In brief

- Over 147,000 Bitcoin, worth around $1.4 billion, has been laundered through unwitting crypto exchanges this year.

- Blockchain security firm Peckshield traced over 40,000 Bitcoin from "high-risk" addresses sent to Singapore-based exchange Huobi.

- A further $1.59 billion in high-risk funds may have been processed through coin mixers.

After a year of rigorous analysis, blockchain security firm Peckshield claims to have traced over $1.4 billion worth of dirty Bitcoin laundered through multiple crypto exchanges in 2020.

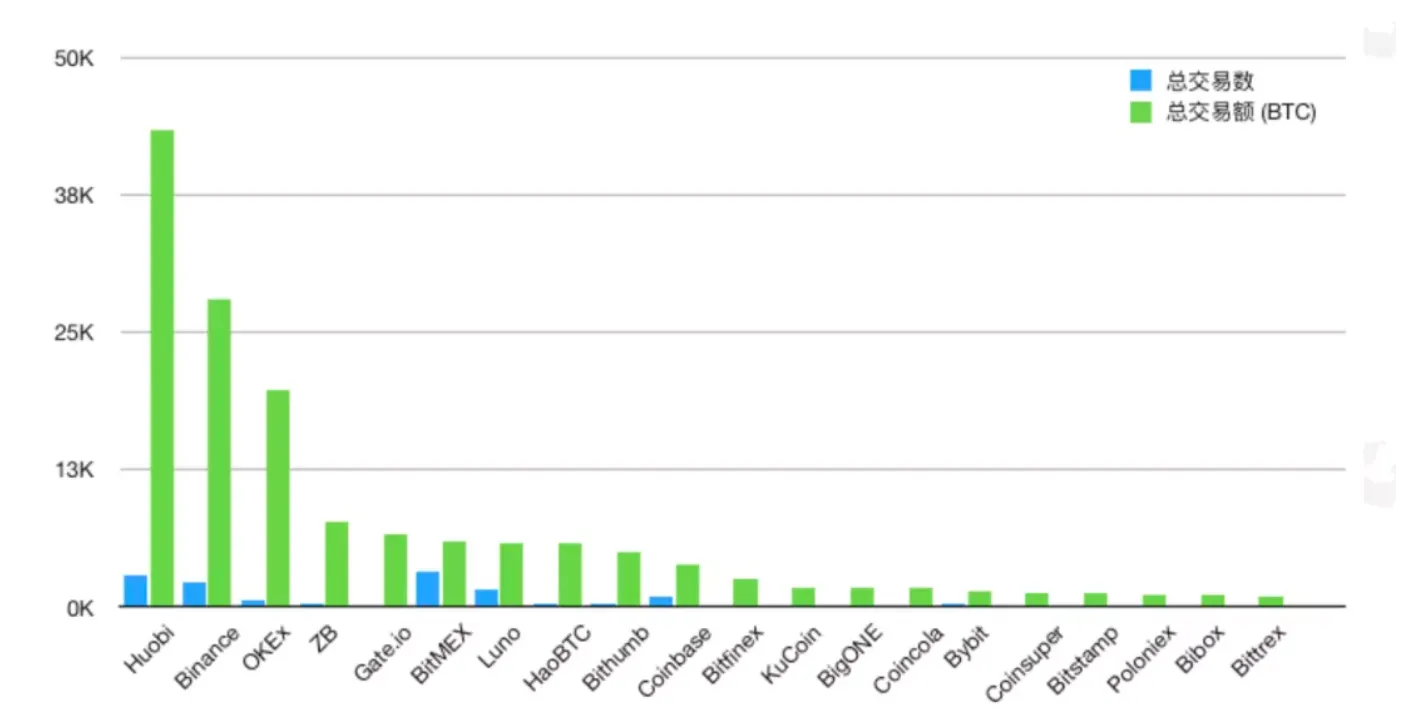

"We ranked the exchanges with the largest amount of stolen money," reads the translated Peckshield report, issued July 14. "The top ten exchanges were: Huobi, Binance, OKEx, ZB, Gate.io, BitMEX, Luno, HaoBTC, Bithumb, and Coinbase."

Per Peckshield researchers, the Bitcoin in question originates from several so-called "high-risk" addresses, including those implicated in hacker attacks and darknet activity.

In the past six months alone, the blockchain sleuths have tracked a total of 13,927 high-risk transactions—amounting to an aggregate 147,000 Bitcoin ($1.4 billion)—flowing into several prominent exchanges.

Singapore-based Huobi was the worst struck by high-risk inflows, with over 40,000 Bitcoin ($364 million) sent to the exchange. Trailing just behind is Binance, with over 25,000 Bitcoin ($227 million) allegedly laundered via the exchange.

Mixing with the wrong crowd

The estimated $1.4 billion may just be a drop in the water. Peckshield researchers caveat that $1.59 billion in high-risk funds moved into coin mixers in order to muddle movement.

Coin mixing appears to be a popular method for money launderers seeking to obfuscate their Bitcoin.

Earlier this month, the infamous "Blueleaks" hack revealed that the FBI is tracking money laundering on the dark web. The 270GB data dump of police documents, exposed by the hacking collective Anonymous, details several cases in which crooks allegedly used Panamanian 'instant' crypto exchange MorphToken to cleanse dirty Bitcoin by exchanging it for the privacy coin Monero.

Huobi and Binance may have been singled out by Peckshield, but they aren't alone. In June, on-chain analysts, Ciphertrace, revealed that peer-to-peer exchange LocalBitcoins has also been used by money launderers. Per a report, 12.01% of all Bitcoin received by LocalBitcoins in 2019 came directly from criminal sources.

Now, following in the wake of this week’s Twitter hack, scammers are likely looking to launder a little more Bitcoin. The big question is: why didn't they use Monero?