For U.S. citizens, there are really only two ways to not pay crypto taxes on profitable trades: renounce your citizenship or simply not pay them. Simply not paying them is a risky proposition that may lead to the Internal Revenue Service (IRS) coming after you for unpaid taxes, late fees and fines, and in some instances may even lead to prison time. Renouncing your citizenship for tax purposes is fairly uncommon and can also lead to other issues (like the inability to get a visa to regain entry into the USA).

However, there are some ways that you can legally minimize the taxes you have to pay on profitable crypto transactions. The first thing you should do is try to keep excellent records on all of your purchases and sales. Besides being required by the IRS, detailed records will allow you to implement various cost basis methods and accounting options (discussed in detail below).

Crypto tax minimization tip #1: Keep good records

A comprehensive transaction record is called a tax lot and should include the following: amount of crypto or digital asset involved in the transaction, value in fiat currency at the time of purchase (and the corresponding date), value in fiat at the time the crypto was traded, sold, or used to purchase a good or service (and the corresponding date).

Which crypto transactions aren’t taxable?

To review, crypto transactions that are taxable include selling crypto for U.S. dollars (USD) or another fiat currency, trading one crypto for another (like exchanging ADA for DOGE), or purchasing a good or service with cryptocurrency; this holds true when the trade or purchase results in a net profit. Even if the transaction resulted in a net loss, it should be recorded to be compliant — and to take advantage of capital losses that can lower your tax bill.

Here is a list of things that are not taxable:

- Buying crypto with fiat isn’t taxable until you sell it, trade it, or use it to make a purchase. Without one of these actions, there isn’t a taxable event.

- Gifting crypto to a friend or family member isn’t a taxable event if done below the allowable limit. Gifts above the allowance would be subject to a gift tax.

- Gifting crypto to a tax-exempt organization (such as a nonprofit) isn’t a taxable event if done properly. Donations in excess of $500 must be noted on Form 8283. This is a tax-deductible donation and the deduction amount depends on how long you have owned the asset you donated.

- Transferring crypto between your own wallets isn’t taxable. For example, if you purchase Ethereum Classic (ETC) from a crypto exchange and send it to a non-custodial software wallet (Exodus, Atomic) this isn’t a taxable event; it’s merely a transfer. You could then take this ETC on your software wallet and freely send it to a hardware wallet (Ledger, Trezor). Later, you could return it back to the exchange from which you originally withdrew it (perhaps to sell it at some future date). None of these actions are taxable events.

While not taxable, the buying of crypto and the gifting of it (to either a person or organization) should be recorded so that your transaction records can be accurate.

Wallet-to-wallet transfers don’t necessarily need to be recorded but some keep track of these transactions to account for crypto holding discrepancies that may occur as the result of transaction fees on certain blockchain protocols.

Crypto accounting tactics and terms

While we previously discussed how short-term and long-term capital gains are charged at different rates, we should look more deeply into how these gains are calculated and the options you have to consider when selling assets—provided you keep good records.

Trading and transaction fees can be added to your cost basis when calculating fair market value.

Fair Market Value

The market price or spot price that a crypto asset can be sold for at a particular time is called the fair market value (FMV) for accounting purposes. The FMV of a crypto asset must be used when reporting capital gains—and losses. In the U.S., the FMV is converted to USD when making both sales, purchases, and crypto-to-crypto trades. If you’re doing trades and transactions on a centralized crypto exchange (CEX), they usually have built-in tools that can help you create crypto transaction reports that include the FMV. You can also calculate the FMV by comparing the transaction date and time with the spot price listed on crypto market sites like CoinMarketCap and CoinGecko.

Transferring crypto between your own wallets isn’t taxable.

Trading and Transaction Fees

Many crypto purchases and trades involve a fee. This could be a transaction fee (paid to a blockchain protocol like Bitcoin) or a fee paid to the crypto exchange you are using. In general, these fees can be added to your cost basis to lower your tax bill (by lowering your capital gains or increasing your capital losses).

Cost Basis Methods

In other countries, the cost basis method that may be required when reporting sales is called average cost accounting. This means that if you have made multiple purchases of an identical crypto asset over time, you must take the average of them to get the fair market price you will be using. The IRS lets you choose from a variety of methods which can allow you to maximize your post-tax investment returns.

Rule #1: Keep good records

Imagine a crypto investor purchased a full BTC on four separate occasions, paying $5,000; $15,000; $25,000; and $50,000; respectively. Let’s say they purchased the $5,000 BTC first, the $50,000 BTC second, the $15,000 BTC third, and the $25,000 BTC last. Here are some cost basis options in this scenario:

- Average Cost Basis (ACB): As the four purchases are for an equal amount of BTC, the cost basis is simply the total purchase price divided by four; this equals a cost basis of $23,750 per BTC. One option of many to choose from in the U.S., countries like Canada and the U.K. only allow this cost basis method.

- First In, First Out (FIFO): The first assets purchased are the first sold. This would be a $5,000 BTC cost basis using this method.

- Last In, First Out (LIFO): The last assets purchased are the first to be sold. This would equate to a $25,000 BTC cost basis using this method.

- Highest In, First Out (HIFO): The assets that cost the most are sold first. This would equate to a $50,000 BTC cost basis.

