Are Ethereum scaling solutions helping?

$30 gas fee on Layer 2 $ZKS $ZKSYNC @zksync

I don't understand, I thought layer 2 were made to reduce gas fees 😱😱 pic.twitter.com/Uz6k5p4bC5— Kool Crypto ⚙️🛸 (@healthymofin) May 5, 2023

$60,729.00

-1.27%$3,369.80

-0.48%$5.80

-1.14%$568.93

-1.23%$135.59

-0.79%$0.999914

-0.02%$3,368.01

-0.51%$0.467446

-1.18%$7.58

1.13%$0.121247

-3.42%$0.377916

-2.95%$0.123012

-0.72%$25.96

0.78%$0.00001694

-3.82%$60,856.00

-1.19%$13.72

-3.08%$370.98

-1.62%$9.19

-2.27%$5.09

-4.09%$3,503.96

-0.59%$5.71

-0.58%$70.59

-0.86%$0.00001221

-3.28%$0.545928

-1.95%$0.174037

7.68%$1.58

-7.93%$8.01

-2.80%$0.99975

-0.06%$23.23

-0.87%$3,392.35

-0.81%$6.75

-1.25%$164.28

-0.66%$7.33

-2.56%$0.07583

-2.74%$6.74

-1.63%$0.804223

-2.15%$0.089081

-2.41%$1.74

0.96%$0.768438

-1.39%$41.82

0.85%$4.32

-2.26%$0.089749

-0.12%$2,510.26

7.12%$1.53

-1.09%$23.50

3.92%$0.998957

-0.05%$2.39

0.58%$0.0256789

-1.72%$2.04

1.12%$0.212515

-3.12%$0.831047

-2.29%$1.74

-0.66%$275.30

-3.25%$3,741.75

-0.51%$26.84

-4.28%$1.16

-6.25%$0.00016697

-4.48%$0.01564887

-4.04%$3,492.60

-0.40%$0.566778

-1.82%$1.56

-3.36%$1.11

-1.25%$0.150459

-4.76%$0.00002186

-4.22%$0.02922085

-2.24%$92.42

1.77%$9.41

0.45%$3.96

-3.87%$6.32

-5.39%$0.57437

-0.39%$1.32

-2.79%$3,365.11

-0.54%$0.137435

-2.48%$0.306048

-5.46%$74.72

-2.50%$0.347672

-4.06%$0.02435295

1.96%$0.770176

-2.65%$3,394.85

-0.64%$7.66

-1.01%$0.02726435

-4.57%$9.80

-0.45%$0.605469

-4.11%$0.01799602

1.46%$6.08

-1.95%$0.687014

-4.00%$0.546931

-5.47%$43.74

-2.93%$0.00000088

-0.22%$0.655616

-7.34%$10.39

-0.67%$5.27

-4.86%$1.34

-1.49%$0.0158244

-8.31%$37.84

-0.08%$11.28

-0.75%$25.25

1.61%$29.04

-2.77%$0.330307

-1.67%$0.759763

-3.08%$3.11

1.27%$162.42

-1.15%$283.04

-0.99%$0.995864

-0.05%$2.21

-0.09%$2.09

-2.33%$2.72

-4.84%$3,621.64

-0.46%$0.075595

-3.83%$3,366.69

-0.59%$1.17

0.68%$0.997348

-0.04%$0.154477

-1.25%$1.95

-3.16%$2.55

-4.18%$0.00909219

-1.81%$160.87

-1.02%$0.333781

-0.90%$10.83

-0.88%$0.091442

2.79%$0.00003113

-3.70%$1.39

-0.01%$0.947853

-1.69%$0.159012

-2.92%$3,568.55

-0.45%$0.325666

-6.36%$0.708574

-2.05%$0.512731

-5.08%$0.00575075

-8.43%$2,311.94

-0.46%$0.154707

-7.97%$0.170909

-3.59%$2.12

-2.56%$3.35

-3.88%$16.23

-5.35%$3,669.85

-0.49%$0.0118485

-0.69%$1.44

5.65%$0.077993

2.93%$0.468597

-6.79%$0.997558

-0.08%$0.387572

-1.34%$0.444774

-4.45%$0.00000131

-9.28%$0.03082748

-0.62%$1.93

-4.31%$0.458272

-2.31%$0.087794

-4.12%$0.00008111

-0.67%$3,471.40

-0.49%$0.00000044

-1.83%$65.62

-1.22%$24.51

-4.83%$2,291.76

-0.34%$0.655687

-7.21%$1.008

1.18%$0.999322

0.18%$20.24

-9.12%$0.02396955

-1.89%$0.481762

-5.59%$0.212131

-3.72%$0.994693

-0.13%$0.01928694

-3.54%$1.52

-1.41%$4.01

-1.44%$8.39

0.67%$0.554304

-0.46%$0.00113358

-0.18%$0.811117

6.74%$0.065388

-5.44%$0.03943045

-2.63%$0.713058

-6.64%$0.293702

-5.50%$67.66

-0.47%$3.17

-3.04%$0.00000017

-1.22%$1.34

-1.31%$3.00

-11.40%$0.207464

-13.20%$8.57

-6.01%$0.526418

-2.97%$0.350621

-4.88%$0.163385

-1.49%$22.60

-3.70%$0.00383423

-2.73%$8.50

-0.12%$1.024

0.62%$48.62

0.15%$3.45

-1.41%$0.01740586

-2.81%$0.588378

-1.61%$0.00177244

-4.54%$0.00454501

-11.92%$1,218.27

-1.20%$0.02930559

-1.82%$0.377931

-3.24%$0.356841

-2.29%$2.11

-0.37%$0.03014001

-4.67%$19.89

-0.50%$0.182331

-2.79%$0.278897

-9.53%$0.727478

-1.06%$3,527.23

-0.56%$2.39

-0.49%$0.0294092

1.59%$0.646361

-4.86%$0.418755

