We do the research, you get the alpha!

Unpacking the AXS unlock

Examining past AXS action

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$67,269.00

2.23%$3,114.72

5.45%$7.25

4.75%$582.96

2.69%$169.63

5.88%$1.001

0.08%$3,110.94

5.40%$0.525693

1.62%$6.69

-0.69%$0.155857

2.86%$0.483532

5.98%$0.00002511

2.26%$37.05

8.33%$0.125139

-0.20%$67,212.00

2.12%$16.10

16.77%$473.24

6.10%$8.11

1.31%$0.719491

6.42%$83.92

1.71%$12.95

6.36%$2.33

5.81%$7.56

5.21%$5.86

0.70%$0.00001025

4.88%$28.61

4.90%$0.116554

5.84%$10.22

2.06%$8.67

4.71%$3,228.59

5.24%$2.43

4.74%$1.001

0.21%$8.77

4.54%$0.126339

1.87%$1.017

4.37%$5.94

4.04%$0.109433

2.95%$47.27

9.11%$2.11

6.13%$3,057.55

5.28%$50.54

2.74%$0.316841

4.85%$0.124033

4.08%$2.89

2.86%$2.59

9.74%$1.061

9.91%$397.45

3.11%$0.03652863

3.27%$2,776.07

2.04%$1.075

2.90%$135.09

3.33%$1.002

0.09%$6.96

8.59%$24.78

6.72%$0.806512

3.37%$2.26

5.27%$0.00021247

5.50%$3,439.98

5.33%$9.46

6.92%$0.567905

3.48%$1.23

7.24%$1.85

-4.29%$0.00002466

2.23%$0.04685151

6.20%$1.80

16.15%$1.09

1.38%$0.183457

5.53%$3,208.27

5.33%$98.31

3.58%$9.89

-0.29%$0.906847

3.88%$0.936753

11.65%$5.79

0.91%$89.07

4.50%$65.22

4.37%$0.974869

6.06%$0.02505693

1.90%$0.00000121

2.22%$2.07

3.76%$0.02844321

1.10%$15.71

3.33%$40.83

2.09%$0.744325

11.73%$19.10

1.17%$7.42

3.02%$0.120818

2.56%$4.96

4.16%$0.02084938

-1.05%$8.01

0.73%$201.62

5.86%$0.02123038

7.02%$0.451992

4.48%$0.56526

5.99%$2.36

8.82%$12.48

4.62%$0.00004938

2.76%$0.825353

3.11%$9.80

2.37%$0.951094

3.79%$0.849648

6.85%$0.22443

5.08%$0.816533

4.14%$2.72

7.05%$2.76

5.76%$42.42

14.63%$1.16

5.13%$0.01230599

8.79%$0.440055

2.95%$4.89

5.02%$0.826292

-0.22%$3,091.53

5.17%$3,137.24

5.38%$303.95

12.06%$1.25

4.58%$201.57

6.55%$1.36

8.12%$13.07

0.95%$4.84

17.22%$0.998959

0.15%$0.01640447

13.08%$0.673835

2.20%$0.220915

4.04%$0.109176

3.70%$2.69

4.68%$1.056

5.51%$0.449437

7.00%$16.92

6.71%$0.178628

3.99%$0.998458

0.04%$0.00011025

3.02%$0.975184

5.93%$3,078.25

4.76%$0.093037

7.40%$19.30

-0.93%$35.54

2.27%$0.381463

3.94%$0.00000029

11.47%$1.95

0.09%$0.744707

6.32%$2,411.01

1.26%$3,281.91

5.34%$2.07

3.58%$3,328.00

5.39%$0.872807

3.37%$0.301455

7.44%$4.53

-1.91%$85.92

5.46%$0.03664737

1.25%$0.545636

3.48%$1.51

1.14%$0.436515

5.07%$2.41

4.98%$0.092414

4.44%$1.002

