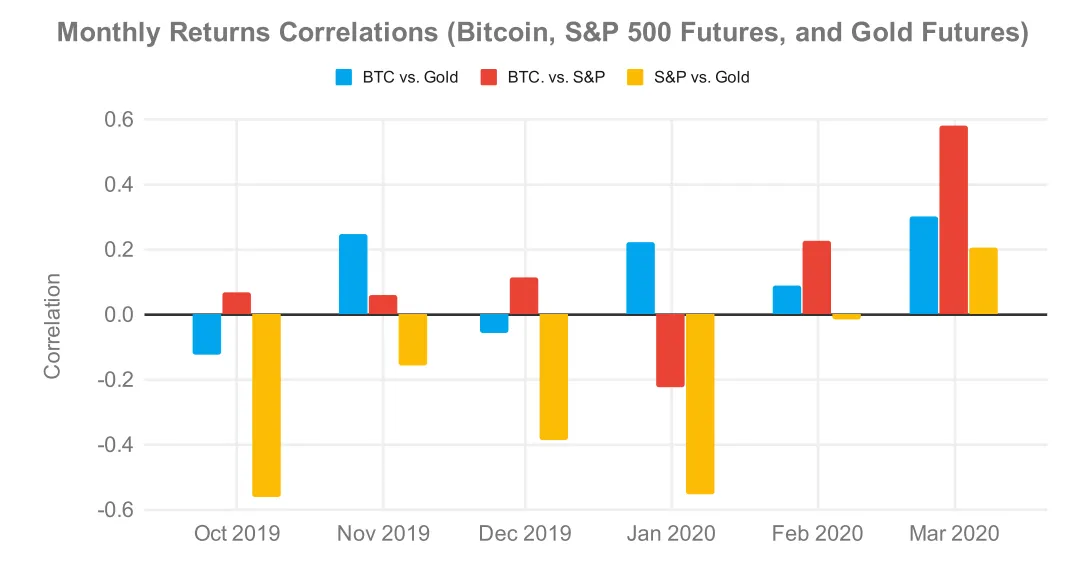

Meanwhile, in reality, actual market data tells a much different story. Bitcoin’s correlation with the S&P 500 recently reached a new all-time high. Bitcoin and gold’s correlation is also positive, but to a lesser degree than its correlation with the S&P 500.

Of course, many assets are trending in the same direction because people are fleeing for stability in dollars. “During the beginning of economic downturns, many investors may flock to cash and liquidate their holdings across the board, which might partially explain Bitcoin’s crash alongside equities and gold on March 12,” said the report.

And investor activity and sentiment in other markets isn’t exactly harmonious right now, either. For example, even as the stock market rallies, America’s unemployment rate is approaching 10%.

So how will Bitcoin react if macro market trends deteriorate further? Will it decouple and become a safe haven like people expect of gold in a crisis?