-1.94%$0.195782

-4.30%$74.84

-0.33%$0.190218

-0.45%$23.81

-1.01%$0.00555945

-3.59%$1.46

-7.97%$0.00487728

-0.69%$38.59

2.89%$47.52

-2.26%$103.29

0.56%$0.01917034

-3.18%$27.98

-1.56%$2.53

-1.77%$0.05125

-2.16%$0.0045367

-2.52%$3.15

-4.27%$0.15395

-5.14%$3.19

-4.08%$2.21

-2.36%$2.36

-1.27%$0.34998

-3.88%$0.173171

-3.14%$2.17

-2.57%$2.49

-1.95%$3,507.48

-0.52%$0.02046121

-3.64%$2.51

-5.96%$23.31

-3.03%$0.496214

-6.44%$2.91

-3.25%$0.283858

5.29%$0.03742345

-0.13%$14.94

-3.31%$0.062547

-3.66%$6.32

2.04%$3.58

-2.67%$0.814761

-2.79%$0.177374

-1.55%$0.485555

-0.61%$0.02250711

-5.53%

Ethereum’s gas fees have surged above a one-year high as the demand for trading the PEPE meme coin continues to soar.

The average cost of a single transaction on Ethereum jumped above $15.82 on May 4.

While Ethereum’s mean transaction fees have reached much higher levels of between $50 to $70 in 2021, things have been quiet since the market crashed in May 2022.

It’s likely that excitement around meme coins, specifically the newly-launched PEPE, is responsible for the revival in gas fees.

In the last 24 hours, the trading volume for PEPE surpassed $150 million on Uniswap, higher than Wrapped Bitcoin (WBTC) and USDT stablecoin volumes.

The PEPE token also entered the top 100 largest cryptocurrencies by market capitalization on May 1, obtaining a valuation of over $500 million. The token has continued to surge since then, last trading at a market value of $879 million.

Following the success of PEPE coin, numerous copycats have also emerged representing different internet memes.

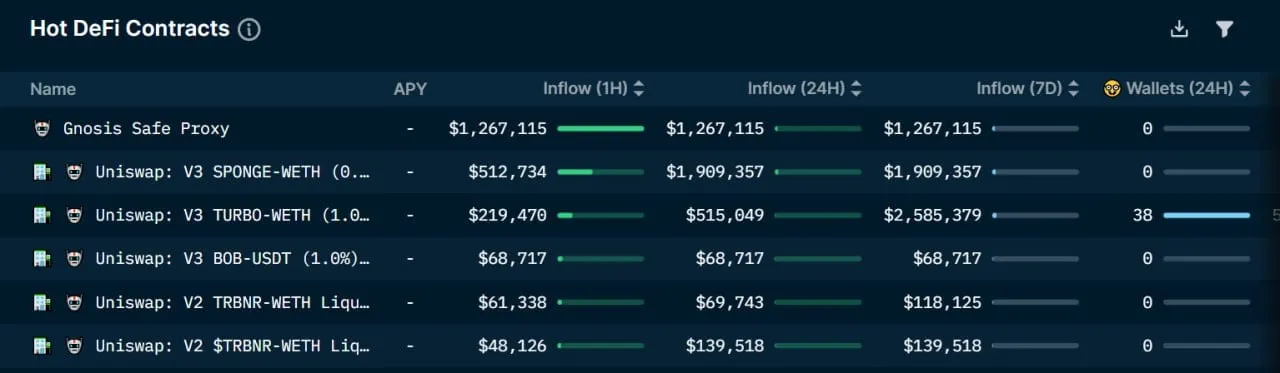

Data from crypto analytics firm Nansen shows that the most active smart contracts on Ethereum are currently Uniswap trading pools for meme coins such as SPONGE, TURBO, BOB, and TRBNR.

The increased gas fees witnessed 9,392 in ETH burned over the last 24 hours, at par with one-year high levels.

Ethereum executed a hard fork in 2021 which meant that a portion of all Ethereum transactions were destroyed. Thus, as activity increases on the network, more ETH is destroyed.

The rise in Ethereum’s transaction fees has led to a rise in gas fees for Layer-2 transactions as well.

The gas fees for layer-2 transactions have also surged with mainnet fees as related data for layer-2 transactions are also posted in layer-1 blocks for security.

There are two kinds of layer-2 scaling solutions: zero-knowledge proofs and optimistic. Both use another technology called rollups, which batch transactions off of the mainnet into a single, smaller transaction before settling on the mainnet.

Notably, zero-knowledge proof (ZK)-based rollups were hit relatively worse than optimistic rollups. The fees for swapping tokens on ZK-based scaling solutions like Polygon zkEVM, Starknet, and zkSync Era mainnet surged between $2 to $11.

A zkSync Discord community member noted they had to pay $11 swap ETH to USDC, noting in amazement that “Is it gonna cost that much?”

Another user complained about $30 in fees for DeFi deposits on zkSync.

$30 gas fee on Layer 2 $ZKS $ZKSYNC @zksync

I don't understand, I thought layer 2 were made to reduce gas fees 😱😱 pic.twitter.com/Uz6k5p4bC5— Kool Crypto ⚙️🛸 (@healthymofin) May 5, 2023

According to L2 Fees data, the gas fees for sending ETH on Arbitrum One and Optimism, both of which are Optimistic rollup solutions, are between $0.2 to $0.6 for swap tokens, which is around ten times higher than the mean value.