0.21%$1.12

3.62%$4.28

11.35%$3,365.50

5.37%$1.86

9.51%$0.051531

4.89%$0.00000049

0.06%$1.069

12.28%$0.56475

14.18%$2.76

5.66%$0.323445

9.67%$0.04489447

1.01%$0.02576213

4.35%$14.97

6.50%$0.28062

2.03%$1.11

4.25%$0.474501

-1.33%$0.85496

5.76%$4.66

1.25%$0.04561504

3.77%$0.393228

3.93%$0.22504

3.73%$0.426417

10.63%$0.02397802

3.12%$2,389.28

1.05%$0.321887

7.81%$5.23

9.30%$9.11

-0.68%$0.554651

19.34%$0.03012923

3.52%$0.00724828

4.86%$0.00231372

4.08%$0.593391

3.68%$3.52

4.46%$3.53

9.63%$4.12

10.04%$1.62

4.50%$1,349.12

2.06%$19.76

-0.60%$0.00712557

1.13%$0.999685

0.07%$0.00116275

-0.03%$1.67

1.28%$3.74

4.16%$3,189.44

5.20%$0.0457563

13.52%$56.75

3.47%$0.0749

4.25%$0.529124

2.55%$3.54

6.56%$0.821812

-0.19%$0.00734204

9.71%$0.03826762

4.18%$0.245826

3.61%$0.747409

8.25%$23.83

2.27%$62.59

5.57%$29.89

2.41%$62.25

8.23%$0.02894166

5.00%$0.03862775

4.43%$0.850119

1.11%$4.32

3.19%$5.20

3.36%$21.03

5.44%$3.44

4.84%$0.00420481

6.99%$0.260934

4.22%$0.881572

9.19%$0.03266143

1.57%$0.748997

5.02%$30.89

1.26%$7.89

5.31%$0.911647

4.15%$0.438403

14.63%$2.60

8.96%$0.458999

8.43%$0.00332777

6.10%$0.333899

4.38%$2.03

2.84%$3.62

1.31%$0.00000075

19.19%$0.323148

2.79%$3.99

6.87%$30.45

0.21%$2.02

-0.46%$40.45

14.29%$0.35071

6.90%$0.367849

4.78%$0.0008876

-4.16%$108.09

2.57%$42.56

8.29%$0.000025

-20.74%$0.193799

4.75%$30.03

3.78%

The price of Axie Infinity (AXS) is up a whopping 21% over the last 24 hours, currently trading at $12.35, further contributing to its 80% rally that started two weeks ago, per data from CoinGecko.

The circulating supply of AXS, the governance token behind the NFT collectible game Axie Infinity, also increased today, with nearly 2% of the token’s total supply unlocking and being distributed.

While Axie Infinity players use the Smooth Love Potion (SLP) token to facilitate in-game functions, holding AXS lets players vote on the game's development and how to deploy the project's treasury.

Unlocks of vested tokens generally result in bearish pressure, as they dilute the circulating supply and often instigate increased selling pressure.

And with today’s unlock now behind the market, it appears that this selling pressure could be underway.

AXS currently has a market capitalization of $1.47 billion and a fully diluted value of $3.46 billion, per CoinGecko.

