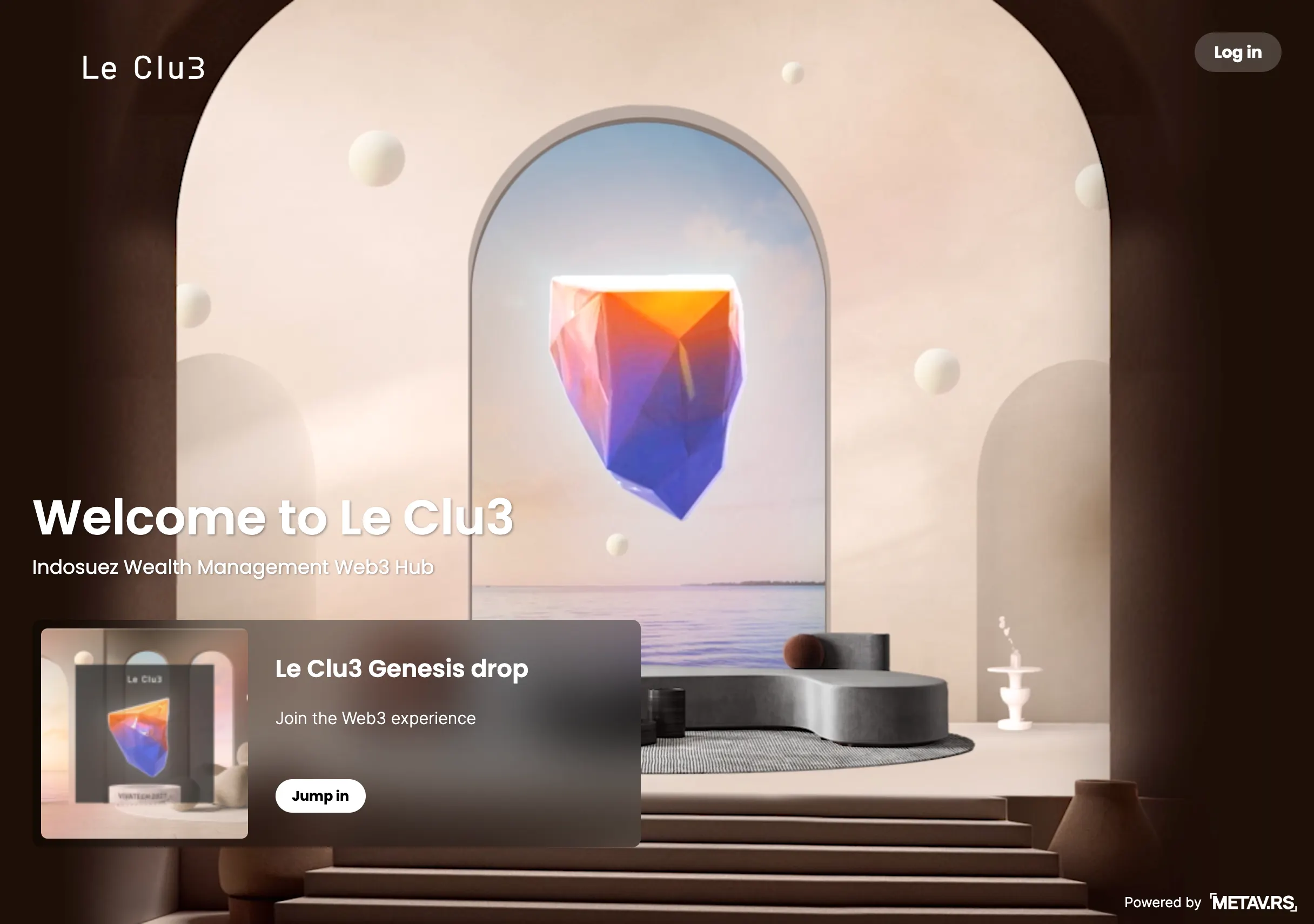

In a first for the world of private banking, Indosuez—the global wealth management arm of leading French bank, Crédit Agricole—has launched Le Clu3, a private NFT-driven membership club for its high-end clientele.

Le Clu3 was created by SiaXperience, the digital design agency of Sia Partners, alongside French Web3 platform METAV.RS.

While such a loyalty program model has more recently been the modus operandi for fashion brands like Adidas, Lacoste, and Louis Vuitton, according to METAV.RS co-founder and CEO Simon Foucher, the aim here is to “create a strong community of next-generation clients” for wealth management.

As Indosuez Chief Innovation Officer Lydie Percier explained last month during an event hosted by Sia Partners at its Paris headquarters, the target audience is tech-savvy offspring of the super rich, in addition to investors and newly-minted crypto entrepreneurs.

The offering comprises a genesis “soulbound” NFT for members, allowing “token-gated access to secret sections of the Indosuez website,” METAV.RS co-founder and Chief Growth Officer Clement Foucher told Decrypt. A soulbound token cannot be sold or transferred once minted, meaning it’s locked to that wallet.

Ownership confers "money-can't-buy" rewards and “unique and unprecedented experiences,” according to Le Clu3’s creators, negotiated with “some luxury partner brands.”

Such is the nature of private banking, the names of these partner brands remain under wraps—but Foucher confirmed that the benefits will relate to the VIP treatment said brands reserve for their top clients.

He stressed that where the brands are concerned, it’s “the guaranteed quality of the audience that is key.”

“Imagine the value for a luxury brand to get access to this kind of high-level customer,” he continued, adding that it also cuts both ways in terms of recruiting more of this type of client to the wealth management division.

A finalist in the 2023 LMVH Innovation Award, METAV.RS’ white label solution allows brands to centrally manage their Web3 strategy. Clients include Louis Vuitton parent company LVMH itself, along with Oetker Group, Stellantis, Westfield, Renault, and Michelin—whom it helps to engage new audiences via tokenization, loyalty programs, and immersive experiences.

The French outfit was also behind a limited-edition luxury token drop for Paris’ Le Bristol hotel earlier this year.

The fact that the tokens are soulbound and cannot be transferred is paramount to address the high security aspect of private banking.

“It guarantees that the owner is a client of the bank and that no tokens can go into wallets of non-customers,” said Foucher.

Notably, the genesis tokens for Louis Vuitton’s own Web3 VIA program launched last month were also soulbound. That approach, said Foucher, lends itself to club creation as “it ensures the quality of your audience.”

Le Clu3 tokens are minted on Polygon, an Ethereum scaling network, and can be held in both regular or cloud-based wallets. In keeping with Indosuez’s tailor-made approach, wallets are set up automatically for users if required, removing obstacles to entry and ensuring the onboarding process is a seamless one.

Going forward, additional soulbound tokens will be created for attendees of events scheduled as part of Le Clu3’s ongoing program. According to Agathe Malinas, Partner at SiaXperience, “This is the start of a long-term story.”