- Lowest Cost, First Out (LCFO): The purchase that cost the least is sold first. This would equate to a $5,000 BTC cost basis. As the lowest cost purchase was also the first, this cost basis is the same as using FIFO in this scenario.

- Specific Identification: If you keep solid records, you can simply choose which purchase you want to use to calculate your cost basis. In our example, you have four choices on what your cost basis will be.

How you choose to calculate your cost basis is solely up to you. Which cost basis designation is the best for you depends on your income, your other investments, and a variety of other considerations. You may want to maximize your returns, minimize your tax bill, or even sell for a loss to offset capital gains in other parts of your portfolio.

While how you calculate your cost basis is your decision, you have to use one method each year; you can’t pick-and-choose methods for individual assets. For example, you can’t use LCFO for your stocks, ACB for your BTC, FIFO for your ETC, and LIFO for your ADA. While creative (and probably a great way to lower your taxes even more), you have to stick with one accounting method for all your assets over the calendar year. On the plus side, you can change your cost basis method every year in order to do what is most beneficial for you during that calendar year.

Capital Gains Taxes and Income Bracket Considerations

When aiming to minimize your crypto taxes, it’s worth considering your filing status, your income tax bracket, and how potential sales may or may not move you into a different tax bracket. Before we explain this further, it’s worth looking at the current tax rates.

This chart shows both the short-term capital gains and taxable income tax brackets for 2024:

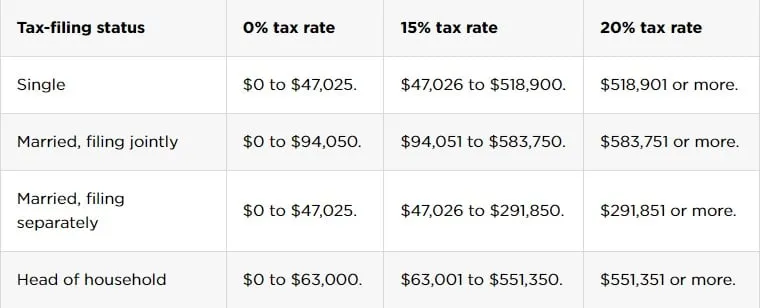

This chart shows the long-term capital gains rate for 2024 for taxable income:

Let’s run through some example scenarios where what you sell, the cost basis you choose, your needs, and how close you are to another tax bracket could factor into your decision. These scenarios would be for filing 2024 taxes. 2023 scenarios are very similar but the tax brackets are slightly different than the charts above. For example, the 2023 0% long-term capital gains rate stops at $44,625 (as opposed to a higher limit of $41,675 for 2024).

Scenario 1:

Investor ABC (filing single) has been investing in cryptocurrency for eight years. ABC has an annual salary of $194,000 and has a crypto portfolio of various projects that ABC has been buying for several years. Based on the current market price, ABC has the option to sell some of their BTC for either a profit or a loss. ABC decides to sell for a net loss of approximately $6,000 using a HIFO cost basis. Through this loss, ABC can implement a tax-loss harvesting strategy that will reduce their earned income by up to $3,000. Per the chart above, this would lower their tax rate from 32% down to 24%. ABC can roll over the other $3,000 in losses to implement this same strategy next year (or use them to offset capital gains).

Scenario 2:

Investors DEF and GHI are married and filing jointly. Normally making approximately $120,000 combined income, they experience an unexpected downturn that results in a combined salary of $60,000. They decide to take the opportunity to sell some of their long-term crypto holdings. At this combined income, they can sell crypto for up to $34,050 in profits, tax free. In a typical year (above the $94,050 combined income threshold), they would have to pay a 15% tax on these profits.

Decide what’s right for you

There are far too many considerations to give you every possible scenario—but here’s one more. You are able to—and want to—harvest substantial long-term crypto gains. However, harvesting them all in one calendar year will bump up your tax rate on long-term gains from 15% to 20%. You realize you could ostensibly sell your crypto in five equal installments to remain at a 15% tax rate if conditions persist. What would you do in this scenario?

Would you sell it all and lock in your gains, but pay the higher tax rate? Would you decide to sell a portion this year to pay a lower tax rate, but take the risk that these gains could diminish—or disappear over the coming years? A decision in a scenario like this isn’t easy; even some of the best crypto hedge funds have struggled to time the crypto markets or determine market sentiment.

For these reasons, any strategies to maximize your returns and minimize your losses should consider the risk:reward ratio and the pros and cons of various investing decisions. These can be done by yourself — or with the guidance of an investment or tax advisor.

Cheat Sheet

- Keeping accurate and detailed crypto transaction records can help you minimize your tax obligations and maximize your investment returns.

- Gifting crypto can be a tax-deductible donation if done properly.

- Trading and transaction fees can be added to your cost basis when calculating fair market value.

- There are various cost basis methods you can use when filing your taxes. The best method may be based on your personal situation and personal preferences.

Disclaimer

This crypto tax series is merely for informational purposes and should not be considered legal or tax advice. Please solicit the services of a crypto knowledgeable certified public accountant, tax professional, or lawyer should you need further guidance.

Sponsored post by Crypto Tax Calculator

Learn More about partnering with Decrypt.