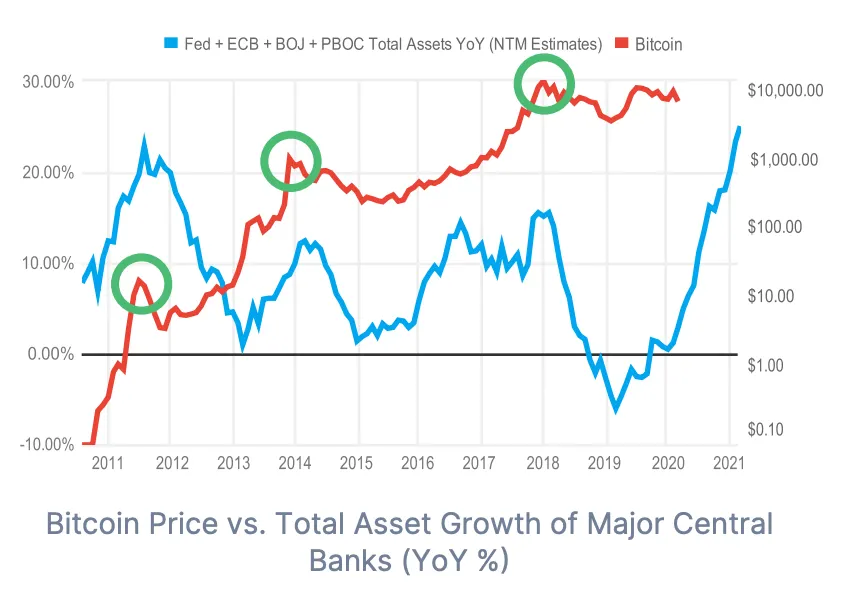

Kevin Kelly, of cryptocurrency data firm Delphi Digital, said it’s too early to scrap the digital gold narrative completely. “The stage is set,” he wrote in a column for the report, in which he makes the bull case for Bitcoin as central banks continue to expand their balance sheets to unprecedented levels.

“In our view, Bitcoin’s performance following the aftermath is far more important than its sell-off going in, given the backdrop has never been more conducive for a non-sovereign, censorship resistant, provably scarce digital asset,” he said.

“Historical precedent is quite limited given Bitcoin’s relatively short lifespan, but it is notable that prior BTC cycles have tended to peak with major central bank balance sheet growth,” Kelly noted.

Anatomy of a crash: Inside March market madness

In another column penned for the report, Sacha Ghebali & Anastasia Melachrinos of cryptocurrency data provider Kaiko break down key elements of the March 12-13 crypto market crash and the fallout.

Specifically, the market cratered in two steps. First came the initial drop as Bitcoin’s price tanked 25 percent from $8k to $6k on March 12. As the sell-off ensued, auto-liquidations were triggered on derivatives markets like the Seychelles-based exchange BitMex.

Many exchanges halted trading or were forced to undergo maintenance as their servers couldn’t handle the surge in trading volume, Ghebali and Melachrinos noted. This was likened to the “circuit breakers” that Wall Street uses to halt trading if a blue chip index falls more than 7%.

And with this came eye-popping volatility, even for crypto—and just when the S&P 500’s volatility was inching closer to Bitcoin’s own. (Bitcoin’s 30-day volatility is currently triple the S&P 500’s).

Another side effect of the March crash has been widening spreads (the difference between how much sellers want and what buyers are willing to pay) across crypto exchanges. Spreads between popular exchanges saw a tenfold increase during the selloff. A wider spread indicates that price discovery for an asset is obscured. And spreads are just now returning to pre-March levels, according to eToro’s report.

How DeFi is DeFi, really?

Black Thursday, as the market crash is being called, also bored a hole in Ethereum’s decentralized finance (DeFi) landscape.

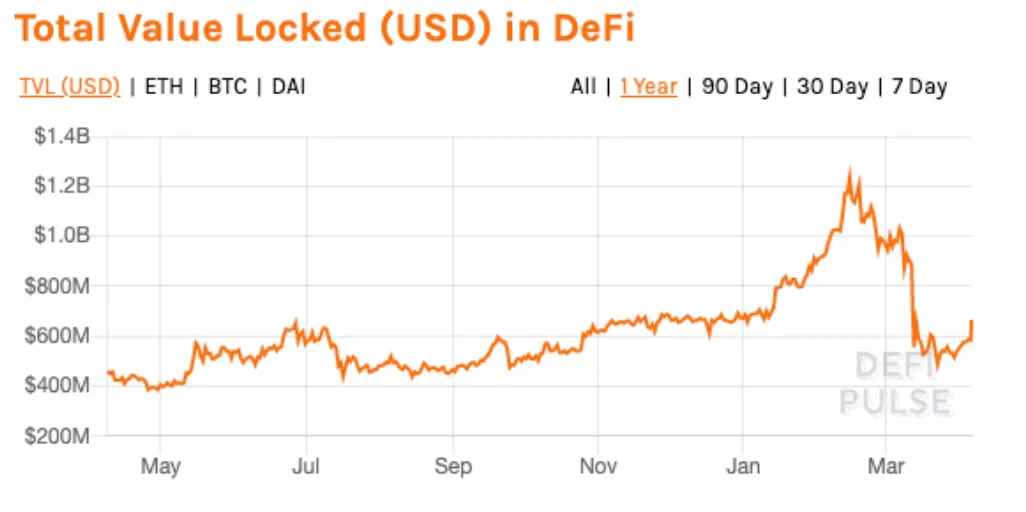

The recent market crash erased more than half the value locked in DeFi protocols. This value reached a peak of $1.24 billion in mid-February, but March’s market downturn sent it spiralling to a quarterly close of $552 million.