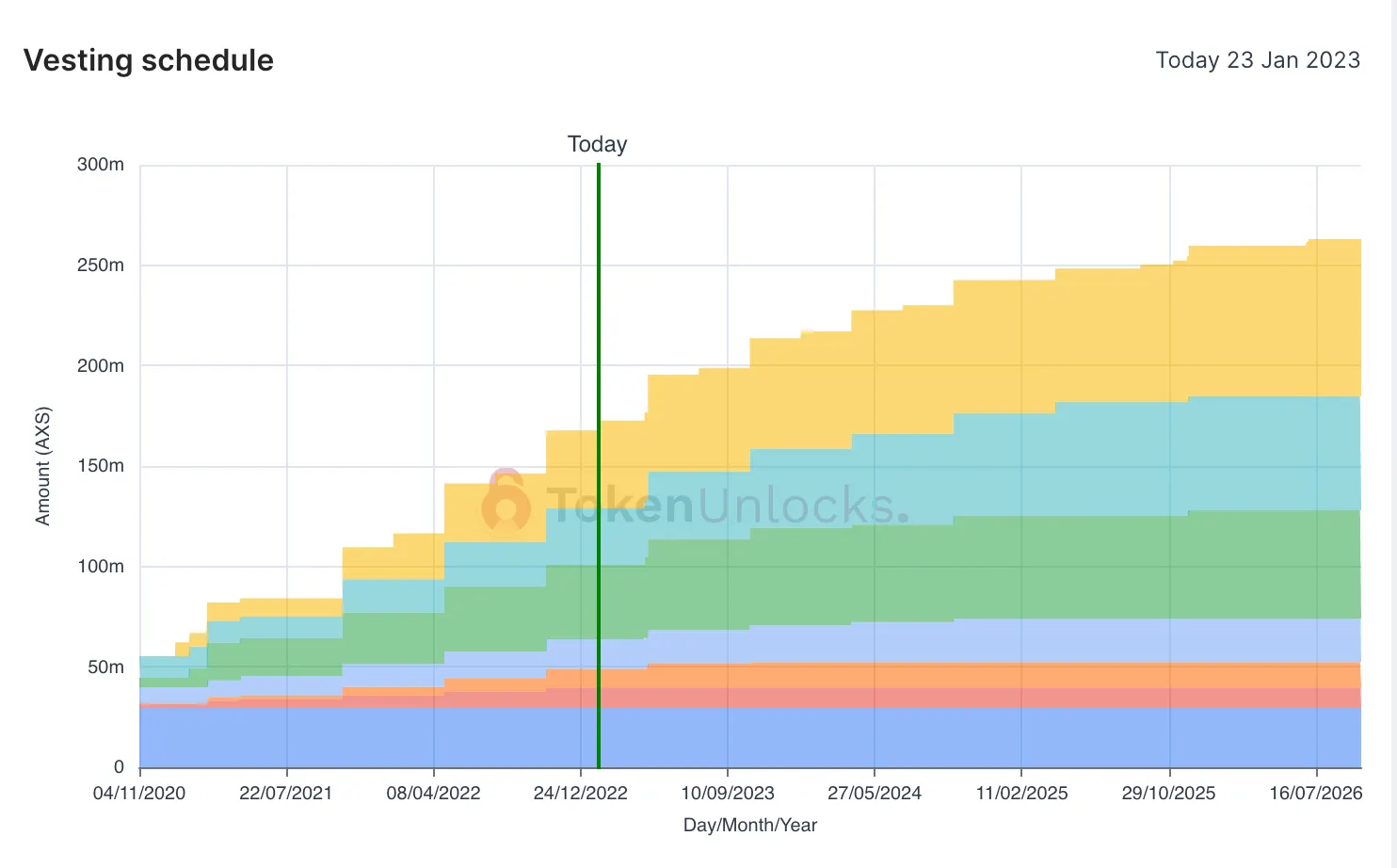

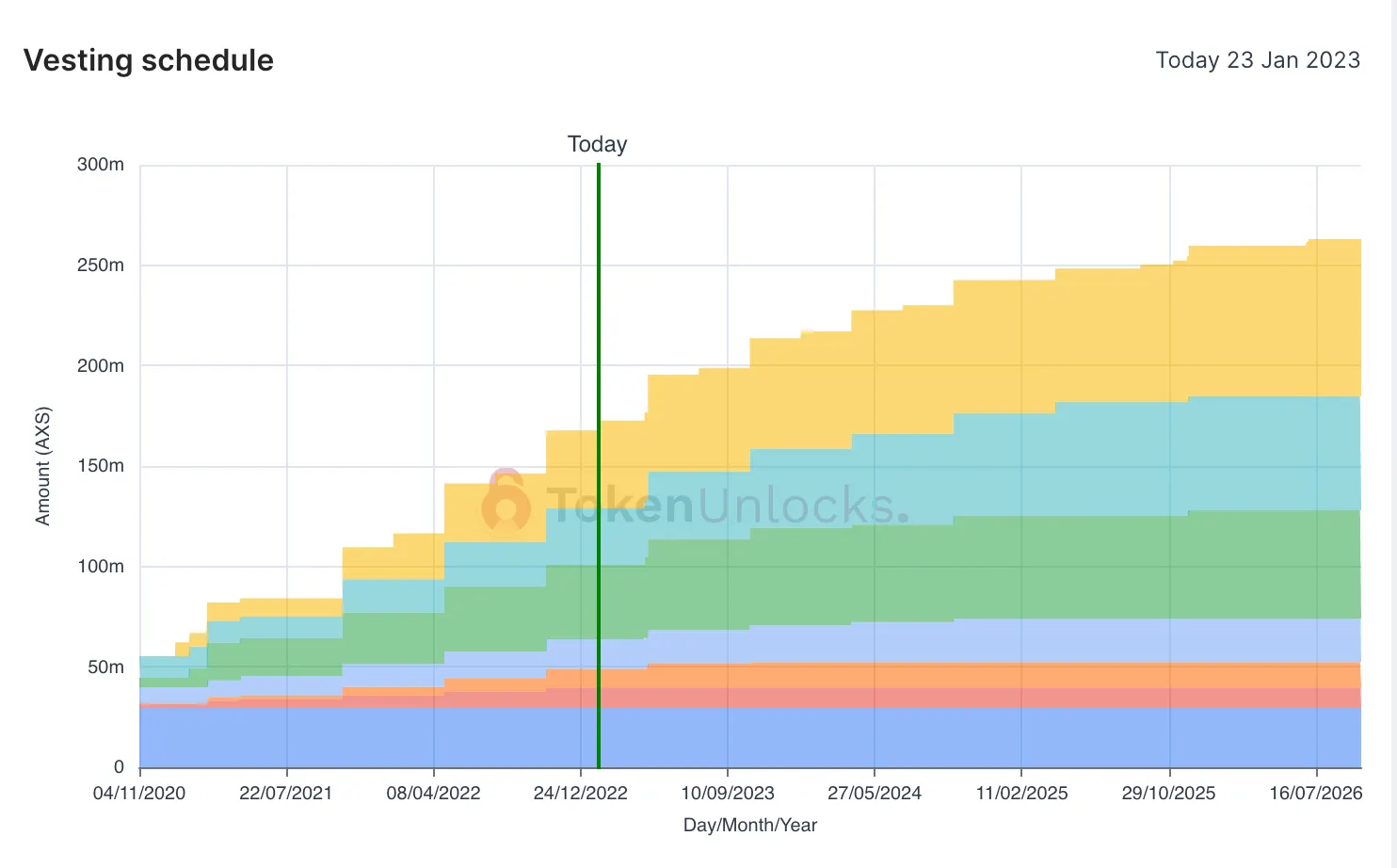

Looking at data from TokenUnlocks, today's unlock is significantly smaller than the previous event in November or the upcoming unlock in May.

According to Axie Infinity's tokenomics and allocation as described in its whitepaper, the largest share of the tokens unlocked over the entire vesting schedule will be distributed as staking rewards (29%), with the second-largest share going to the team (21%).

According to the vesting schedule, however, today's unlock will only be distributed to those who earned staking rewards, which is why there will be fewer tokens unlocked today compared to previous unlocks.

In the weeks leading up to the previous AXS unlock on October 25, 2022, AXS had been significantly underperforming the rest of the market, per Delphi Research analyst Priyansh Patel.

Patel said that traders who were entitled tokens once they were unlocked may have started opening short positions via futures contracts as a partial hedge, which they then began to unwind after receiving their unlocked tokens.

Futures contacts allow traders to open positions on an asset's price without needing to own the asset outright. Compared to the spot market, in which there are fewer ways to be short, derivatives like futures contracts can easily facilitate hedging.

To unwind the short leg of their hedge, traders then began buying futures, pushing the price of AXS up and thus forcing speculative traders playing the downward trend with uncovered short positions to close, causing the price crunch.

It is unclear whether this precise structure is also the case for today’s token unlock.

Still, aggregated open interest—which shows the total number of derivative contracts between the entity going short and the entity going long that are open at a given time—suggests traders have been opening more derivative trades over the past few days.

Now that the unlock is concluded, it does indeed appear that some AXS holders or derivative traders holding long positions have sold.

CoinGecko indicates that the Axie Infinity governance token has dropped 1.3% over the past hour.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.