Daily NFT trading volume hit a three-month high on Monday, as $19.1 million worth of JPEGs and other tokenized assets traded hands, according to public blockchain data compiled on a Dune dashboard by analyst Hildobby.

A notable portion of that tally can be attributed to Bored Ape Yacht Club (BAYC) co-founder Wylie "Gordon Goner" Aronow, who bought an expensive CryptoPunks NFT and made the biggest purchase of the day.

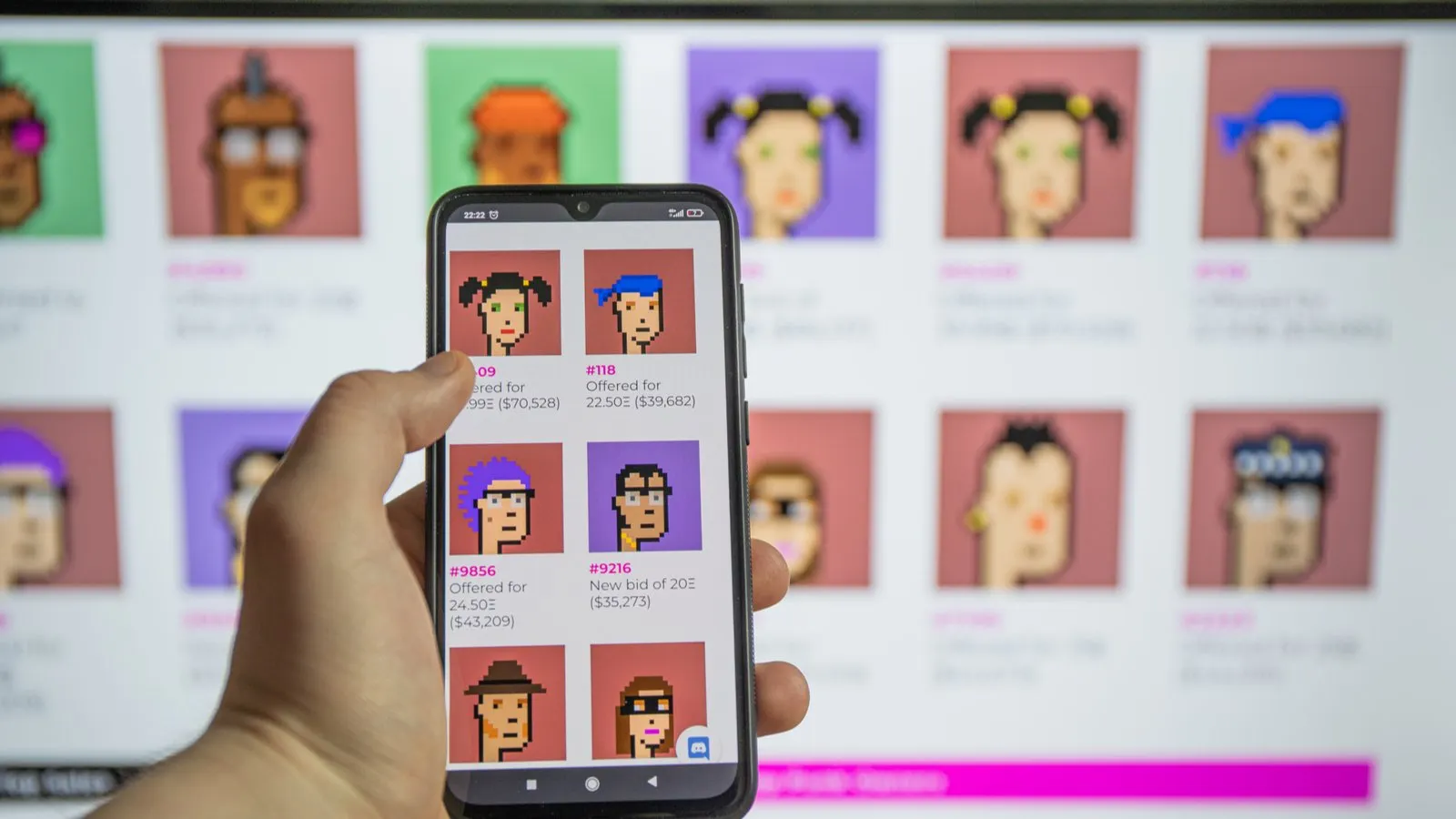

BAYC creator Yuga Labs acquired the intellectual property of CryptoPunks in March 2022, and Aronow purchased CryptoPunk #7458 for 600 ETH ($1.1 million) on the secondary market, according to CryptoSlam. The NFT-focused analytics platform recorded $3.6 million worth of CryptoPunks sales on Monday.

That seven-figure CryptoPunks sale led the charge in terms of top sales yesterday, but it wasn't the only factor that contributed to the market's best day in months.

— GordonGoner.eth (Wylie Aronow) (@GordonGoner) November 6, 2023

The uptick in trading volume comes as a high-profile segment on “The Simpsons”, which pokes fun at the NFT industry, ripples throughout the Crypto Twitter zeitgeist. Riddled with references to real-life projects, the show’s 34th annual Halloween-themed “Treehouse of Horror” episode inspired several popular knockoff NFT collections. Collectively, such projects notched millions of dollars in sales on Monday.

Before “The Simpsons” bashed NFTs in front of millions of home viewers, NFT trading volumes had snapped a year-long downtrend in October, as sales jumped 32% from the month before. Monday’s tally of $19.1 million in NFT trading volume eclipsed activity from any day that month.

While “The Simpsons” segment may have exposed some mainstream viewers to NFTs, it’s been the “same ole folks buying NFTs” with “not many new entrants” lately, pseudonymous Proof Director of Research Punk9059 said on Twitter. Tracking the number of unique wallets that buy Ethereum-based NFTs, he said that the NFT market “just had the third-lowest week in two years.”

That was his assessment—until Monday came to a close. On Tuesday, Punk9059 said the number of unique NFT buyers reached its highest daily level since June in the segment’s wake.

actually had the most wallets of any day since June. pic.twitter.com/91nLVyOoaG

— NFTstats.eth (@punk9059) November 7, 2023

In October, NFT trading volume became more concentrated on Blur, the NFT marketplace that overtook the once-incumbent OpenSea earlier this year. By the month’s end, Blur accounted for 73% of total NFT trading volume while OpenSea commanded an 18% slice, according to Hildobby’s dashboard.

The increased activity on Blur could be related to the platform’s “imminent end of Season 2,” Punk9059 said. Incentivizing traders to stay active based on the prospect of an airdrop—where users are awarded BLUR tokens for behavior over a certain period—has garnered controversy. Still, Blur’s trading volume is rising as “farming has picked up,” Punk9059 said.

Even though NFT trading volumes may have enjoyed a bump from “The Simpsons”, the market is still in the doldrums compared to its previous period of maximum hype—as “The Simpsons” NFT-centric FOMO meter might put it, “Mortgage the House!”

At the NFT market’s peak in April of 2022, weekly trading volumes totaled $1.4 billion, according to Hildobby’s dashboard. And last week, just $98 million worth of NFTs traded hands.

Edited by Andrew Hayward