Regarding Ethereum, the report gave significant oxygen to how the March price crash affected MakerDAO, Ethereum’s most popular decentralized application (dapp) which makes up 50% of all value in decentralized finance (DeFi) protocols on Ethereum.

Except, it appears MakerDAO isn’t all that decentralized—as the report detailed, its Foundation had to intervene to keep Maker’s smart contracts from going bust.

These smart contracts, the blood vessels of the MakerDao ecosystem, allow users to mint DAI, a stablecoin that is pegged to the dollar, by fronting ETH and other tokens as collateral. You’re essentially taking out a loan of DAI against your tokens; you then pay an interest rate back on this loan on top of the loaned amount to reclaim the collateral.

To keep DAI stable, MakerDAO mandates that minters collateralize their position 2:1 for every DAI minted (so, for every $1 of DAI you mint, you need $2 of ETH, for example). Why do you need to overcollateralize? Well, March 12 and 13 are why—if cryptocurrencies tank in price, then you need the added collateral to cushion the DAI stablecoin against the fall.

Market participants have long postulated what would happen to MakerDAO in the event of a serious price hit, and now we have our answer: Maker nearly shut down, and its Foundation had to step in to save it.

The dramatic price action meant that contracts used to mint DAI were undercollateralized and were put up for liquidation via auction. At the same time, Ethereum’s network was severely congested as users moved funds around in the panic.

The result, according to the report: all but one MakerDAO user halted their operations for fear that there wouldn’t be enough ETH in the system to buy their DAI at auction for a fair price. That one active user was able to win several contracts with a $0 bid, the report said, meaning they claimed the ETH in these contracts without paying any DAI for them.

With no new DAI in the system to stabilize the contracts, MakerDAO debated shutting down the network and recalling all DAI in the system. In effect, this reset button would convert all DAI in circulation back into the ETH used to collateralize them. This would have released 2.4 million Ethereum from these contracts in the midst of a massive market sell-off, perhaps driving prices further. It would also forcibly seize DAI from Maker’s user base.

So rather than make everyone unhappy, Maker decided to auction off MKR tokens (another token used in MakerDAO’s design) for DAI to cover the $4.5 million in uncollateralized debt.

In addition, to ease the liquidity strain on DAI that the crash caused, MakerDAO added new coins to Maker’s accepted collateral to encourage users to mint more DAI.

Market participants rushed to buy DAI from exchanges or convert it on token-swapping protocols like Uniswap, either to pay off DAI contracts or to find stability during the price drop. (This resulted in DAI temporarily trading a few cents above a dollar.) To boost supply and drive the price back down to its peg, Maker added USDC, Coinbase’s stablecoin, as a collateral option.

With Maker tinkering so liberally with monetary policy, it begs the question: just how decentralized is DeFi and its dapps? How is Maker buying DAI from its users any different from the US Federal Reserve buying treasuries and securities from banks to boost liquidity? As Coin Metrics founder Nic Carter put it to Decrypt, Maker is “effectively a currency board and buyer of last resort for DAI.”

Yet, despite the mayhem, sentiment among users remains mostly positive, according to the report. And Ethereum-related engagement on social media was up 11% in Q1.

Optimism for what the future holds is one thing Ethereans and Bitcoiners have in common, even as DeFi and digital gold narratives undergo significant stress tests.

Guy Hirsch, managing director of eToro US, still believes that Bitcoin’s digital gold destiny will come to fruition in time. Hirsch told Decrypt that even though Bitcoin’s price may be down, it’s still performing better than its closely-correlated cousin in the stock market, the S&P 500.

“Bitcoin did perform better than the S&P 500, down 10.45% in Q1 vs. the S&P 500 which was down -19.92% at the same time period,” Hirsch said.

“We think that Bitcoin’s high volatility might explain some of these price movements in the short term but over the course of the next few years believe that the fact it is decentralized sound money will reveal itself to many new potential investors, and they will diversify their portfolio to include Bitcoin as a hedge against government failure.”

And the crypto narratives live on.