In brief

- Central banks have more positive things to say about digital currencies than ever before.

- That's according to a new report by the Bank for International Settlements.

- More and more governments are starting work on CBDCs.

Central banks are talking about digital currencies in greater numbers than ever. And what’s more, many even like the idea of making their own central bank digital currency, or CBDC, according to a report by the Bank for International Settlements, published today. The days of the state-rolled crypto edge ever nearer.

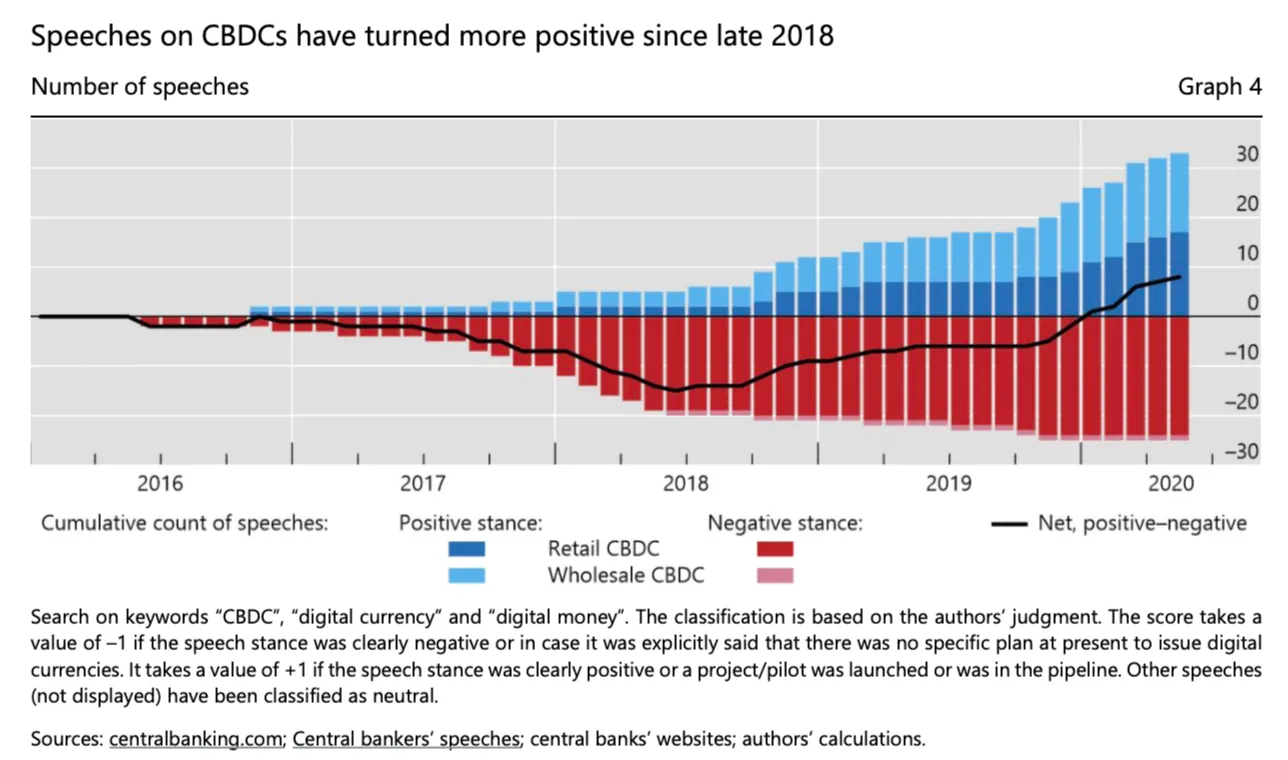

Per the BIS’s report, the number of speeches on digital currencies has ballooned over the past few years. And while central bank governors and board members used to be skeptical (or downright dismissive) of the technology in their speeches, their tone has changed.

“In fact there have now been more speeches with a positive than a negative stance,” said the BIS, pointing to a sentiment analysis of all the speeches of 175 central banks. That’s a recent development: Around mid-2018, there were roughly four negative speeches for every positive one.

Central banks aren’t just talking about CBDCs. They’re actively studying them. As of mid-July 2020, the BIS found that at least 36 central banks have published work about CBDCs.

At least three countries have completed a pilot for retail CBDCs (those intended for public distribution, akin to digital cash), and six more projects are ongoing. Another 18 have published research about retail CBDCs, and 13 more announced they’re researching or developing wholesale CBDCs (those that would be used by banks to cut costs and increase transaction speeds).

The true number of central banks considering the technology is far greater. According to a January report, the BIS found that 80% of the world’s central banks are thinking about it.

Just last week, Brazil’s central bank announced that it had formed a working group for a CBDC, which it thinks could “improve the current model of commercial transactions between people and even between countries.” The 12-person team tasked with researching a Brazilian CBDC will file a report to the central bank in six months.

A week earlier, a governor at the US Federal Reserve announced that the Fed has partnered with MIT researchers to build and test a CBDC.

Although most CBDCs are still in their infancy, there’s a reason governments are working toward them, said Gregory Klumov, CEO of Stasis, a stablecoin pegged to the Euro. He told Decrypt the benefits of CBDCs are numerous: “On demand, irreversible, immutable, auditable, almost-instant transactions. Like cash but better as the cost of counterfeiting is sky high [and therefore] economically unviable.”

The benefit to governments, specifically, he said, is that it “disrupts clearing, custody and settlement—services that became oligopolized [by commercial entities].”

Right now, however, there’s an emerging divide governing which countries are exploring CBDCs. In a systematic review of 175 countries, the BIS found that a jurisdiction’s interest in CBDCs “is strongly associated with higher mobile and internet use, a higher innovation capacity, an existing or planned [fast payment system] and greater government effectiveness.”