Why Bitcoin’s yearly average hashrate shot up in 2019

TokenInsight reports an 80% rise in Bitcoin’s yearly average hashrate—but 2020 could buck the trend.

2 min read

Bitcoin’s yearly average hashrate increased by almost 80% in 2019 compared to the previous year, according to a new report by TokenInsight, published Friday.

TokenInsight claimed that the increase is due to improvements in mining hardware, and the profitability of the Bitcoin mining segment.

However, 2020 might buck the trend. The block reward of Bitcoin is expected to halve in the middle of May, due to a feature hardcoded into the protocol of the Bitcoin network. Once the “halvening” happens, we can assume that the hash rate of the entire network will also be reduced, said TokenInsight.

Should that be the case, TokenInsight concluded that, “under the current network difficulty and price, most of the cloud mining products on the market are not worth investing in.” Following Bitcoin’s halving, TokenInsight estimates that a little under half of the cloud mining products it tracks “cannot make a positive ROI.”

How to mine Bitcoin for a profit

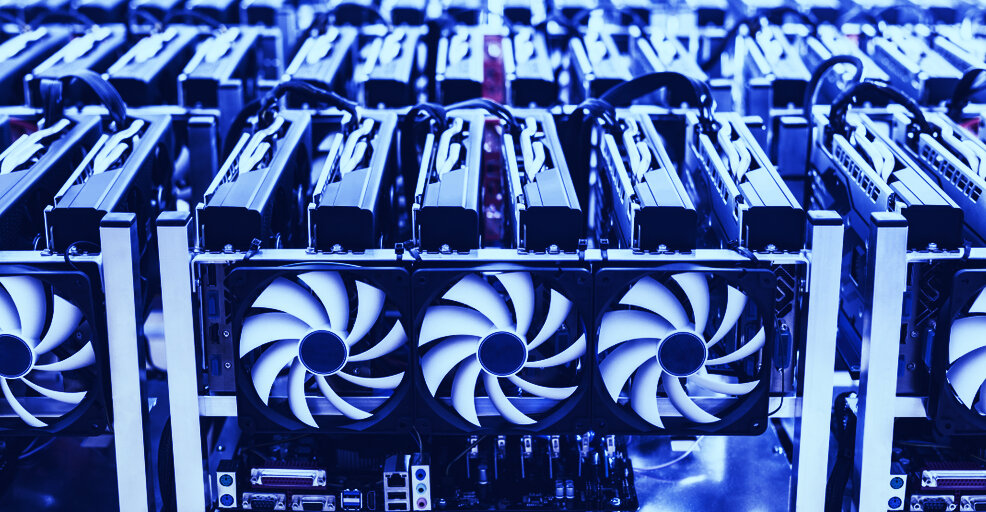

So, how to turn a profit in such a cutthroat industry? Well, the same as always: steal, buy, or borrow the biggest, baddest and most powerful mining machine you can get your hands on, and set up shop in a place with low electricity rates. Alternatively, join a mining pool of cloud miners, which handle it all for you.

China’s still a good bet if you’re thinking of setting up your own mining farm, since the government ruled out a ban on mining. Electricity costs are lower because it’s cold enough in the mountains that you don’t need to run fans to cool the miners. In addition, wrote TokenInsight, “non-Chinese cloud mining products generally charge a high electricity than those in China.”

Get crypto news straight to your inbox--

sign up for the Decrypt Daily below. (It’s free).

Recommended News

Decrypt-a-cookie

This website or its third-party tools use cookies. Cookie policy By clicking the accept button, you agree to the use of cookies.